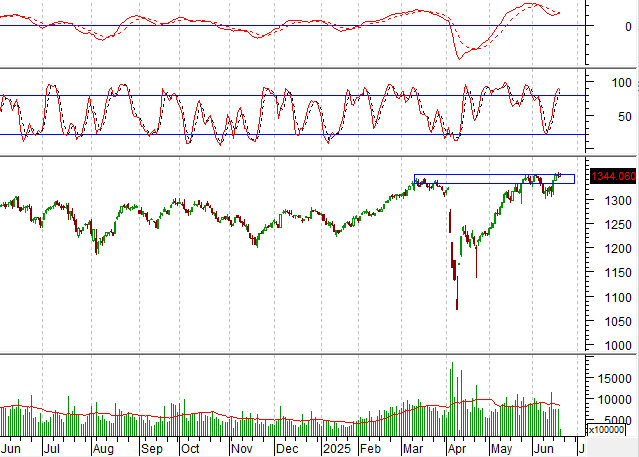

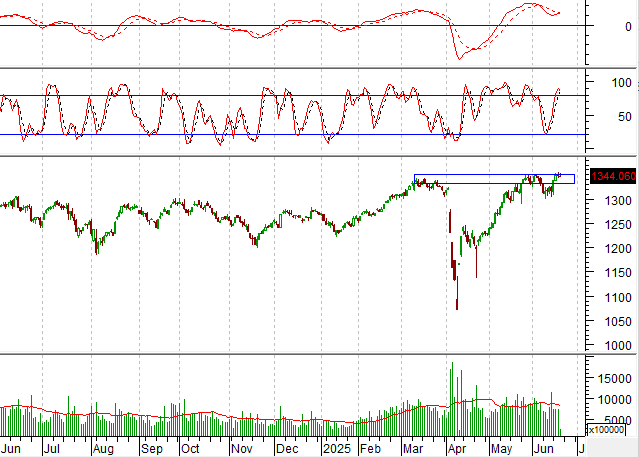

Technical Signals for VN-Index

During the trading session on the morning of June 19, 2025, the VN-Index witnessed a slight decline alongside a significant drop in trading volume, indicating investors’ cautious sentiment.

Additionally, the index continued to fluctuate within the resistance zone of 1,330-1,350 points.

The ADX indicator remained weak and fell below the 20 level, suggesting a feeble underlying trend as the MACD formed a bearish divergence.

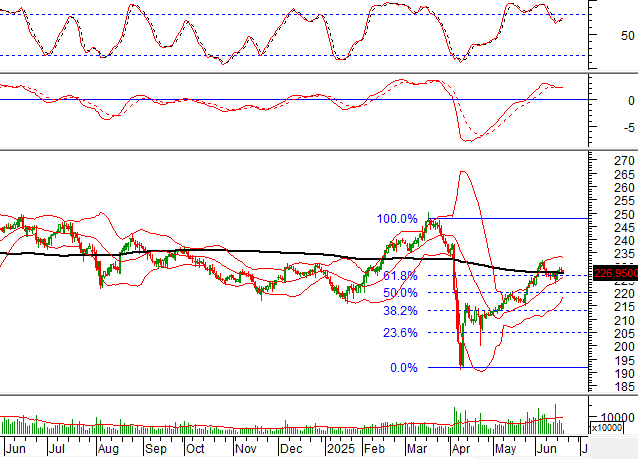

Technical Signals for HNX-Index

On the morning of June 19, 2025, the HNX-Index extended its decline and approached the Middle line of the Bolliger Bands. A breach of this threshold would elevate the risk to a higher level.

Moreover, the index retested the 61.8% Fibonacci Retracement level (corresponding to the 227-228 zone) while the MACD indicator maintained its downward trajectory.

GAS – Vietnam National Gas Corporation

On June 19, 2025, GAS shares maintained a slight upward trend, and trading volume was expected to exceed the 20-session average by the end of the session, reflecting investors’ optimism.

Additionally, the price broke above the downward trend line in June 2025, and the MACD indicator signaled a buy, further bolstering the stock’s recovery prospects in the coming period.

GEE – Gelex Electricity Joint Stock Company

On the morning of June 19, 2025, GEE shares formed a Three Black Candles pattern, and trading volume plummeted compared to the 20-session average, indicating investors’ cautious attitude.

Moreover, the share price fluctuated around the June 2025 support zone (equivalent to 90,000-92,000) while the MACD indicator continued downward after triggering a sell signal. If the situation does not improve, the risk of a sharp decline will increase in the coming period.

Technical Analysis Team, Vietstock Consulting Department

– 12:39, June 19, 2025

Stock Market Outlook for June 19: Are Funds Still Hesitant to Flow Into Equities?

Market liquidity is at a low, indicating that supply-side pressure isn’t overly intense. Yet, funds are awaiting clearer signals before making moves.

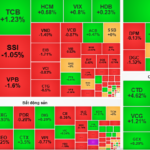

Market Beat: VN-Index Falls Flat, Failing to Breach Reference Level

The VN-Index, after reaching a high of 1,350 points, corrected sharply to 1,344 points and remained range-bound at this level. At the end of the morning session, the VN-Index closed 2.77 points lower at 1,344.06, while the HNX-Index and UPCoM-Index also witnessed declines, falling 1.25 points and 0.47 points to 226.95 and 98.84, respectively.

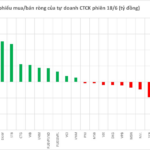

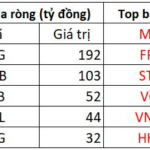

The Cautious Market Ahead of Expiry: Foreigners Sell a Three-Week Record

The sea of red continues to spread in today’s morning session, attributed partly to the market’s inability to demonstrate a breakthrough surge and partly to the often-unpredictable futures expiration. Trading liquidity on the two exchanges plummeted by 22% compared to yesterday’s morning session, hitting an eight-day low.

A Blue-Chip Stock Gets a Big Boost on June 18th

The proprietary trading arms of securities companies were net buyers to the tune of VND147 billion on the Ho Chi Minh Stock Exchange (HoSE).