In a recent decision by Maybank IBG Holdings, Ms. Che Zakiah Binti Che Din will step down from her role as Chairwoman of MSVN, while Foong Seong Yew will also cease to be a member of the Board of Directors, effective June 18th.

|

Philip Tan Puay Koon has been appointed as an independent member and Chairman of the Board of Directors. Additionally, Tengku Ariff Azhar Bin Tengku Mohamed has been added to the Board as a member.

Notably, while the decision came into effect on June 18, 2025, the term is for 2023-2025, implying that the new appointees will serve for the remaining six months of the term before further changes are made.

Maybank Securities Joint Stock Company, formerly Kim Eng Securities Joint Stock Company, was established under a license dated December 14, 2007, by the State Securities Commission (SSC) and officially operated from April 2008. The first Chairman of the Company was Mr. Lam Quang Loc.

After Maybank Finance Group (Malaysia) completed the acquisition of all shares of Kim Eng Holdings Limited, the company officially changed its name to Maybank Kim Eng Securities Joint Stock Company in August 2012 with a modified license. At that time, Maybank Group held 49% of the shares through Maybank Kim Eng Holdings Limited.

During 2012-2013, the position of Chairman of the Board of Directors saw a notable change. Shahrul Nazri Abdul (Malaysian nationality) held this role briefly from July 2012 to September 2013 before being replaced by Le Minh Tam.

In January 2014, the company was officially approved by the SSC for a new ownership structure as Maybank Kim Eng Securities Limited Liability One-Member Company, becoming the first 100% foreign-owned securities company in Vietnam.

This event also marked the beginning of a cycle where the Chairmanship was held by Malaysian leaders, including Ronnie Royston Fernandiz (March 2014 – February 2019), Che Zakiah Binti Che Din (February 2019 – August 2020 and September 2021 – June 2025), Mohamad Yasin Bin Abdullah (August 2020 – September 2021), and most recently, Philip Tan Puay Koon.

In March 2022, after more than ten years of complete integration into the Maybank Group, the company officially received approval from the SSC to change its name to Maybank Securities Limited Liability Company as it is known today.

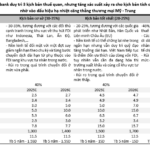

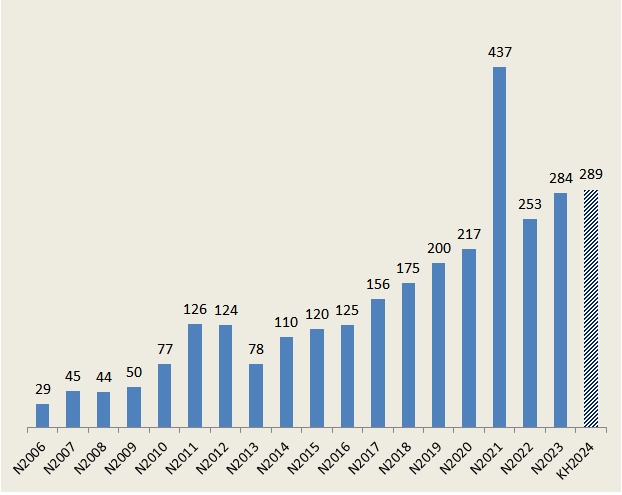

In terms of business operations, the company has set a revenue plan for 2025 of over VND 1,136 billion, an increase of 39% compared to the previous year. The two largest sources of revenue are interest from loans and receivables of nearly VND 699 billion, an increase of 48%, and securities brokerage revenue of more than VND 317 billion, an increase of 46%.

Total expected expenses are nearly VND 714 billion, an increase of 31%. Through this, the company expects a pre-tax profit of over VND 422 billion in 2025, an increase of 55% and the highest in its operating history.

In the first quarter of 2025, MSVN reported a pre-tax profit of nearly VND 35 billion, down 45% over the same period last year and only about 8% of the full-year plan.

| MSVN’s quarterly business results in recent years |

– 17:56 20/06/2025

“Maybank Securities Revises VN-Index Forecast, Bullish Scenario Could Reach 1,500 Points”

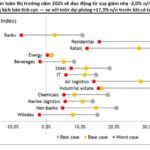

In Maybank Securities’ May strategy report, the brokerage assesses that the easing of trade tensions continues to be a positive factor for market valuations. On this basis, Maybank Securities revises up its 2025 full-market earnings forecast by 5-10% and adjusts its year-end VN-Index target according to three scenarios: 1,300 points (base); 1,500 points (bull case); and 1,050 points (bear case).

The Stock Exchange Company Raises Forecast for VN-Index to Reach 1,500 Points by Year-End

The MSVN analyst team has adjusted their profit forecast for the entire market, now expecting a 5-10% increase across all scenarios.