Real Estate Credit Surges

According to the State Bank of Vietnam, as of May 28, total credit outstanding in the economy reached over VND 16,600 trillion, up 6.32% from the beginning of the year.

Data from the Ministry of Construction shows that real estate credit in the first quarter of this year grew by 7.49%, significantly higher than the overall market growth of 3.91%. This positive momentum reflects simultaneous improvements in both supply and demand, amid persistently low lending rates.

A notable bright spot is the rebound in credit for social housing after a period of adjustment. As of the end of April 2025, total outstanding social housing credit reached VND 2,764 billion, up 4.84% from the previous month, the highest increase in the last three months (up 1.7% in March and down 2.55% in February).

This impressive recovery is attributed to commercial banks actively offering preferential credit packages for low-income earners. Flexible loan packages with competitive interest rates and affordable repayment terms have provided added motivation for homebuyers, while also boosting capital inflows into the social housing segment.

Low interest rate environment and ample credit room fuel surge in real estate credit. |

In addition to traditional social housing loans, many banks have been introducing new credit programs targeting young people, such as exclusive packages for those under 35 years old. These initiatives help address housing needs for young working individuals, especially in major cities like Hanoi, Ho Chi Minh City, and Haiphong.

A deputy branch director of a Big Four bank in Haiphong shared: “The fixed interest rate of 5.5% for the first three years has attracted many young families to take out loans to buy houses, with strong disbursements since the beginning of May. Currently, property prices in Haiphong are much lower than in large cities like Hanoi and Ho Chi Minh City, so disbursements at our branches have increased significantly.”

Real Estate Credit Not “Overheating”

Real estate credit remains a key component of banks’ lending portfolios. The outlook for the real estate market in the second half of 2025 is relatively positive, with interest rates expected to remain low and legal frameworks continuing to improve…

However, this recovery also warrants some caution. Housing prices in many areas are still significantly higher than the average income of urban residents, especially for first-time homebuyers. If not properly managed, the imbalance between prices and affordability could lead to a potential supply-demand mismatch in the medium term. Therefore, the market structure needs to be adjusted to focus on actual demand, with reasonable price levels and products that match repayment capabilities.

Dr. Nguyen Huu Huan, an expert from the University of Economics in Ho Chi Minh City, opined that after a period of stagnation, the real estate market has shown positive recovery signals, resulting in a significant increase in real estate credit outstanding, but not to the extent of “overheating.”

However, Dr. Huan noted that while banks have strategies for credit allocation based on their business orientations and risk management solutions, an excessively large and prolonged concentration of credit in the real estate sector could impact the resources available for other priority economic sectors.

“Therefore, it is necessary to accelerate the implementation of credit packages for other sectors, such as the VND 500 trillion package for science and technology, innovation, and strategic infrastructure. We should also continue exploring supportive credit policies for production and business sectors, especially export-oriented ones, to promote healthy credit flows and support sustainable economic development,” Dr. Huan suggested.

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, cautioned that currently, over 50% of capital for real estate businesses comes from bank credit, while banks rely on short-term capital for long-term lending, posing significant risks to the financial system.

According to Mr. Dinh, diversifying capital channels through bonds, bills, investment funds, and development funds is essential. These alternatives have been discussed for over a decade, but legal obstacles have hindered their implementation.

Ngoc Mai

Unlocking Real Estate Credit Growth: Navigating the Cycle

In the face of ongoing external uncertainties, the Government maintains an ambitious GDP growth target of over 8%. To achieve this goal, in addition to promoting public investment, unlocking capital for the real estate sector is crucial. The current low-interest-rate environment and ample credit room are conducive to attracting funds back into the real estate market.

A Brokerage Firm Launches Margin Loan Package with 6.6% Interest, Up to VND 3 Billion Credit Limit

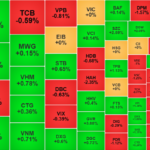

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented offer is accompanied by a host of other benefits, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.

What’s the Impact of ‘Ultra-Low’ Interest Rates on Home Loan Credit Growth?

With an unprecedented interest rate advantage, banks are offering an incredible opportunity for young homebuyers under 35 years old. With rates as low as 3.88% per year and loan tenures of up to 40 years, the home loan credit balance has seen a positive improvement since the beginning of the year.