The VN30 group of stocks witnessed a positive recovery trend this afternoon, pulling the VN-Index up for most of the trading session. The index closed above the reference level, with trading volume on the HoSE exchange increasing by 24.3% compared to the morning session. For the first time since May 2022, the VN-Index closed above the 1350 mark.

The stocks that had the most positive impact on the VN-Index were also those with the largest weights in the VN30-Index. The derivatives expiry had a significant influence on the representative index of the blue-chip basket, and the VN-Index benefited as a result.

The VN30-Index, which tracks the performance of the 30 largest stocks in Vietnam, ended the morning session down 0.26% with 7 gainers and 19 losers. However, it managed to turn things around in the afternoon session, closing 0.44% higher with 17 gainers and 9 losers. Furthermore, 22 stocks in the basket traded higher compared to the morning session, with only 4 stocks trading lower. While some stocks were still unable to recover fully and close above the reference level, they still contributed positively to the index’s performance.

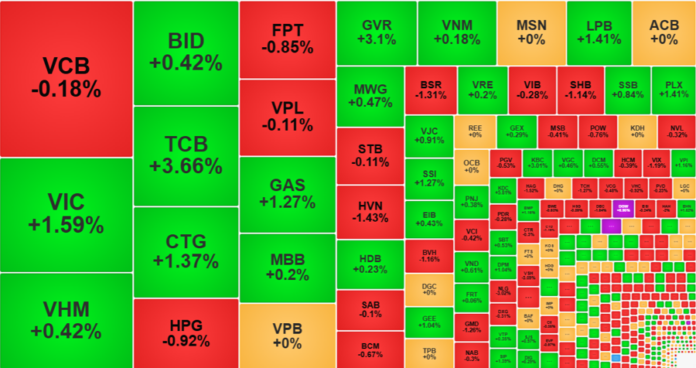

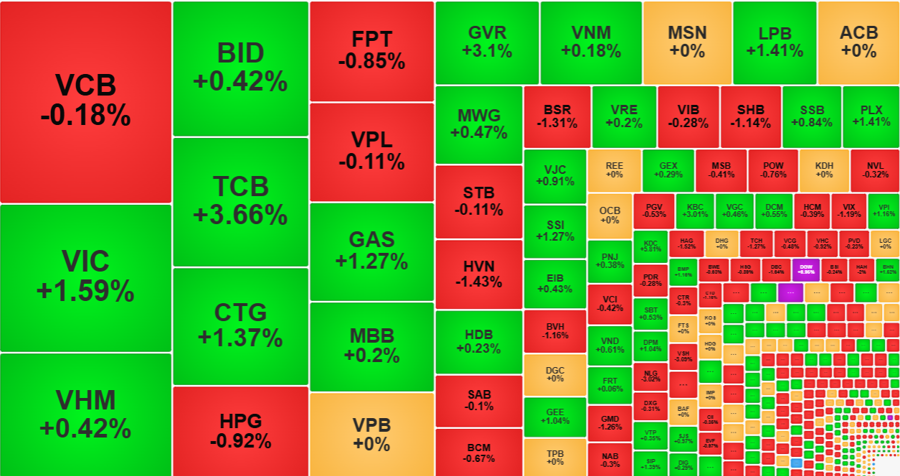

TCB had the most significant impact on the VN30 index in the afternoon session, as it added another 1.64% to its gains and closed above the reference level by 3.66%. This was the best performance by TCB in 22 sessions, and it pushed the stock to a new all-time high earlier in the week. With its strong performance, TCB contributed almost 2 points to the VN-Index and pulled the VN30-Index up by 3.4 points, accounting for half of the basket index’s total gain.

VIC, one of the largest stocks by market capitalization, also showed strength as it shook off morning losses and closed 1.59% higher. Mid-cap stocks such as GVR also performed well, soaring 2.05% in the afternoon session and ending the day with a total gain of 3.1%. MSN staged an impressive comeback, recovering from a morning loss of 1.96% to close flat. PLX even managed to turn a 2.86% loss into a 1.41% gain by the end of the trading day. LPB followed a similar trajectory, reversing a 1.57% loss to close 1.41% higher. SSI also contributed positively, turning a 1.49% loss into a 1.27% gain. While these stocks may not have had as much of an impact on the VN-Index, they certainly had a positive influence on the VN30-Index.

The trading volume of the VN30 basket increased significantly in the afternoon session, surging 32.4% compared to the morning session and reaching 4,841 billion VND. This improvement in price performance, coupled with higher trading volume, is a positive sign, even though the blue-chip group still experienced the slowest trading volume in the last 6 sessions. Moreover, the decline in trading volume among blue-chip stocks was not as severe as that of other groups. Specifically, while the total trading value on the HoSE exchange decreased by 2,314 billion VND compared to the previous day (a 12% drop), the VN30 basket only saw a decrease of 781 billion VND (less than 34%).

The HoSE exchange ended the day with a positive market breadth of 135 gainers and 160 losers, a significant improvement from the morning session’s 77 gainers and 205 losers. However, most stocks only managed to recover slightly above the reference level. Out of the 135 gainers, 58 stocks rose by more than 1% (compared to 34 in the morning session). The top 11 stocks in terms of trading volume accounted for the majority of the trading activity, with a trading volume of over 100 billion VND each. These included blue-chip stocks such as TCB, SSI, CTG, VIC, GVR, GAS, and PLX. The remaining stocks in this group were DGW, which rose 6.95%, DPM up 1.04%, KBC up 3.1%, BFC up 4.38%, VPI up 1.16%, and KHG up 1.4%.

On the downside, the situation also improved compared to the morning session. Not only did the market breadth turn more favorable, but the number of stocks falling by more than 1% also decreased to 62 from 86 in the morning. Seven stocks stood out due to their high trading volume and confirmed strong selling pressure: SHB, which fell 1.14% with a trading volume of 675.3 billion VND; DBC, down 1.64% with a volume of 361.2 billion VND; VIX, down 1.19% with a volume of 192.2 billion VND; HAH, down 2% with a volume of 175.5 billion VND; NLG, down 3.02% with a volume of 153.5 billion VND; GMD, down 1.26% with a volume of 121.8 billion VND; and VSC, down 1.81% with a volume of 103.3 billion VND.

Foreign investors maintained a similar selling intensity in the afternoon session as in the morning but showed improved buying activity. They injected 852.2 billion VND of new money into the HoSE exchange in the afternoon, twice as much as in the morning session, while continuing to offload 1,094.3 billion VND worth of stocks. The net selling value in the afternoon session was 242.1 billion VND, a significant improvement from the morning session’s net selling value of -651.3 billion VND.

It is worth noting that several stocks experienced increased selling pressure from foreign investors: FPT saw a total net sell-off of 388.9 billion VND for the day, compared to -152.5 billion VND in the morning session. VHM also saw increased net selling, with the value rising from -58.8 billion VND to -120.9 billion VND. STB’s net selling value increased from -21.7 billion VND to 101.6 billion VND. Other stocks that witnessed notable net selling included VIC, MWG, HPG, NLG, and HEX, all with net selling values of over 30 billion VND. On the buying side, some stocks stood out, including GVR (+37.1 billion VND), NVL (+34.5 billion VND), DGW (+62.6 billion VND), SSI (+60.9 billion VND), and CTG (+47.3 billion VND).

The VN-Index closed above the 1350 mark today, reaching 1352.04 points. However, this does not change the fact that the market remains slow and lacks clear breakout signals. The index’s performance is largely dependent on a few large stocks rather than a broad-based rally.

Technical Analysis for June 19: The Tug-of-War Continues

The VN-Index and HNX-Index opened lower, with a slight dip in trading volume, indicating investor uncertainty at resistance levels.

The Art of Business: Unveiling Nam Tan Uyen’s Strategies Ahead of its HoSE Listing

“Nam Tan Uyen, a prominent Vietnamese company, has filed for the listing of nearly 24 million NTC shares on HoSE. This news comes on the heels of the company’s impressive first-quarter performance in 2025, where it reported a profit of VND 69 billion. With a strong financial track record and a promising future ahead, Nam Tan Uyen is poised to make a significant impact on the stock exchange.”