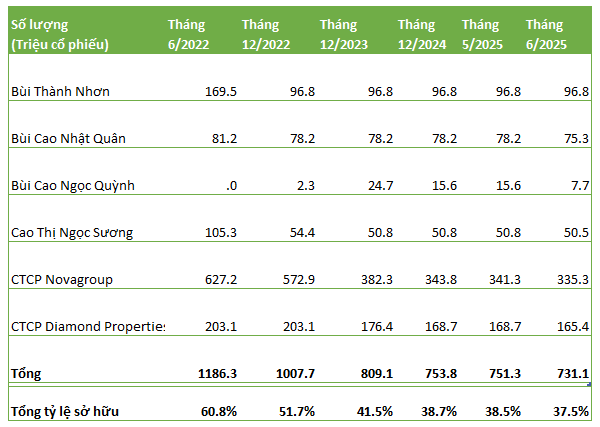

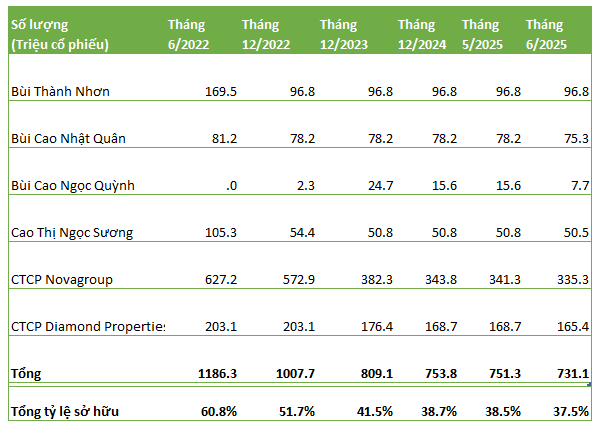

Novaland Group (Novaland, stock code NVL) has disclosed the trading results of its insiders and related parties of the NovaGroup.

Specifically, Ms. Bui Cao Ngoc Quynh, daughter of Chairman Bui Thanh Nhon, sold 7.8 million NVL shares (out of over 84 million registered shares). The trading method was order matching, with the trading period from May 30 to June 13, 2025.

NovaGroup also sold nearly 3.5 million shares (out of 3.9 million registered shares). The transaction was carried out through order matching, from May 19 to June 13, 2025.

Earlier, on May 30, 2025, Diamond Properties successfully sold 3.2 million NVL shares as registered, to balance its investment portfolio and support debt restructuring. The transaction was carried out through order matching.

Individuals, Ms. Cao Thi Ngoc Suong and Mr. Bui Cao Nhat Quan, also sold 221,133 and 2.9 million NVL shares, respectively, through order matching in May 2025.

This move is part of a strategy to support debt restructuring, with major shareholders registering to sell 18.7 million NVL shares.

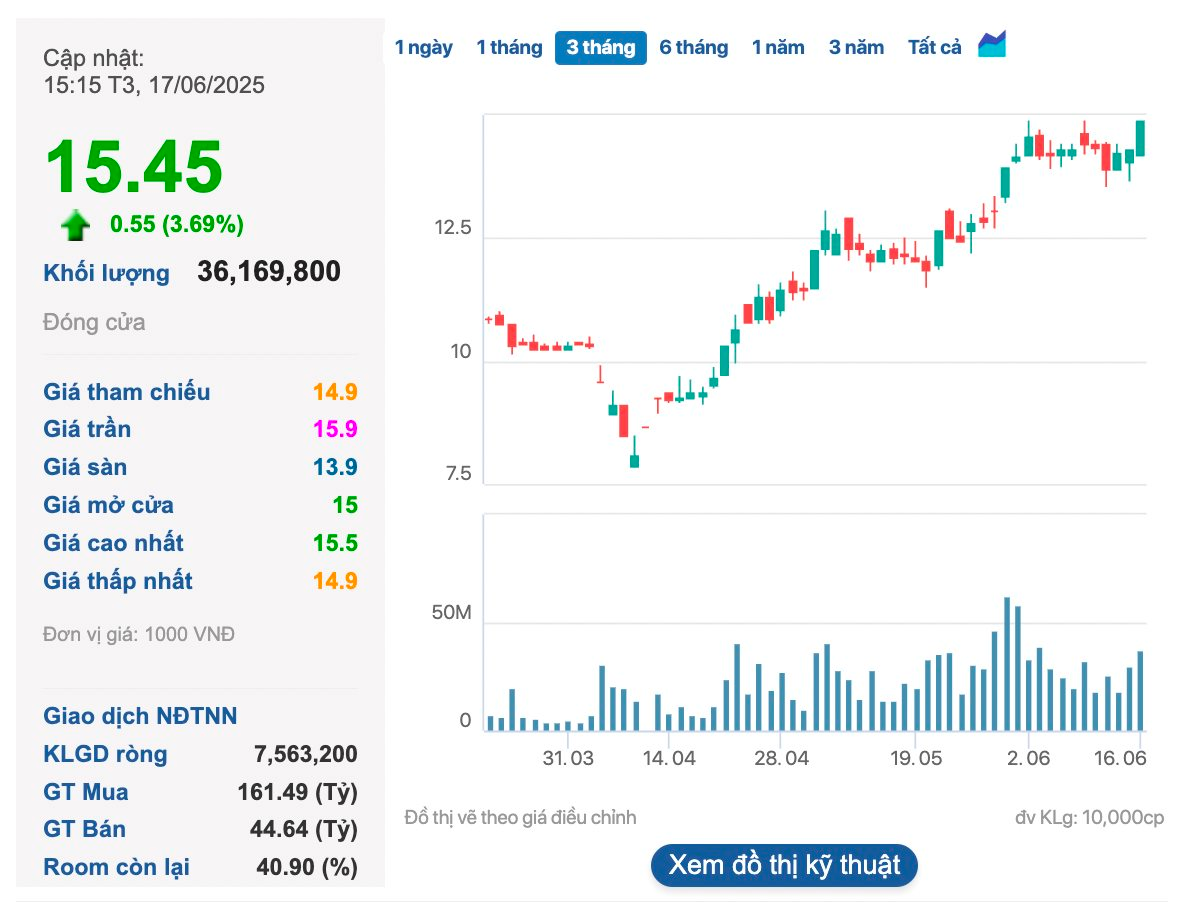

In the market, NVL is on an upward trend. The share price has doubled since its low in early April 2025. Currently, NVL is trading at VND 15,450/share.

NVL’s upward momentum has been partly supported by news that the FTSE Vietnam Swap UCITS ETF (with a scale of $261.4 million) may purchase about 13 million NVL shares during the portfolio restructuring period.

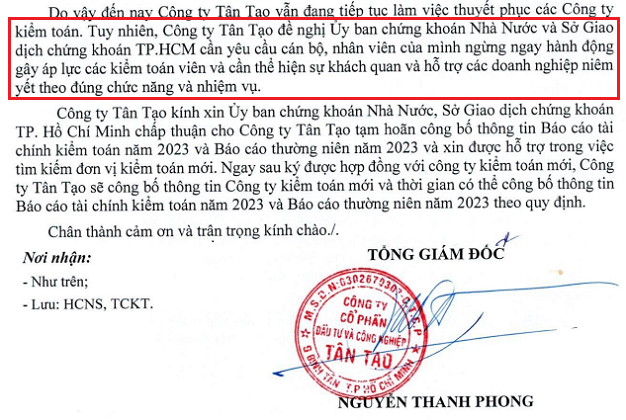

Additionally, the Company will soon hold an extraordinary general meeting on July 8. At the meeting, Novaland will present a proposal to issue shares to settle debts with two major shareholders related to Chairman Bui Thanh Nhon – NovaGroup JSC and Diamond Properties JSC. The specific number of shares to be issued has not been announced. According to Novaland, this is a solution to repay shareholders who have sold collateralized assets to support the company through difficult times, especially related to loans and bonds falling due.

“The Imminent Threat of Non-Performing Loans: A Comprehensive Overview”

The latest predictions indicate a continued rise in non-performing loans for banks in the second quarter of this year. This forecast is based on the significant net increase in Group 2 debts, estimated to be equivalent to the net formation of non-performing loans in the first quarter, with a substantial amount of potential bad debt still looming.

Unleashing the Power of Words: Crafting a Captivating Title for Your Piece

“Unraveling the Novaland Knot: A $60 Million Apartment Project’s Pink Book Conundrum”

“The Task Force has agreed to grant certificates for 170 officetel apartments in the Sunrise City – North area, located at 27 Nguyen Huu Tho, Tan Hung Ward, District 7. This project is also developed by the reputable real estate company, Novaland.”

“HAGL Proposes Issuing 210 Million Shares to Swap Bond Debt, with a Focus on Fruit-Centric Business Ventures”

At the upcoming 2025 Annual General Meeting, HAG is expected to propose a plan to issue 210 million shares at VND 12,000 per share to swap bond debts with eight bondholders. These bondholders include several individuals who have lent the company billions of VND, ranging from tens to hundreds of billions.

Two Insider Shareholders, Including Chairman Bui Thanh Nhon, Successfully Sell Nearly 3.5 Million NVL Shares.

On May 30, 2025, Diamond Properties successfully offloaded over 3.23 million NVL shares, while Cao Thi Ngoc Suong, wife of Chairman Bui Thanh Nhon, sold 221,133 shares.