Short-Term Concerns Over Profit-Taking

Mirae Asset Securities’ mid-year strategy report indicates that Vietnam’s stock market performance in the first five months was significantly impacted by Trump’s election win, with the market fluctuating in response to executive orders and statements pressuring allies, trade partners, and economic counterparts.

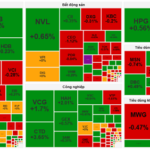

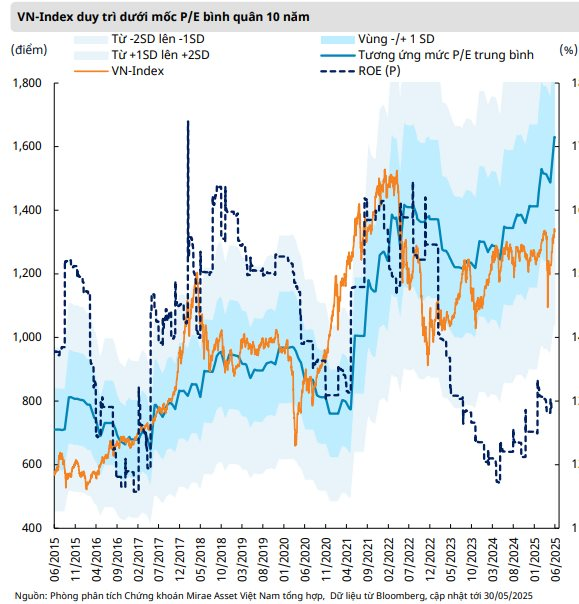

Specifically, the Vietnamese market quickly established a new baseline in April and surged in May, pushing the VN-Index to close at 1,332.6 points (+8.67% from the previous month and +5.2% year-to-date), following a sharp decline earlier (-18.76% from April 2nd to April 9th).

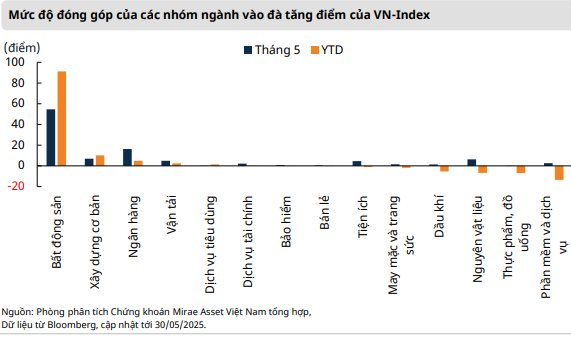

However, the recovery among sectors was relatively polarized, with even intra-sector divergence within stocks of the same industry. Notably, excluding the sudden surge in Vingroup stocks, the total market cap of the VN-Index actually only increased by 2% year-to-date, compared to the current gain of 9.49% (including additional market cap from newly listed stocks on HOSE).

According to Mirae Asset’s analysis, this raises short-term concerns about profit-taking by individual investors to realize gains after an impressive 100% rally within just two months for Vingroup stocks (VIC, VHM, VRE).

Additionally, many other stock groups, excluding Vingroup, may enter a state of re-accumulation to establish higher price equilibrium zones before continuing their mid-to-long-term upward trends.

From a holistic perspective, MASVN believes that

the lack of commensurate growth drivers in the short term poses a relatively tangible risk to the overall market

, especially as stocks with significant weightings such as Banking, Technology, Retail, Securities, and Steel have not fully recovered to their Q1 2025 price levels, except for a handful of uniquely positioned bank stocks.

Real Estate Sector Expected to Lead Short-Term Growth

Entering the second half of 2025, Vietnam’s stock market is expected to continue its growth trajectory, with the Real Estate sector anticipated to spearhead short-term gains.

Underpinning Vietnam’s economic ambitions are domestic growth drivers aimed at achieving an 8% GDP growth target for 2025. The government has deployed a “strategic quartet” of Resolutions 57, 59, 66, and 68, followed by a series of directives and implementation guidelines to boost the private sector, streamline legal frameworks, and foster a business-conducive environment.

According to Mirae Asset, the Real Estate sector is expected to benefit from these factors, coupled with legal framework adjustments, including revisions to the Planning Law and the legalization of Resolution 42. Specifically, Resolution 42 introduced mechanisms for addressing bad debts and restructuring distressed projects, enhancing leverage, and facilitating capital flow for both real estate developers and credit institutions.

Nonetheless, the real estate sector’s recovery prospects hinge on capital mobilization and land fund availability to increase the number of new projects while simultaneously balancing consumer spending and investment recovery in the upcoming periods.

While underpinned by solid domestic fundamentals, the outcome of trade negotiations with the US remains a significant unknown, as favorable tariff agreements are crucial to sustaining long-term FDI inflows. ”

In a less favorable scenario, external pressures could trigger market corrections, and VN-Index could retreat to test lower support levels around 1,240 points in Q3

,” the report states.

However,

the mid-to-long-term upward trend will necessitate the spread of capital inflows to sectors with large market capitalizations and leading roles, such as Banking, Technology, and Retail

. Nonetheless, sustainable growth prospects in the mid-to-long-term will require the spread of capital inflows to propel the VN-Index beyond the 1,400-point threshold.

This outlook is shaped by the combination of robust domestic growth drivers and significant uncertainties stemming from exogenous factors, particularly the outcome of trade negotiations with the US.

As domestic factors lay a solid foundation for growth, Vietnam needs to navigate the challenges and uncertainties arising from the trade tensions in the upcoming periods.

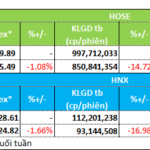

Market Beat: Foreigners Resume Net Selling, VN-Index Hangs on at 1,345 Points

The market closed with the VN-Index down 0.86 points (-0.06%), settling at 1,346.83, while the HNX-Index dipped 0.04 points (-0.02%) to 228.2. The sell-side dominated with 381 declining tickers against 300 advancing ones. However, the VN30 basket painted a balanced picture with 15 gainers, 13 losers, and 2 flat liners.

The VN-Index Struggles at Former Peak, Selling Pressure Intensifies on the Green Zone

The Vietnamese stock market witnessed a robust upward momentum during the morning session, largely driven by the strong performance of the Vin group’s stocks. The VN-Index soared to a high of 1353.01 points, surpassing the peak reached earlier in June. However, this upward trajectory was short-lived as the index began to retreat…

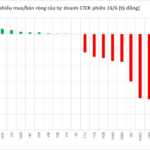

The Stealthy Sell-Off: In-House Brokers Dump $30 Million in Stocks in a Single Day

The proprietary trading group at FPT witnessed a significant sell-off, with a notable net sell value of VND 104 billion.