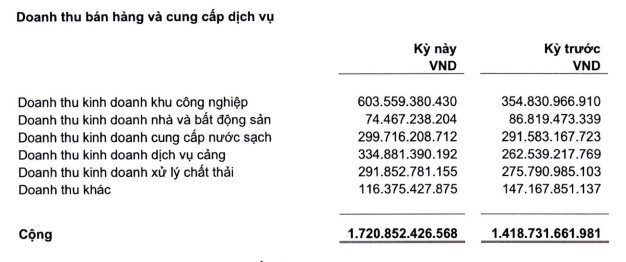

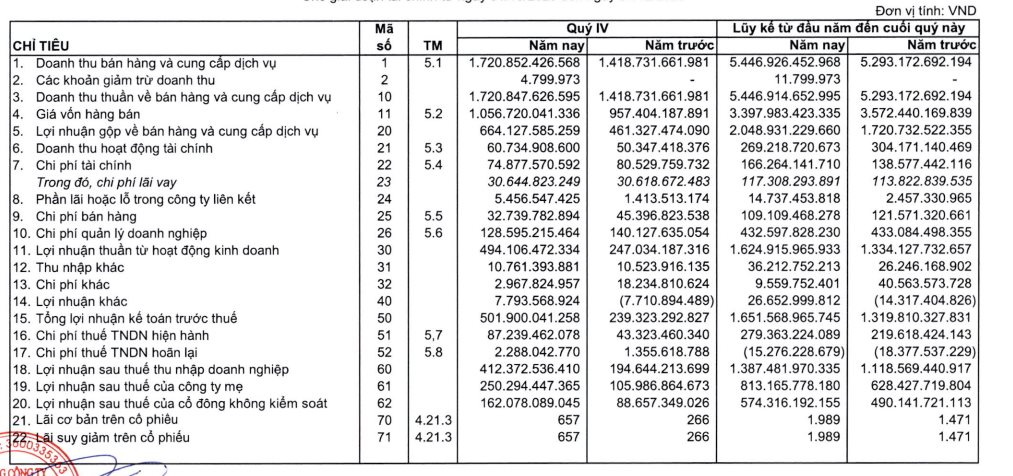

The Industrial Development Corporation Joint Stock Company (Sonadezi; UPCoM: SNZ) has just announced its consolidated financial statements for the fourth quarter of 2023, recording a net revenue of VND 1,720 billion, an increase of 21.29% compared to the same period in 2022. However, the Cost of Goods Sold (COGS) only increased by 10.37%, reaching VND 1,056 billion, resulting in a gross profit of VND 664 billion from sales, a 43.96% increase compared to the same period in 2022.

During the period, the company generated VND 60.7 billion in financial activities (a 20.63% increase); other profits amounted to nearly VND 8 billion, compared to a loss of VND 7.7 billion in the same period of 2022; and the equity from joint ventures contributed VND 5.4 billion, compared to VND 1.4 billion in the same period of 2022.

In addition, Sonadezi has also reduced most of its expenses in the fourth quarter of 2023, with financial expenses amounting to VND 74.8 billion (a 7% decrease), sales expenses amounting to VND 32.7 billion (a 27.8% decrease), and general business management expenses amounting to VND 128.6 billion, an 8.23% decrease compared to the same period in 2022.

As a result, Sonadezi recorded a net profit after tax of over VND 412 billion in the fourth quarter of 2023, doubling compared to the same period in 2022.

For the cumulative results of 2023, Sonadezi achieved a net revenue of nearly VND 5,467 billion (a 2.9% increase) – a record high revenue for the company. The COGS decreased by 4.88%, amounting to VND 3,398 billion, resulting in a gross profit of VND 2,048 billion from sales, a 19.07% increase compared to 2022.

In addition, financial activities generated VND 269 billion (an 11.49% decrease), other profits amounted to VND 26.6 billion, compared to a loss of VND 14.3 billion in the same period.

Meanwhile, financial expenses increased by nearly 20% compared to 2022, reaching VND 166 billion. On the other hand, sales expenses and general business management expenses decreased by 10.25% and 0.11% respectively compared to the previous year, amounting to VND 109 billion and VND 432 billion respectively.

For the business results of 2023, Sonadezi recorded a net profit after tax of VND 1,387 billion, a more than 24% increase compared to 2022. This is the fifth consecutive year that Sonadezi has achieved a net profit of over VND 1,000 billion, and is the second highest net profit year to date for the industrial real estate giant in Dong Nai province.

As of December 31, 2023, Sonadezi’s total assets reached VND 23,138 billion, a more than 2% increase compared to the beginning of the year. Short-term assets amounted to VND 7,507 billion, a 3.16% decrease. Cash and cash equivalents amounted to VND 1,149 billion, an 18.215% decrease.

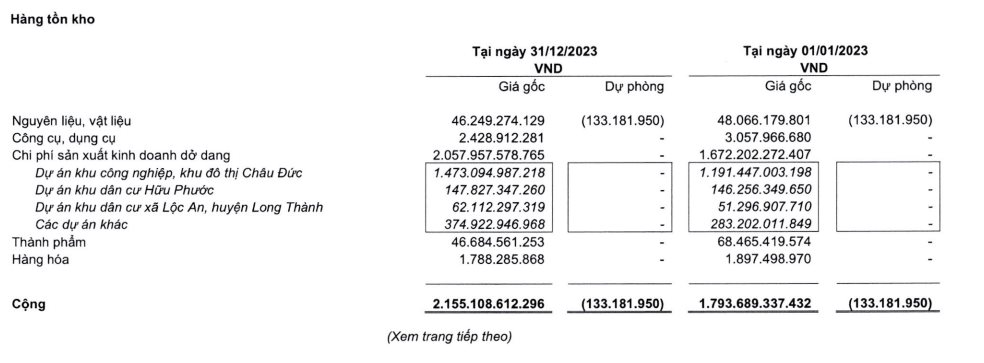

Inventory amounted to nearly VND 2,155 billion, a 20.15% increase. Among them, the unfinished production and business costs in the industrial park and Chau Duc urban area increased by nearly VND 300 billion compared to the beginning of the year.

The company’s total liabilities at the end of 2023 amounted to VND 13,043 billion, a slight decrease compared to the beginning of the year. However, short-term debts amounted to VND 3,864 billion, a 6.07% increase. Financial borrowings amounted to VND 4,815 billion, a 3.68% decrease.

On the stock market, at the end of the trading session on January 31, SNZ’s stock price was VND 34,000 per share, a 2.1% increase compared to the previous trading session, with a trading volume of nearly 27 thousand shares.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)