Hoà Thọ Garment Joint Stock Company (HTG on the HoSE exchange) has recently disclosed information regarding Administrative Penalty Decision No. 2512/QD-CCTKV.XII dated June 13, 2025, issued by the Area XII Tax Authority.

The company has been fined nearly VND 128.7 billion for misdeclaration, resulting in an underpayment of corporate income tax for the tax period in 2023.

In addition to the fine, the company is required to remedy the underpayment by paying over VND 643.3 million in outstanding corporate income tax to the state budget. They must also pay late payment fees (up to January 1, 2025) amounting to nearly VND 53 million.

Illustrative image

Consequently, the total amount of tax, penalties, and late payment fees that Hòa Thọ Garment must pay to the state budget following the inspection is nearly VND 825 million.

However, on January 2, 2025, the company settled the outstanding corporate income tax and late payment fees. Therefore, the remaining fine to be paid is approximately VND 128.7 million.

Previously, on May 16, 2025, the Area XII Tax Authority issued Decision No. 1981/QD-CCTKV.XII on administrative penalties for tax violations against Hòa Thọ Garment.

Specifically, the company was fined over VND 3 million for misdeclaring input and output value-added tax, leading to an increase in refundable value-added tax.

The company was also required to repay the refunded tax amount and late payment fees as decided by the Director of the Area XII Tax Authority.

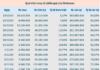

In terms of business performance, according to the consolidated financial statements for the first quarter of 2025, Hòa Thọ Garment recorded a revenue of VND 1,277.5 billion, an increase of 8.3% compared to the same period last year. After deducting various taxes and fees, the company reported a net profit of nearly VND 57.8 billion, an increase of 29.6%.

As of March 31, 2025, the company’s total assets decreased by 4.3% from the beginning of the year to VND 2,797.5 billion. Inventories accounted for VND 650.7 billion, or 23.3% of total assets.

As of the same date, total liabilities stood at VND 1,816.5 billion, a decrease of 9.1% from the beginning of the year. Short-term financial loans and leases accounted for VND 929.4 billion, or 51.2% of total liabilities.

Deputy CDC Construction Chief Resigns After 9 Months on the Job

The Ho Chi Minh City Construction Corporation (HOSE: CCC) announced that it has received the resignation of Mr. Nguyen Huu Bang, Deputy General Director and Director of the Construction Management Board, effective June 23rd. Mr. Bang cited personal reasons for his departure, bringing his tenure at the company to a close just nine months after taking office.

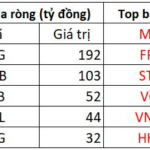

The Big Foreign Buying Spree: Unveiling the Top Stock Accumulated by Foreign Investors in the June 17th Trading Session

The afternoon trading session witnessed robust activity, with FPT stock emerging as the most prominent recipient of net buying, attracting a substantial 218 billion VND. HPG and NVL stocks also witnessed robust net buying, each surpassing the hundred-billion-dong threshold.

No Back Taxes for Small Businesses

“Business households can proactively request an adjustment to their tax bracket if their actual revenue fluctuates by over 50% within a year. This adjustment is applicable only from the point of fluctuation onwards. Rest assured, the tax authority confirms that there will be no retroactive collection of the differential amount.”