Illustrative Image

In addition to its strength in agricultural exports, Vietnam boasts a powerhouse product in its footwear industry, raking in tens of millions of USD annually. According to preliminary statistics from the General Department of Customs, footwear exports from Vietnam garnered over $2.1 billion in May, a 3.5% dip from April’s figures.

Cumulative figures for the first five months of the year show that this sector has brought in $9.76 billion, marking a 12.9% increase compared to the same period in 2024.

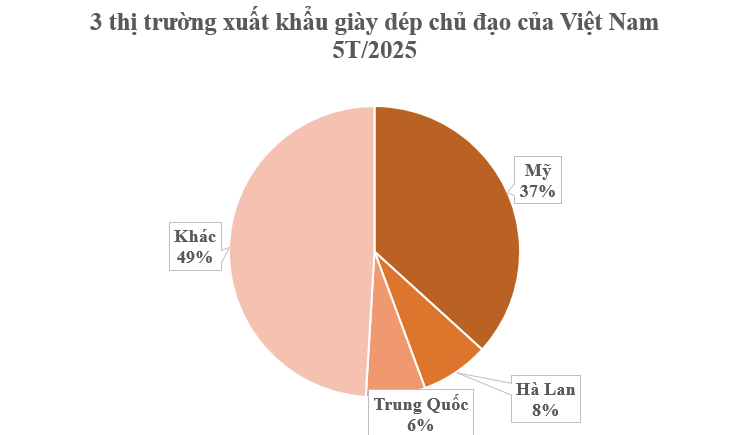

When it comes to markets, the US takes the cake as Vietnam’s largest footwear export destination, with a trade value of over $3.5 billion, reflecting a 16% surge from 2024. Closely following in second place is the Netherlands, with more than $742 million, indicating a 17% jump from the previous year.

China, the third-largest market for Vietnamese footwear exports, contributed over $644 million, despite a 16% decline year-on-year.

In 2024, Vietnam’s footwear export value reached approximately $27 billion, an increase of about $3 billion from the previous year. Since late 2023, footwear exports have witnessed a noticeable recovery. This success is attributed to businesses’ proactive and flexible strategies in retaining traditional markets while simultaneously venturing into new ones, thereby maintaining a growth rate of over 12%. Currently, Vietnam ranks second globally in footwear exports, just behind China.

The footwear industry has effectively leveraged free trade agreements, particularly with markets in the EVFTA and CPTPP blocs. In 2024, numerous enterprises secured substantial export contracts. Beyond traditional markets, trade promotion activities have enabled the leather and footwear sector to expand into new markets such as the Middle East, South America, and Africa.

Sporting footwear, a forte of Vietnam, holds a dominant position and promises rapid and robust export growth to the Middle East. Additionally, this market consumes slippers, albeit in smaller quantities.

Vietnam is proactively negotiating bilaterally, proposing tax exemptions for high domestic value-added products, and scrutinizing certificates of origin to prevent the misuse of the “Made in Vietnam” label.

However, for the long term, Vietnam needs a “post-preference” strategy, encompassing: increasing the localization rate in export products; developing technology, materials, and automation to reduce reliance on cheap labor; expanding domestic consumption and non-traditional markets like Europe and the Middle East.

“Hot: Hotels Near My Dinh Stadium Fully Booked Ahead of G-Dragon’s Performance, Venue that Hosted BLACKPINK Also ‘Sold Out’”

With just a few days to go until G-Dragon’s highly anticipated arrival in Hanoi, the excitement and buzz in the air are palpable. As the countdown begins, hotels near the Mỹ Đình National Stadium are experiencing a surge in bookings, with many reporting full occupancy and a significant rise in room rates compared to regular days.