In contrast to the gloomy morning session, the market rebounded after lunch, led by the Vingroup trio. VIC and VHM contributed a significant 9 points to the overall gain, with VIC surging to its daily limit of 92,800 VND per share, while VHM rose over 5%.

Other stocks in the Vingroup family also witnessed a boost, with VRE and VPL climbing by approximately 1% each. This positive momentum followed the group’s recent groundbreaking ceremony for a 44 trillion VND resort project in Da Nang.

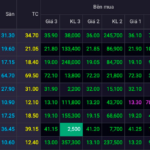

VIC surged to its daily limit of 92,800 VND per share.

Despite a sea of red on the market, the VN-Index managed to hit a new peak, propelled by a handful of heavyweight stocks. These included GAS, BSR, PLX, MBB, VRE, OCB, VPL, and GEX, which collectively added over 13 points to the index.

Oil and gas stocks rallied alongside surging global oil prices amid escalating geopolitical tensions in the Middle East. In Asian markets, oil prices climbed sharply, with US WTI crude rising over 2% to $75.22 per barrel and Brent crude increasing nearly 2% to $78.53.

On the flip side, the market remained divided, with pressure from banking, securities, and real estate sectors partially offsetting the gains. Heavyweights such as VCB, HVN, VNM, TCB, and BID dragged the main index down, although the decline was modest.

At the closing bell, the VN-Index gained 8.83 points (0.65%) to reach 1,358, while the HNX-Index added 0.35 points (0.15%) to close at 227.42. In contrast, the UPCoM-Index dipped 0.25 points (0.25%) to 98.93. Turnover slightly eased, with HoSE’s trading value surpassing 21,000 billion VND.

Despite tensions in the Middle East, Vietnam’s stock market kicked off the week on a brighter note compared to its regional and global peers. However, the rally was concentrated in a handful of large caps, leaving the broader market relatively subdued. Turnover eased slightly as investors adopted a cautious stance.

Mr. Dinh Quang Hinh, an expert from VNDirect Securities Corporation, advised investors to maintain a balanced portfolio and refrain from aggressively increasing their exposure amid lingering risks. The situation in the Middle East remains volatile and could escalate into a regional conflict. Risk management is key, even as the market flashes positive signals.

He suggested focusing on sectors with strong liquidity and stable business prospects, which are less susceptible to geopolitical tensions, such as retail, technology, and real estate.

A Historic Turning Point for Vietnam’s Stock Market: 25 Years in the Making

Celebrating 25 years of the Vietnamese stock market is an opportunity to reflect on its proud achievements and chart a course for the future.

Expert Insights: Equities May Witness a Correction; Seize Opportunities in Cash-Attractive Stocks with Positive Outlook

“Liquidity and stability are key in the current market climate, and astute investors are turning their attention to stocks in the retail, technology, and real estate sectors. These sectors offer a reprieve from the geo-political tensions that are impacting other industries. With their robust business models and steady growth prospects, these stocks are a safe haven for those seeking to weather the storm.”