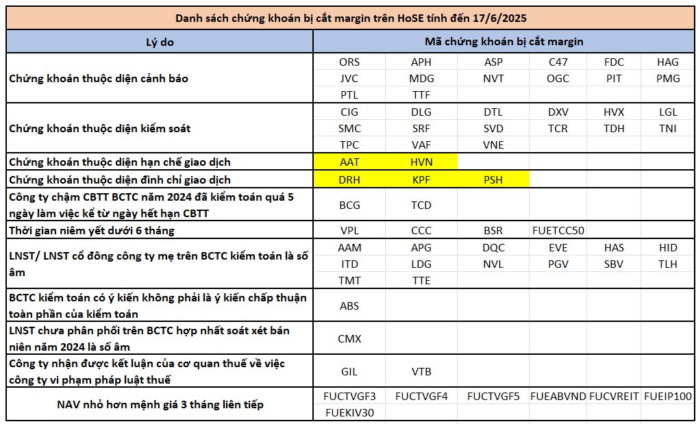

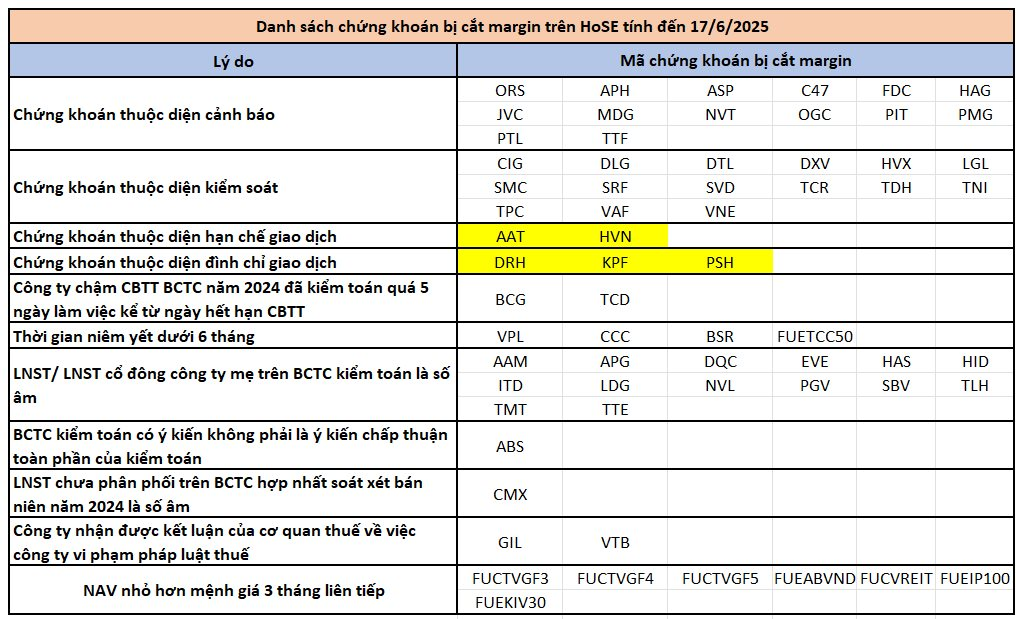

The Ho Chi Minh City Stock Exchange (HoSE) has updated the list of securities ineligible for margin trading.

RYG of Royal Production and Investment Joint Stock Company has been eligible for margin trading as it has been listed for over 6 months.

As of June 17, 2025, the number of stocks restricted for margin trading on HoSE is 65. Notable codes include VPL, NVL, QCH, HVN, HAG, and BSR.

Reasons for ineligibility, as stated by HoSE, include securities under warning/control/trading restriction; negative after-tax profit, audited report with auditor’s opinion; and listing time of less than 6 months.

Highlighted in yellow are codes with more than one reason

According to regulations, investors will not be able to use the credit limit (financial leverage-margin) provided by securities companies to purchase these 65 stocks on the list of ineligible securities for margin trading.

The Ticking Time Bomb of Maturity: Blue-chips Bounce Back, VN-Index Soars Past 1,350 Points

The VN30 stock group’s impressive recovery this afternoon propelled the VN-Index on an upward trajectory for almost the entire session. The index closed above the reference level, with trading volume on the HoSE surging 24.3% compared to the morning session. This marks the first time since May 2022 that the VN-Index has closed above the 1350-point mark.

The Art of Business: Unveiling Nam Tan Uyen’s Strategies Ahead of its HoSE Listing

“Nam Tan Uyen, a prominent Vietnamese company, has filed for the listing of nearly 24 million NTC shares on HoSE. This news comes on the heels of the company’s impressive first-quarter performance in 2025, where it reported a profit of VND 69 billion. With a strong financial track record and a promising future ahead, Nam Tan Uyen is poised to make a significant impact on the stock exchange.”