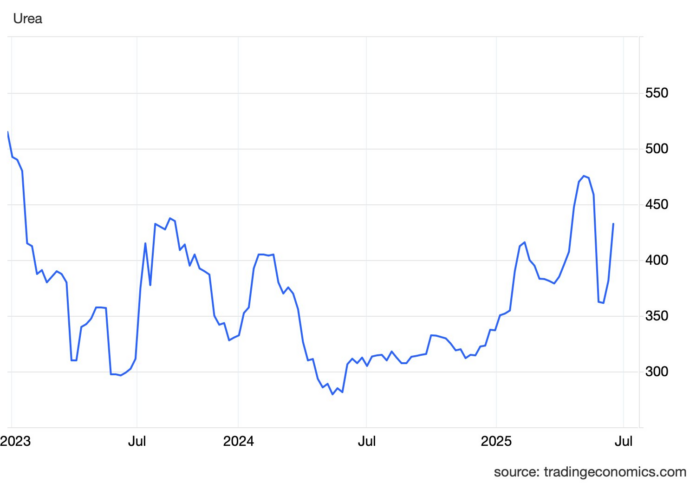

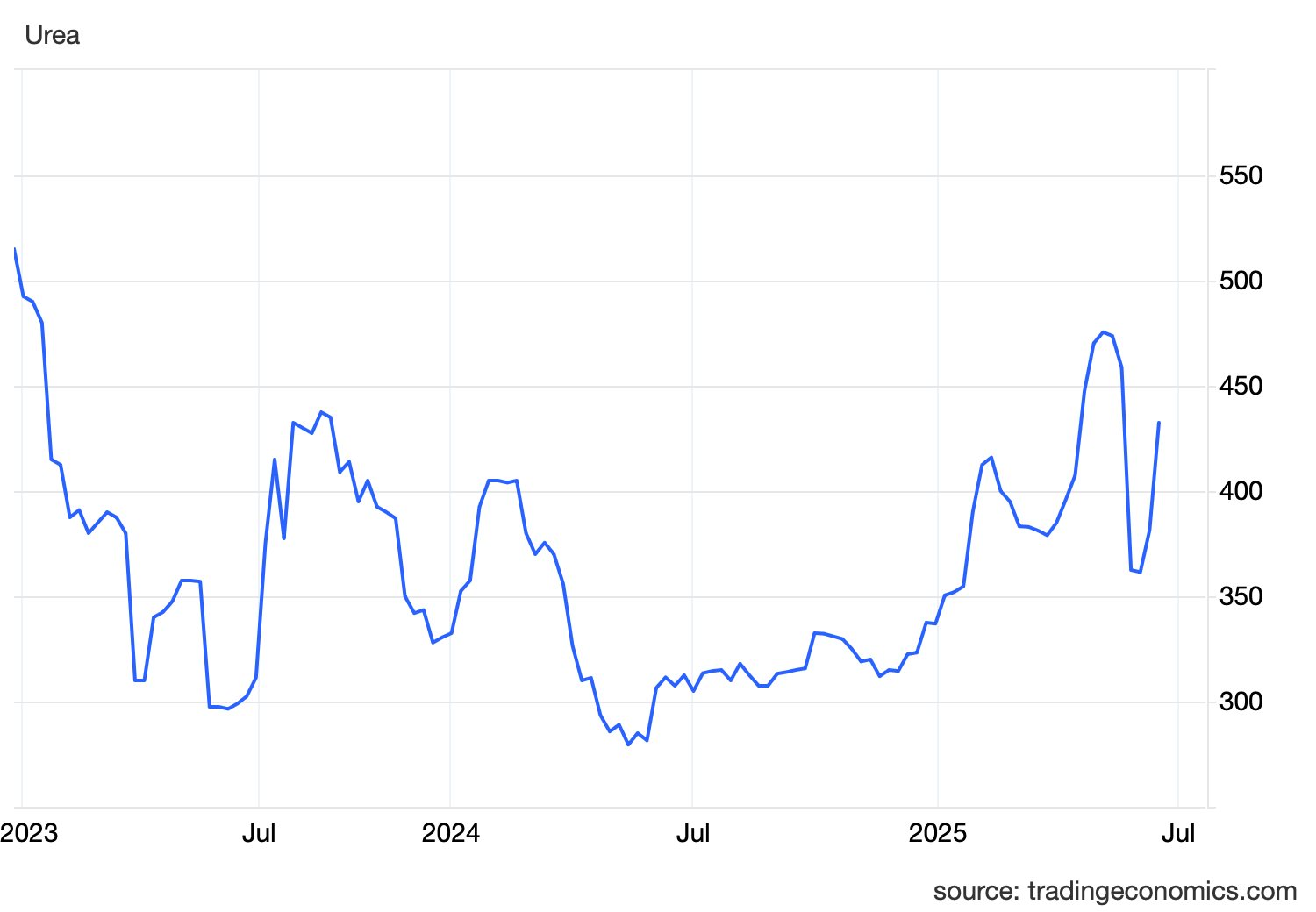

The Middle East tension has caused a surge in commodity prices, including urea. With cheap gas as a key advantage, the Middle East, particularly West Asia, is one of the world’s largest suppliers of urea. In just the last three sessions, urea prices have soared by over 20%.

At the recent 2025 Annual General Meeting, the management of Ca Mau Fertilizer (DCM) expressed optimism about rising urea prices in the coming quarters. This is driven by (1) supply disruptions in the Baltic and Middle East due to geopolitical tensions, (2) increasing demand from upcoming Indian urea tenders, and (3) the halt in urea production in Egypt.

A recent analysis by Vietcap suggests that these factors are expected to offset the impact of China’s partial resumption of urea exports, which are still limited in volume. Additionally, rising natural gas prices will positively impact urea prices. This increase usually has a lag of 2-3 weeks, allowing producers to offset partially or fully the higher input gas costs.

Vietcap has increased its forecast for Middle East urea prices in the 2025-29 period by an average of 3%, while also raising its assumptions for the average selling price (ASP) of Phu My Fertilizer (DPM) and DCM by 2.6% and 0.9%, respectively. However, Vietcap maintains the view that urea prices will eventually return to the 2012-21 average of 321 USD/ton as the impact of the Russia-Ukraine conflict and Chinese supply disruptions diminishes.

On the other hand, Vietcap has lowered its assumptions for average Brent oil/fuel oil prices in the 2025-29 period by 7%/4%, respectively. This has led to a 4.9% reduction in DCM’s average input gas price during this period, while DPM’s price has decreased by only 0.1%. This is due to (1) DPM using fuel oil prices as a benchmark for gas prices, while DCM determines it based on a 50:50 ratio of fuel oil and Brent oil prices; and (2) DPM’s higher-cost gas source.

Furthermore, Vietcap maintains its tax savings forecast for DPM/DCM at approximately VND 160/140 billion in 2025 and an average of VND 350/280 billion in the 2026-2029 period, only slightly lower than previous estimates due to lower assumed gas prices. The management of both DPM and DCM has confirmed these estimates.

Regarding the US countervailing duties, DPM predicts a limited impact, while DCM may face some slight obstacles but is awaiting the final tax negotiation results. According to Vietcap, neither DPM nor DCM is directly affected by President Trump’s proposed tariffs, as they do not export to the US.

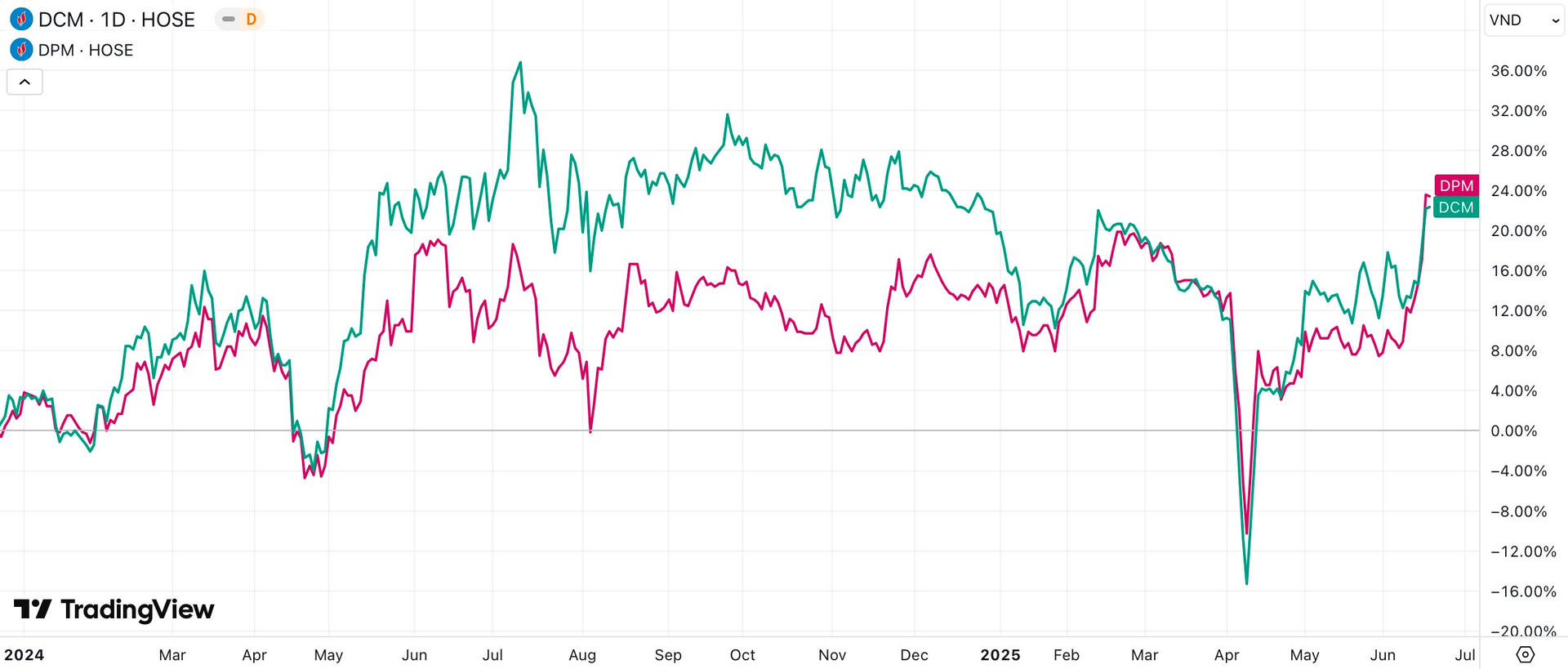

In fact, the DPM-DCM duo has recovered swiftly from the tariff lows in mid-April. After more than two months, these stocks have surged by approximately 35-45% in market price. DCM has climbed to its highest level since the beginning of the year, while DPM is hovering near a 3-year peak. Vietcap attributes this recovery partly to the companies’ consistent and high dividend yields.

The Powerhouse Industries: Banking and Oil to the Rescue, Yet Stocks Suffer

The Middle East tensions erupted suddenly before the domestic market opened, causing a significant impact. While the VN-Index was propped up by some large-cap stocks, a deep sell-off occurred across hundreds of stocks. The index closed slightly lower, down 0.57%, but 107 stocks fell by more than 2%, not to mention nearly 70 others that declined between 1% and 2%, or on the HNX.

The First Enterprise to Unveil Q2 2025 Financial Results

In Q2 of 2025, estimated revenue reached an impressive VND 6.2 trillion, marking a remarkable 60% growth compared to the same period last year.

“Oil Prices Surge to a Two-Week High: A Market Update”

The energy complex witnessed a boost on June 3rd, with oil prices reaching a 2-week high. Silver maintained its strength, holding near a 7-month high, while gold experienced a notable decline of almost 1%. In contrast, rubber plunged to a 1-year low, and raw sugar prices plummeted to levels not seen in 4 years, creating a challenging environment for commodities.

“Global Markets on June 3rd: Oil Prices Surge by Almost 3%, Robusta Coffee Plunges to a 7-Month Low”

As of the market close on June 2nd, oil prices surged by nearly 3%, while natural gas and gold reached their highest levels in three weeks. Silver shone even brighter, climbing to its highest point in over seven months. Conversely, Robusta coffee prices plummeted to a seven-month low, marking a stark contrast in the commodities market.