Today’s profit-taking pressure wasn’t much stronger than yesterday’s, but stock prices performed worse. The issue isn’t that the VNI lacks momentum at its current peak—as the index doesn’t represent a resistance level for individual stocks—but rather, the breadth of the market reflects widespread profit-taking sentiment. Intraday trading remains the dominant strategy.

The matched order volume on the two exchanges today was around 19.9k billion, compared to 19.8k billion yesterday, but the VNI’s rise/fall ratio was 1.33 yesterday and only 0.59 today. Today is T+3 since the strong dip-buying session last Friday, and many stocks have reversed course. This indicates a trend of quick profit-taking.

Typically, a buy-quick-sell-quick mentality prioritizes safety. Investors are willing to discount and overlook potential for better gains to ensure profits. This coincides with the VNI returning to its previous peak, but it’s not necessarily the main reason, as many stocks don’t have peaks or resistance levels corresponding to the index.

Additionally, the moderate trading volume—similar to the sessions when the VNI hovered near its peak at the end of May and early June—suggests a waning enthusiasm among investors. If supportive funds were strong, today’s volume would have been higher, and prices would have dropped less. Instead, the intraday trend was to peak early and then gradually slide downward.

I still believe that the ups and downs are just fluctuations within a price range, and while the pullback may not be significant, there isn’t enough momentum to signal an end to this phase. The market isn’t bad, but it’s in a holding pattern. The exact level of the countervailing tax remains unclear, especially when compared to competitive markets. Large funds need a reason to show their hand. In the meantime, opportunities remain short-term and isolated; take advantage of individual stocks when they arise, but it’s not yet a true bonanza.

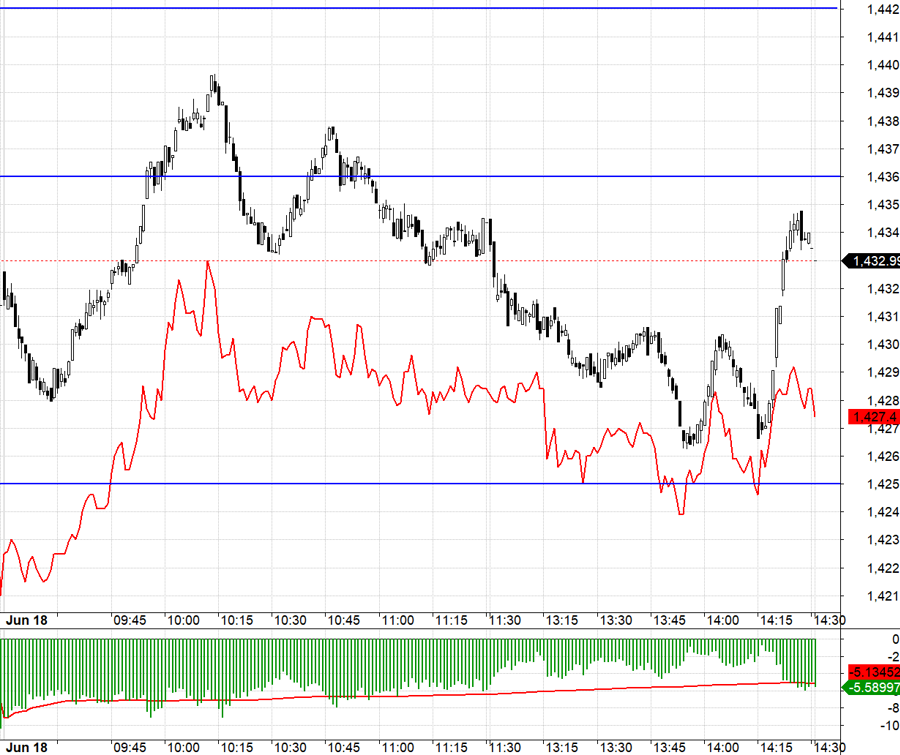

Today, the derivatives market rejected the ‘opportunity’ in the underlying market. Despite the imminent expiration, F1 still accepted a wide discount on the upside of VN30. When this index climbed to nearly 1440 points early in the morning session, the average basis was more than 7 points negative. While the index has a very wide range of movement from 1425.xx to 1436.xx, this basis, though seemingly advantageous for Long, greatly limits profit margins.

The same is true in the opposite direction. When VN30 turned downward below 1436.xx, the basis also discounted by more than 7 points. As a result, Short is also faced with a choice: In a plausible scenario, VN30 will move from 1436.xx down to 1425.xx, a range of 11 points. If the basis narrows, profit margins will only be about 4-5 points. If VN30 doesn’t reach 1425.xx and F1 narrows the basis, the opportunity is almost nil (VN30 has an intraday low around 1429 at the start of the session). It’s nearly impossible for the basis to maintain the same level of discount as VN30 falls because expiration is imminent. This makes Short a 50/50 choice as well. There’s no need to engage in such a trade.

With the upward-pushing funds weakened and quick profit-taking sentiment prevailing, it’s advisable to take profits on stocks with gains. The VNI’s breakthrough to new peaks without a corresponding explosion in breadth and volume is merely a technical breakout and not a signal to break the current oscillating trend. The strategy is to wait for buying opportunities, employing a flexible Long/Short approach with derivatives.

VN30 closed at 1432.99. The nearest resistance level for tomorrow is 1436; 1442; 1450; 1458; 1466; 1473. Supports are at 1428; 1420; 1410; 1400; 1393; 1383.

“Stock Market Blog” reflects the personal views and opinions of the author and does not represent the views of VnEconomy. The opinions, estimates, and projections expressed are those of the author and do not reflect the opinions of VnEconomy, who has no responsibility for the accuracy or completeness of any information provided herein. VnEconomy and the author disclaim any responsibility for any direct or indirect consequences arising from the use of this material.

The Stock Exchange Company Names a Sector Expected to Lead the VN-Index’s Rise

From a holistic perspective, MASVN believes that the absence of commensurate growth catalysts in the short term poses a relatively extant risk to the broader market.

No Worries About Missile Issues, the Market Bounces Back Strongly, VN-Index Recaptures the 1,320-Point Level

The Middle East tensions continue to escalate, but investor sentiment has improved significantly following the weekend. Although this morning’s market saw a substantial 34% drop in capital inflows compared to the previous session, stock prices witnessed a broad-based recovery. However, the upward momentum showed signs of waning in the latter half of the session as selling pressure emerged at higher price levels.

The Flow of Funds: Post-“Bull-Trap”, Market Faces Further Downside Risk

The escalating Middle East conflict sparked a global stock market sell-off last weekend, impacting domestic markets. However, experts deem this a mere catalyst, as the downward trend had already been brewing.

Chairman Truong Anh Tuan Increases HQC Holdings to Nearly 8.7%

“In a series of strategic moves, Mr. Truong Anh Tuan, Chairman of the Board of Directors at Hoang Quan Trading Services Real Estate JSC (HOSE: HQC), has successfully acquired an additional 25 million shares, bringing his total ownership to nearly 8.7%. This development comes on the heels of his previous purchase of 23 million HQC shares in late April, signaling a strong vote of confidence in the company’s future prospects.”