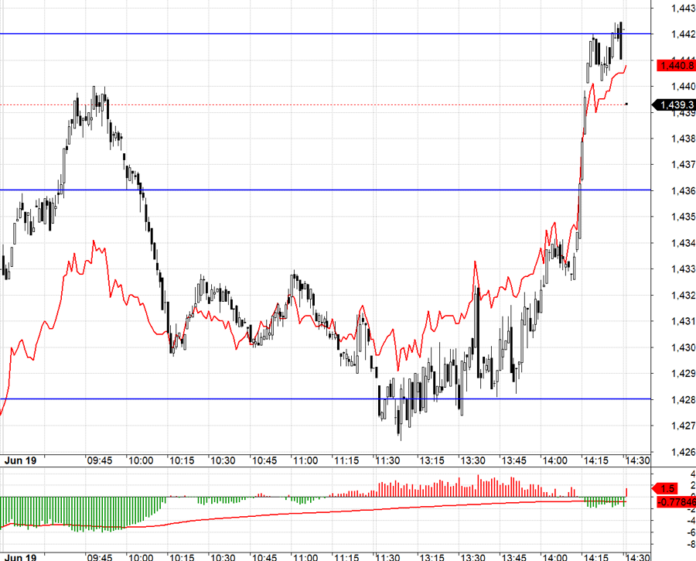

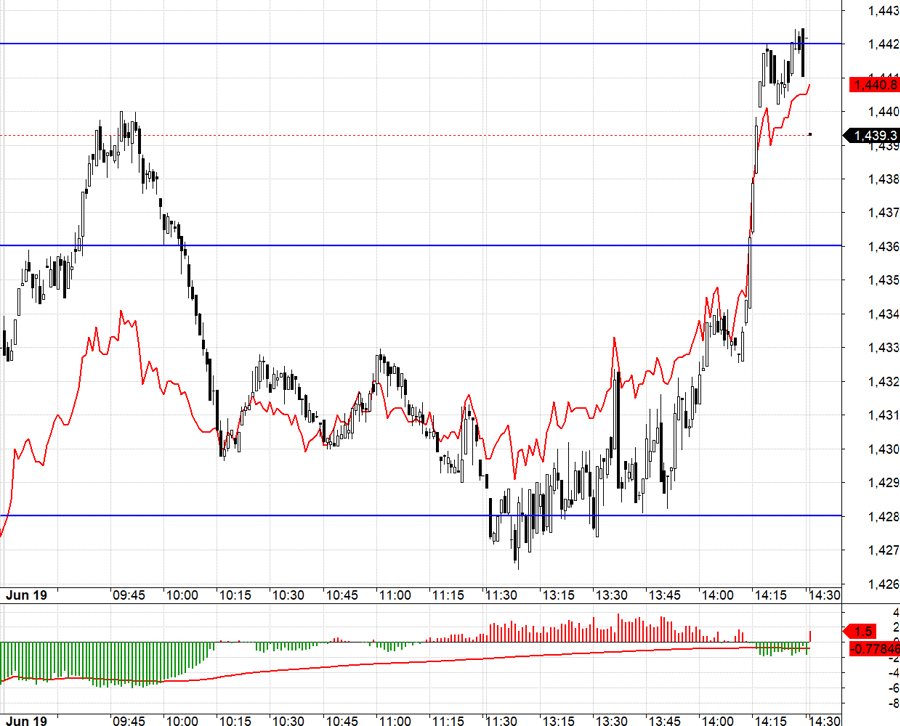

Today’s VN30 futures witnessed a mixed session, with a strong afternoon rally driving the index close to its early-June peak, only to be followed by a significant discount of over 15 points in the next contract.

As expected, F1 futures exhibited volatility equivalent to VN30 due to expiration, but F2 remained relatively stable. While VN30 steadily recovered throughout the afternoon, F2 displayed narrow fluctuations, maintaining an average discount basis of around 10 points. Notably, as VN30 surged past the reference point in the final trading hours, F2 barely budged, resulting in a widened gap of 15.3 points at the end of the day.

This unprecedented basis widening in consecutive expiration sessions indicates a substantial increase in short positions, despite clear position shifting and net foreign long positions of 1,494 contracts in F2. The significant basis discount persisted despite robust trading volume, suggesting a cautious sentiment among investors.

Although there is a possibility of basis adjustment in F2 during tomorrow’s session with higher liquidity, today’s dynamics highlight investors’ skepticism about the upward trajectory. It’s worth noting that today’s rally pushed VN30 back to the early June peak, technically poised to breach new highs.

The impact of today’s futures expiration was predominantly confined to the VN30 basket, with a positive price recovery towards the end. The broader market, however, exhibited typical fluctuations without any explosive signals in terms of index breadth, price margins, or liquidity. This scenario has unfolded a few times, and the VNI is not considered a decisive factor. For instance, today’s 5.2-point gain in the VNI was largely driven by TCB, VIC, GVR, CTG, and GAS.

The stock market remains fragmented, with localized strength and liquidity. Today’s total matched orders on the HSX and HNX fell short of 17.7k billion VND, significantly lower than the five-week average and even the first three sessions of this week, which surpassed 20k billion VND per day. Typically, breakout events above the peak are accompanied by robust liquidity, reflecting investors’ confidence and collective buying sentiment. Isolated index gains driven by a handful of large-cap stocks without a broader market impact should not be interpreted as definitive breakouts but rather as technical fluctuations.

Despite the potential positive technical signals from the VNI, the market has yet to attract substantial capital inflows. Ultimately, robust liquidity is the most convincing evidence and the key to fostering consensus among investors.

The futures market presented intriguing dynamics in F1 today. Initially, VN30’s upward push failed to propel F1, resulting in a wide basis discount. The index climbed above 1436.xx but fell short of reaching 1442.xx before reversing. However, the significant discount rendered short positions impractical. As VN30 approached 1428.xx in the afternoon, the basis turned positive, signaling long positions. Despite VN30’s volatility, F1 maintained a positive basis, leading to an impressive rally. VN30 surged from 1428.xx to 1442.xx, offering lucrative long opportunities.

With F2’s “rejection” of VN30’s movement, the underlying market remains uncertain post-expiration. The weak liquidity in the underlying market suggests that despite potential gains in the VNI driven by select large-cap stocks, the overall market dynamics remain unchanged. The strategy going forward involves a cautious approach, employing long/short tactics in the derivatives market.

VN30 closed today at 1439.3. Near-term resistance levels to watch are 1442; 1450; 1460; 1466; 1472. Support levels are 1430; 1420; 1411; 1400; 1394.

Disclaimer: “Stock Market Blog” reflects the personal views and opinions of the author and does not represent the position of VnEconomy. The opinions and views expressed are those of the individual investor, and VnEconomy respects the author’s style and perspective. VnEconomy and the author are not responsible for any consequences that may arise from the investment opinions and recommendations presented in this blog.

The VN-Index Struggles at Former Peak, Selling Pressure Intensifies on the Green Zone

The Vietnamese stock market witnessed a robust upward momentum during the morning session, largely driven by the strong performance of the Vin group’s stocks. The VN-Index soared to a high of 1353.01 points, surpassing the peak reached earlier in June. However, this upward trajectory was short-lived as the index began to retreat…