On June 18th, the Management Board of Kinh Bac Urban Development Corporation – JSC (code: KBC) approved a plan to offer private placement shares at VND 23,900/share. The total offering volume is 250 million shares, equivalent to 32.57% of the current circulating shares, and is expected to raise nearly VND 6,000 billion.

The issuance targets this time are professional securities investors approved by the Board of Directors in Resolution No. 1511/2024/KBC/NQ-HĐQT dated November 15, 2024.

The issued shares will be restricted from transfer for a period of 1 year from the date of completion of the offering.

The expected timeline for the offering is within 90 days from receiving approval from the State Securities Commission.

Kinh Bac will announce the specific time for investors to register and pay for the shares. In case investors do not pay or only partially pay, the remaining shares will be redistributed or canceled according to regulations.

The KBC Board of Directors has authorized Mr. Dang Thanh Tam, Chairman of the Board, to implement the relevant procedures, ensuring compliance with current legal regulations.

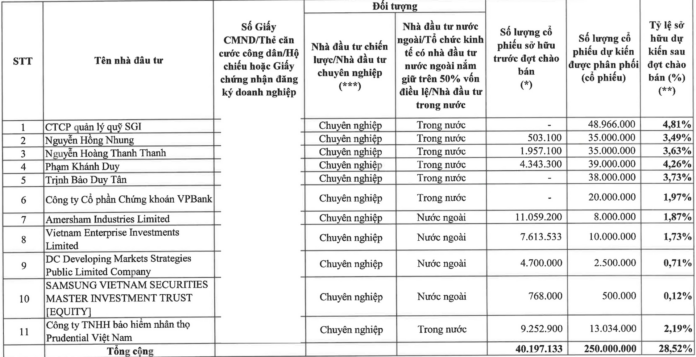

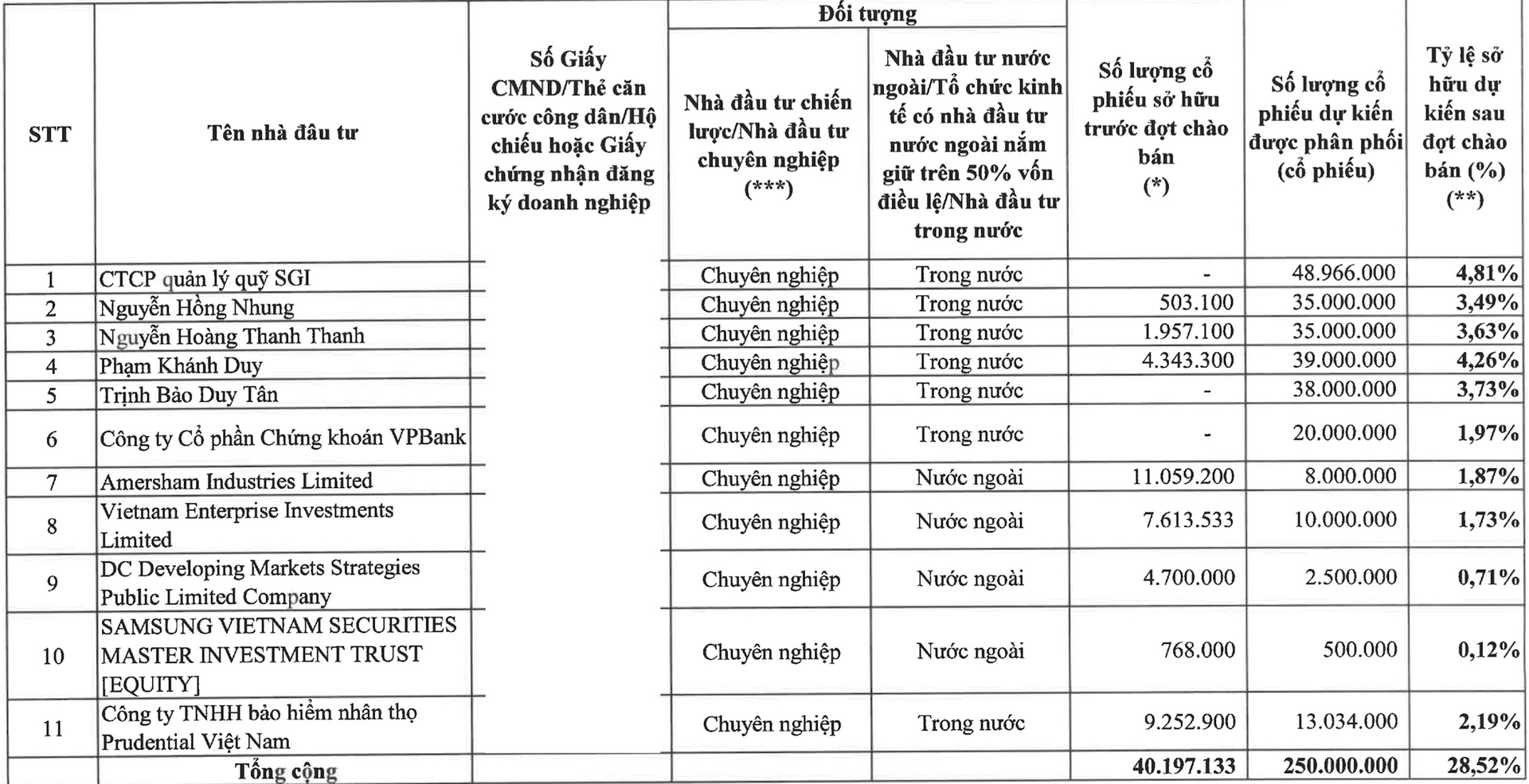

Notably, the list of expected participating investors includes billion-dollar “sharks” such as Dragon Capital, Prudential Vietnam, along with a few notable organizations like SGI Fund Management and VPBank Securities.

In the group of individuals, Ms. Nguyen Hong Nhung and Ms. Nguyen Hoang Thanh Thanh each purchased 35 million shares, respectively increasing their ownership to 3.49% and 3.63%. Mr. Pham Khanh Duy bought 39 million shares (4.26%), and Mr. Trinh Bao Duy Tan bought 38 million shares (3.73%).

With the expected proceeds from this offering, KBC will use approximately VND 6,000 billion to restructure its debts, mainly to repay principal and interest on loans to two subsidiaries: Saigon Bac Giang Industrial Park JSC (over VND 4,428 billion) and Saigon Hai Phong Industrial Park JSC (over VND 1,462 billion).

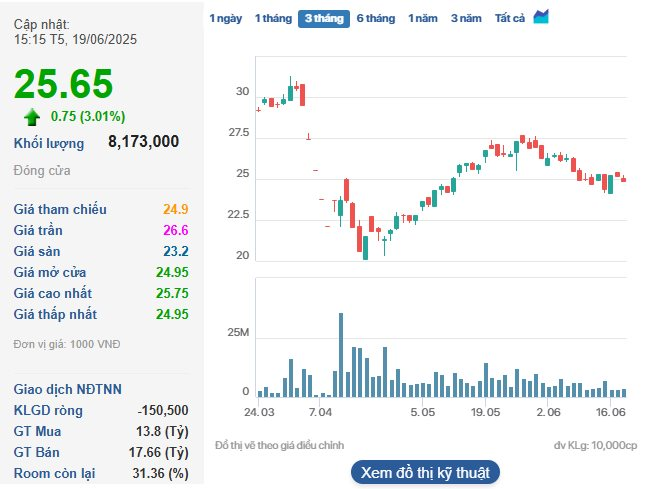

In the stock market, KBC shares closed at VND 25,650/share on June 19th. Thus, the private placement offering price is about 6.8% lower than the current market price of KBC shares.

“Novaland Share Price Doubles from Bottom, Major Shareholders Related to Chairman Bui Thanh Nhon Sold Nearly 18 Million Shares”

The recent large-scale sell-off is part of a strategic move by the major shareholders to optimize their debt structure.

“The Imminent Threat of Non-Performing Loans: A Comprehensive Overview”

The latest predictions indicate a continued rise in non-performing loans for banks in the second quarter of this year. This forecast is based on the significant net increase in Group 2 debts, estimated to be equivalent to the net formation of non-performing loans in the first quarter, with a substantial amount of potential bad debt still looming.

“TCBS Completes Private Placement of Nearly 119 Million Shares, Chairman Purchases Almost 90%”

As of June 10th, Techcom Securities Joint Stock Company (TCBS) successfully concluded its private offering of over 118.8 million shares, raising a substantial amount of over VND 1,188 billion. This strategic move has elevated the company’s charter capital to nearly VND 20,802 billion, firmly establishing it as the leader in the securities industry. Notably, Chairman of the Board of Directors, Nguyen Xuan Minh, demonstrated his strong confidence in the company’s prospects by acquiring over 106.1 million shares.