Vietnam Rubber Group – Joint Stock Company (VRG, Stock Code: GVR) has announced changes to its board of management. The company has relieved Mr. Tran Ngoc Thuan from his duties as a member of the Board of Directors, effective June 17, 2025, as per the resolution passed at the recent Annual General Meeting.

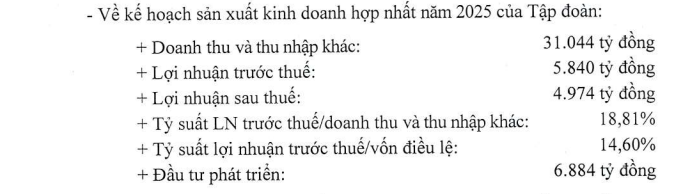

The Annual General Meeting also approved the production and business performance report for 2024 and the direction for 2025, along with reports on the activities of the Board of Directors and the Supervisory Board for 2024 and their plans for 2025.

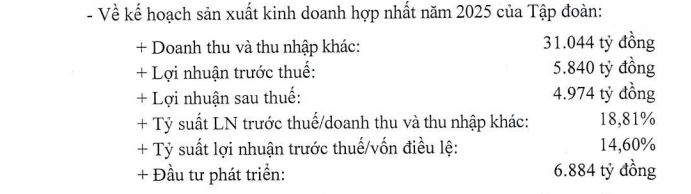

In 2024, GVR recorded consolidated revenue and pre-tax profit of VND 28,739 billion and VND 5,606 billion, respectively, surpassing the targets by 115% and 137%. The company’s parent-only after-tax profit stood at VND 2,353 billion.

Given these impressive results, the GVR Board of Directors proposed an increase in dividend payout for 2024 from 3% to 4%, amounting to VND 1,600 billion. Additionally, they allocated VND 704 billion to the development investment fund.

Source: VGR

The meeting approved the report on remuneration for 2024 and the plan for salaries and remuneration of the Board of Directors and Supervisory Board for 2025 as proposed in Report No. 339/TTr-HQTCSVN dated May 27, 2025. Accordingly, the remuneration paid to the non-executive Board of Directors and Supervisory Board in 2024 amounted to VND 606 million. The planned salaries for the executive Board of Directors and Supervisory Board for 2025 are VND 4,440 million, and the planned remuneration for the non-executive Board of Directors and Supervisory Board for 2025 is VND 1,641.6 million. The remuneration payment for the Board of Directors and Supervisory Board will be decided and executed by the Board of Directors in accordance with current regulations.

“TCO’s Ambitious Venture: Direct Exports to Global Giants Olam and Louis – Elevating Vietnam’s Rice Industry on the World Stage.”

Sharing at the 2025 Annual General Meeting, TCO Holdings (TCO) revealed its plans to expand its value chain in the rice industry. Having successfully restructured and positioned itself as a leading rice processor for domestic enterprises, TCO now sets its sights on direct exports to global giants such as Olam and Louis.

Vietinbank Securities Raises Capital Beyond 2.1 Trillion VND Following Dividend Payout

Are there any other adjustments you would like to make to this text? I can perform further edits if you wish to refine it further.

As of June 6th, Vietinbank Securities has successfully issued 63.95 million bonus shares as dividend payments to its 10,651 shareholders. This move has effectively increased the company’s charter capital to VND 2,126.9 billion.

“DCM Finalizes Dividend Payment Date, Approves Nearly VND 1.1 Trillion Payout, and Revises Down Profit Targets for 2021-2025.”

The Petro Vietnam Ca Mau Fertilizer Joint Stock Company (HOSE: DCM) has announced a planned cash dividend payout for 2024, offering a generous 20% dividend rate, equivalent to VND 2,000 per share. Shareholders will be able to reap the benefits of this dividend on July 15, 2024, with a record date set for June 27, 2024.