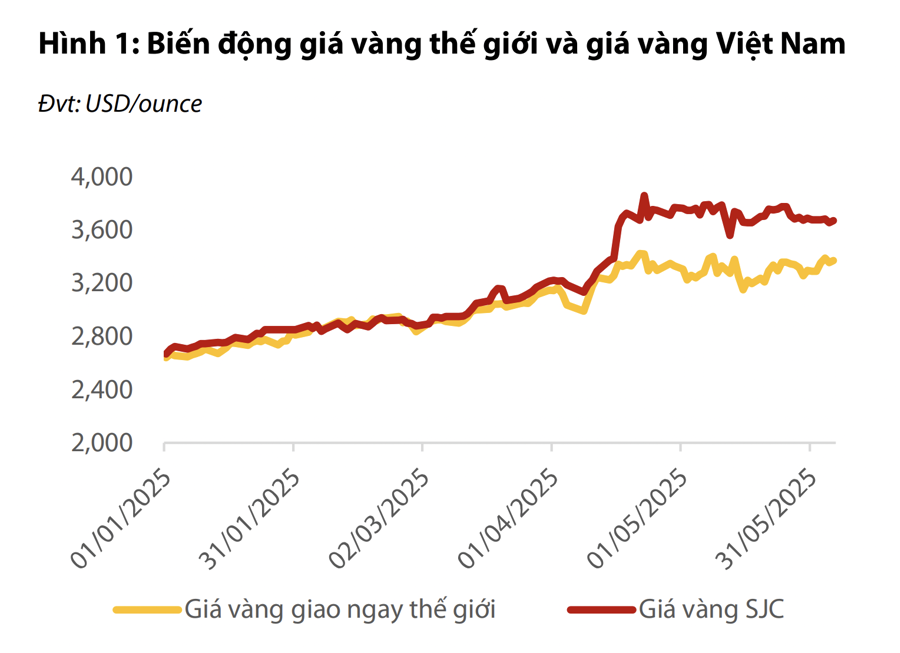

The gold market in the first half of 2025 witnessed notable fluctuations. Gold prices continuously reached peaks at certain times, while the gap between domestic and global gold prices tended to widen. However, positive signals have recently emerged in the market as the ‘gap’ shows signs of narrowing again.

In an updated report on the Vietnamese gold market, Rong Viet Securities (Rong Viet) stated that in the past time, the price of gold in Vietnam increased rapidly and was much higher than the world gold price. Typically, since the period of mid-April 2025, the gap between the domestic and world gold prices widened from 4% to 8-11% within just two days and lasted until the end of May 2025, when there were signals of narrowing again.

Although the narrowing of the gap between world and domestic gold prices has only been observed for a short period, this still indicates a positive signal towards the market’s reaction to the strategic and focused proposals on “resetting” the gold market.

The high domestic gold price over an extended period has made gold bar trading difficult, with transactions in the market assessed as lacking transparency. Jewelry manufacturers face challenges in collecting gold raw materials and gold bars with reasonable quantities and purchase prices.

The demand for gold in the Vietnamese market fluctuates strongly quarterly and is witnessing a trend that runs counter to that of other countries in the region. Gold demand in Vietnam usually peaks in the first quarter of each year, coinciding with the Tet holiday shopping season and the period of volatile global gold prices, indicating seasonality in the behavior of gold hoarding by the people.

However, Q1/2024 saw a 15% decrease compared to the previous quarter, mainly due to the prolonged scarcity of gold bar supply in the domestic market.

In contrast to the somewhat cooling trend in Vietnam, the Southeast Asian market has seen a slight recovery in gold demand recently. Thailand, in particular, is emerging as a bright spot in the Southeast Asian gold market, with gold demand in the first quarter surging by 16.7%, according to a World Gold Council report. This development reflects the growing trend of choosing gold as a safe-haven asset amid ongoing global economic uncertainties.

However, Vietnam’s gold demand remains higher than that of its regional peers as of Q1/2025.

Several policy proposals are expected to positively impact the gold market in general and the jewelry manufacturing and retail industry in particular. Among the suggested solutions, VDSC identifies some critical recommendations to the market and businesses, including: Controlled elimination of the state monopoly on gold bar brands, possibly licensing enterprises to participate in production; Expanding controlled import rights; Establishing Vietnam as a high-quality gold jewelry manufacturing and export hub;

Developing attractive alternative investment channels to mobilize gold from the people; Maintaining macro-economic stability to enhance people’s confidence in the Vietnamese dong; and Establishing a gold market information and data system promptly.

VDSC assesses that “realizing” the above proposals is necessary for the long-term goal of stabilizing the market, narrowing the domestic and international gold price gap, and reducing speculation through a transparent market mechanism. In the medium and long term, these are undoubtedly positive steps for the jewelry manufacturing and retail industry, with the expectation of a sufficient, legal, and stable gold material supply, avoiding reliance on small-scale gold collection with risks in price, quantity, quality, and origin.

The jewelry manufacturing and retail industry in Vietnam can benefit from a more controlled gold market. Promoting alternative investment channels will help divert funds away from gold bars while guiding consumers toward products with more practical value.

However, the “bottleneck” still exists and needs time to be “untied”: For many years, the common perception among Vietnamese people has been to consider gold as a safe asset storage channel, with less risk of depreciation than other investment channels. This leads to a tendency to buy more than sell, regardless of market fluctuations.

The Golden Slumber: Unraveling the Mystery Behind the Domestic Gold Market’s Quietude.

The SJC gold bar and ring prices remain steady, yet they continue to surpass the global market by a significant margin of 9-12 million VND per tael.

Gold Prices Falter Despite SPDR Gold Trust’s Buying Spree

“Gold prices are finding support from escalating geopolitical tensions in the Middle East. The ongoing aerial assaults between Israel and Iran, now in their seventh day, have heightened concerns about potential supply disruptions in the oil-rich region. This has triggered a flight to safety among investors, driving up the demand for gold as a traditional safe-haven asset. The precious metal is widely regarded as a hedge against economic and political uncertainty, making it an attractive investment during times of heightened global tensions.”

Gold Prices Stifled Below $3,400/oz as US Dollar Strengthens

The gold price weakness also reflects investor caution ahead of the outcome of the US Federal Reserve’s monetary policy meeting.

The Golden Dilemma: Can Gold Prices Break the $3,400/oz Mark Ahead of the Fed Meeting?

“The ‘Shark’ SDPR Gold Trust continues its buying spree, maintaining the fund’s buying trend over the past three weeks. This voracious appetite for gold investments showcases a strategic move by the trust, indicating a potential shift in the market and highlighting the precious metal’s enduring appeal as a safe-haven asset.”