VN-Index ended May at 1,332.6 points, up 5.2% from the beginning of the year, with a particularly strong recovery since the 09/04 session – the market bottom following the tariff shock. Notably, the index even surpassed its pre-shock level, up 2% from the end of March.

Despite the market recovery, the fact remains that it is dependent on large-cap stocks, especially the Vin group, implying that investors will face a “green shell, red flesh” situation if they do not hold these stocks in their portfolios.

This phenomenon is also evident when looking at the performance of many funds operating in the Vietnamese stock market, even when considering the cycle from the beginning of the year.

Most funds underperformed, still reeling from the tariff shock

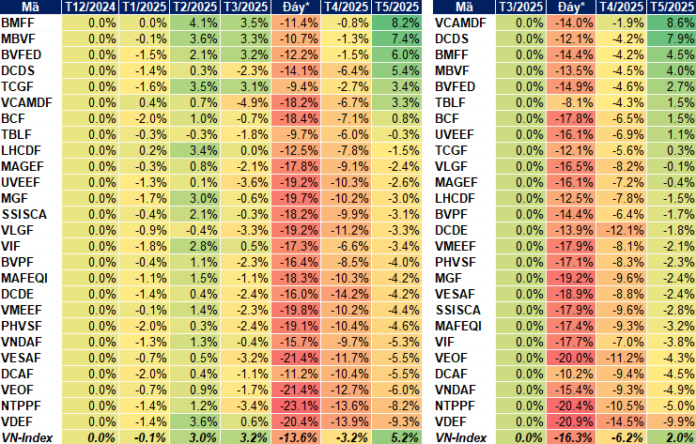

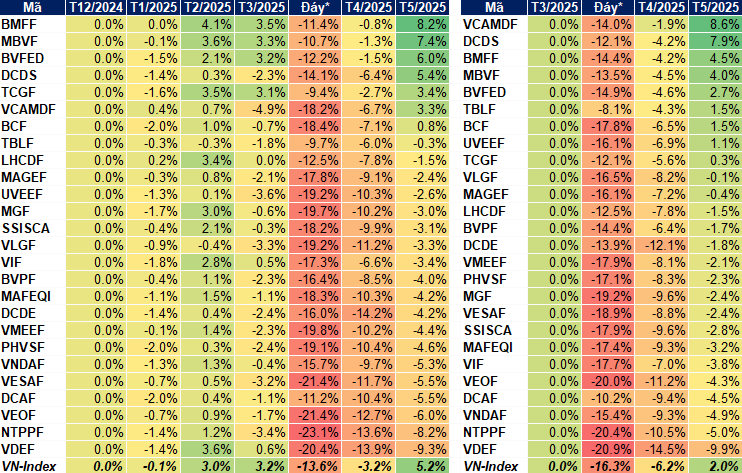

A review of the performance of 26 prominent equity funds for the first five months of 2025 reveals an overall lackluster picture, with 19 funds experiencing NAV/ccq declines, while only seven funds posted growth.

Among the funds with declining NAV/ccq, the most significant drop was recorded by the VinaCapital Dynamic Dividend Equity Fund (VDEF) with a negative performance of 9.3%, followed by the NTP Prospective Equity Fund (NTPPF) at -8.2%, VinaCapital Thriving Equity Fund (VEOF) at -6%, DFVN Growth Fund (DCAF) at -5.5%, VinaCapital Market Access Equity Fund (VESAF) at -5.5%, and VND Active Fund (VNDAF) at -5.3%.

However, the market also witnessed several funds with NAV/ccq growth. The Bordier – MB Flagship Growth Fund (BMFF) led the gains with an 8.2% increase since the beginning of the year, followed by the MB Capital Value Fund (MBVF) at 7.4%, Bao Viet Dynamic Equity Fund (BVFED) at 6%, and DC Dynamic Securities Investment Fund (DCDS) at 5.4%.

It is understandable that many equity funds were significantly impacted by the market shock, with the broad market dipping to a low of 1,094.3 points (closing price on 09/04), a 16.3% decline after the negative tariff-related news broke. Most funds touched their lows during the 09-10/04 period. At the bottom, 12 funds recorded larger declines than the VN-Index; among them, VDEF, NTPPF, and VEOF fell more than 20%. Subsequently, most funds have recovered considerably from their lows.

In fact, many funds rebounded strongly after the April slump. Notable performers include the BV Investment Discovery Fund (VCAMDF), which led the gains with an 8.6% increase over its March-end level, followed by DCDS at 7.9%, BMFF at 4.5%, MBVF at 4%, and BVFED at 2.7%.

|

Investment returns of open-ended equity funds

*Funds with NAV/ccq touching bottom during 09-10/04

Source: Author’s compilation

|

Portfolio composition determines success

Data from VietstockFinance shows that in the first five months of the year, real estate was the best-performing sector, surging 48.2%. This impressive performance was driven not only by the Vingroup’s stocks but also by the broader rally across the sector. In contrast, the financially dominant group, including banks, securities, and insurance, rose a modest 1.09%.

On the other hand, the information technology group, with FPT as its highlight, suffered the most significant decline in the market, plunging 22.8%.

|

Sector performance for the first five months of 2025 (%)

Source: VietstockFinance

|

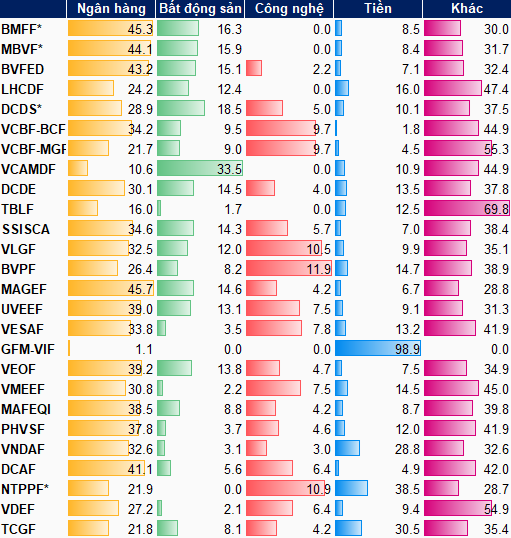

This performance somewhat reflects the investment results of the funds during this period. VDEF, NTPPF, and VESAF experienced substantial declines, accompanied by a considerable allocation to information technology stocks in their portfolios, while their exposure to real estate stocks was relatively low.

As of the end of May, VDEF had a 6.42% allocation to technology stocks, while only 2.14% was dedicated to real estate. VESAF held 7.77% in the technology sector, compared to just 3.46% in real estate. Even NTPPF, with a 10.9% allocation to the technology sector, had no exposure to real estate stocks (as of the end of April).

In contrast, the top-performing funds, such as BMFF and MBVF, maintained allocations of 15-16% to real estate, and VCAMDF had an even higher allocation of 33.5% to the sector, with no exposure to technology stocks.

|

Portfolio composition of open-ended equity funds

*Data as of the end of April 2025

Source: Author’s compilation

|

In reality, the performance of the funds depends on various factors, not just the sector allocation but also the specific stocks held within those sectors.

At the 2025 Annual General Meeting of the open-ended funds managed by Vietcombank Fund Management JSC (VCBF), Mr. Pham Le Duy Nhan, Portfolio Management Director, presented the first-quarter performance of the funds, with most of them generating negative returns while the benchmark indices posted slight gains.

Specifically, the Vietcombank Growth Equity Fund (MGF) returned -1.7% while the VN70 index rose 1.6%. Similarly, the Vietcombank Leading Equity Fund (BCF) returned -1.8% while the VN100 index climbed 1.1%.

Regarding MGF, the fund held higher allocations in stocks like FPT, MWG, PNJ, and BWE compared to the VN70 index, and these stocks underwent adjustments in the first quarter. Additionally, MGF did not invest in LPB, which has a relatively high weight in the VN70 index.

For BCF, the fund allocated a lower proportion to the real estate sector, particularly VHM and VIC, than the benchmark, while it held higher allocations in the discretionary consumer sector, including MWG and PNJ.

At the 2025 Annual General Meeting of VinaCapital Investment Fund JSC, in response to an investor’s question about strategies to ensure effectiveness amid tariff tensions, Deputy General Director Nguyen Hoai Thu shared that the company had reviewed and adjusted its portfolios. Generally, the weight of stocks in sectors directly impacted by tariff policies has been reduced, such as exports, industrial parks, and seaports, while the allocation to sectors less affected by tariffs, including domestic consumption, retail, and finance, has been increased.

Addressing another question about risk management and cash holdings for defense or seizing opportunities, Ms. Hoai Thu stated that if there are concerns about the market, the cash ratio would be above 12%. Currently, VinaCapital’s funds maintain a cash ratio of around 7-10%, reflecting a balance between optimism and caution, and this cash position allows them to seize attractive investment opportunities during market corrections.

– 10:15 20/06/2025

Two HAGL Executives Follow Chairman Doan Nguyen Duc’s Lead, Buying Millions of HAG Shares

Mrs. Vo Thi My Hanh and Mrs. Ho Thi Kim Chi are set to increase their stakes in HAGL by acquiring 1 million shares each. This move will see Mrs. Vo’s and Mrs. Ho’s holdings rise to 0.12% and 0.15% of the company’s charter capital, respectively.

“Vietstock Daily: Anticipating a Liquidity Rebound”

The VN-Index surged, successfully surpassing the 1,350-point resistance level. For this upward trend to solidify, confirmation from trading volume is necessary. The Stochastic Oscillator is pointing upwards and has already given a buy signal, while the MACD is narrowing its gap with the signal line, potentially providing a similar indication. These signals bode well for the index’s short-term positive outlook.

“VPBank’s Expert Advice: Investors Should Buy on Dips and Avoid Chasing Strong Rallies”

“Despite the mounting geopolitical risks, global stock markets will always weather these storms and emerge resilient,” asserted Duc.