After three consecutive gaining sessions, the VN-Index approached the 1,350-point resistance level (as of the close on June 17th) and returned to its highest level in three years. This positive recovery has sparked new hopes for investors after a period of market volatility and deep corrections.

However, determining the market bottom or the optimal “bottom-fishing” timing remains a challenging task, even for experienced investors.

At the event “Vietnam and the Indices: Prosperous Finance,” Mr.

Nguyen Viet Duc, Director of Digital Sales at VPBank Securities JSC (VPBankS),

shared his insights on market trends.

In your opinion, should investors try to time the market bottom?

Mr. Nguyen Viet Duc:

In my view, if one does not use margin, there is no need to attempt to time the market. This has been proven throughout history.

According to a recent study, if investors tried to time the market bottom during the period of 1970 – 1996 (approximately 300 months), and missed out on just the 12 best months, their investment returns would be halved compared to simply holding stocks. When this hypothesis was tested for the period of 1997 – 2024, it was found that if one stayed out of the market during the 12 best months, their investment returns would be only 5%, similar to long-term bonds. On the other hand, if investors had simply bought and held stocks, their returns would have been 9.3%.

Missing out on just the four best months would cause investors to significantly underperform the market. Therefore, very few people can succeed in timing the market.

Meanwhile, “timing the top” is far more crucial than “bottom-fishing.” According to the aforementioned study, if one could avoid the 30 worst months of the S&P 500, their investment performance could increase by 50%. However,

both timing the top and bottom are extremely challenging tasks.

Additionally, the study presented three investment scenarios: investing 100% in stocks; investing 80% in stocks and 20% in bonds; and investing 60% in stocks and 40% in bonds. The results indicated that the performance differences between these scenarios were not significant, amounting to only about 1%. Hence, investors should not spend excessive time attempting to predict market movements.

Market timing is only suitable for those who use margin. Investors should maintain a stable allocation of 80% in stocks. In adverse situations, they can sell a portion but should still hold around 70% of their portfolio, as missing just a few upward sessions of the VN-Index can easily lead to underperformance. Only allocate about 20-30% of your portfolio for timing the tops and bottoms.

If using margin, timing the tops and bottoms requires a relatively high level of accuracy. For non-margin investors, focus on selecting the best-performing stocks in each phase rather than trying to time the market.

If not timing the market, how should investors select stocks?

Mr. Nguyen Viet Duc:

When the market is sideways, investors often tend to favor timing the tops and bottoms: buying when the VN-Index drops to 1,200 points and selling when it reaches 1,300 points. This short-term approach relies on predicting each upward movement of the VN-Index and is suitable for margin trading. If you’re using margin during a short-term uptrend, any profitable trade will result in a win.

However, for non-margin investors, just one or two incorrect predictions can lead to significant issues. Upon reflecting on my investment journey, I realized that despite accurately timing the tops and bottoms on multiple occasions, just one or two mistakes led to underperformance compared to the overall market. Therefore, investors should learn from investment funds regarding their market strategies.

Most large funds never maintain less than 80% allocation in stocks. They only attempt to time the tops and bottoms within a small portion of their portfolio, typically around 20%. Over the medium term, well-selected stocks will consistently outperform.

Smaller funds often have three allocation thresholds: 100%, 80%, and 30%. When the market conditions are unfavorable, they will aggressively sell down to the 30% threshold. During most periods, they maintain a 100% allocation in stocks. If the market undergoes corrections and volatility within an upward trend, they usually adjust their allocation to around 80%.

In my opinion, if the market continues its upward trajectory with only minor corrections, investors should maintain a 70-80% allocation in stocks and only sell aggressively when the uptrend ends, awaiting opportunities to buy at lower prices.

For those who still wish to time the market, it is crucial to pay attention to trend reversal points or exhaustion points (sequence). Various techniques can be employed to predict these sequences, such as Elliott waves or candle-counting methods.

When a stock has declined significantly and shows signs of bottoming out, investors should consider buying. Conversely, if a stock has been rising for an extended period, indicating a potential slowdown in upward momentum, it may be prudent to take profits.

Knowing when to take profits is the most critical aspect of investing with market trends.

How can investors identify strong stocks?

Mr. Nguyen Viet Duc:

According to statistics from Goldman Sachs, different sectors perform differently during market cycles. For instance, Vietnam’s strong GDP growth in 2025 boosted the performance of growth stocks, while their valuations remained below the average of the past 5-10 years.

In such cases, investors can allocate capital to commodity and financial stocks. When market valuations are high, investors may consider technology and luxury stocks, which benefit from high valuations and rapid growth.

From a technical analysis perspective, looking back at 2024, VTP maintained an upward trend throughout the year, but it also experienced corrections of up to 27%. This was due to VTP’s high beta, which caused it to decline two to three times more than the market during corrections. If we apply this concept to this year’s leading stocks, such as VIC or GEX, corrections of 30% or more are normal, and these are the points where investors should consider buying. This is the trade-off for investing in stocks with the potential to triple or quadruple in value.

From a fundamental perspective, investors can consider stocks that the market has overlooked. By purchasing these stocks, investors reduce the risk of significant losses. When the market rises, these stocks will eventually follow suit. Additionally, if positive catalysts emerge, such as the Israel-Iran situation for energy stocks, investors can benefit from both the market uptrend and the specific catalyst. In such cases, investors should avoid taking profits too early.

According to Jim Rogers, the right-hand man of George Soros, there are six key principles for investment success. First, buy low and sell high. As I’ve mentioned before, the risk of not owning low-priced stocks when the market surges is significant. Therefore, when you spot undervalued stocks, take the opportunity to buy.

Second, only invest in what you know and understand thoroughly. This principle is also emphasized by Warren Buffett.

Third, gain a deep understanding of economic cycles and industries. Only macroeconomic factors can cause market crashes, while geopolitical conflicts will not significantly impact long-term trends.

Fourth, be a contrarian and avoid following the crowd. If you want to avoid the situation of being fully margined during a market decline, focus on stocks that are just starting to gain momentum or are in accumulation phases, as they only need a small catalyst to surge 15-20%.

Fifth, in emerging markets, pay close attention to exchange rates. Currency fluctuations affect growth, inflation, and market stability. For instance, the recent corrections in Korean and Taiwanese stocks were partly due to currency-related issues. In Vietnam, the sharp corrections in 2010-2012 and 2024 were also attributed to currency fluctuations.

Sixth, cultivate patience and discipline.

Finally, prepare for market extremes. Markets often exhibit overreactions, so once you’ve purchased a stock, remain patient and disciplined until the stock’s valuation surpasses its true value.

Which sectors are you currently focusing on?

Mr. Nguyen Viet Duc:

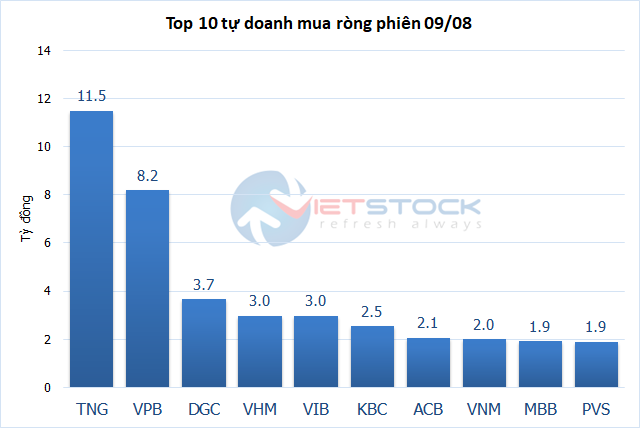

First, pay attention to bank stocks, as they account for approximately 50% of the market’s capitalization. Within this sector, there are always winners, regardless of whether the overall market is rising or falling. Investment funds in Vietnam typically allocate 40-50% of their portfolios to bank stocks.

In the first half of this year, bank credit growth has been positive. Currently, banks are benefiting from improving economic conditions and reduced risks.

Regarding energy stocks, the recent upward momentum is mostly driven by expectations rather than actual improvements in fundamentals. However, if oil prices remain in the $70-80 per barrel range for the full year, these companies’ financial performance will be positively impacted.

Additionally, keep an eye on retail stocks. Recently, the government has taken strong actions against counterfeit and pirated goods, which had previously affected companies like DGW and MWG. Although these stocks have already risen significantly, they may still present buying opportunities during corrections.