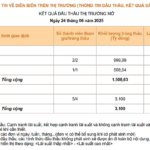

On June 25, the State Bank of Vietnam set the daily reference exchange rate at 25,055 VND/USD, a decrease of 3 VND from the previous day. With a permitted bandwidth of 5%, commercial banks will trade the US dollar at rates between 23,800 and 26,308 VND.

Commercial banks are trading the US dollar close to the permitted ceiling. Vietcombank offers buying and selling rates of 25,987 VND and 26,307 VND, respectively, a decrease of 3 VND from the previous day.

Similarly, BIDV, Sacombank, and Eximbank have also pushed their buying and selling rates close to the permitted ceiling, with buying rates hovering around 25,980 VND and selling rates at 26,307 VND.

Since the beginning of the year, the exchange rate has increased by approximately 2.9%. This is a significant rise considering the US dollar’s performance in the international market. The US Dollar Index (DXY) is currently trading at 98 points.

Speaking to the Laborer Newspaper, Ms. Bui Thi Thao Ly, Director of Analysis at Shinhan Securities Vietnam, shared that the USD/VND exchange rate is under pressure, despite the US Dollar Index’s decline of 8.71% since the end of last year. Many regional currencies have appreciated against the US dollar, while the VND has depreciated significantly.

“In the first five months of this year, inflation remained low, but the exchange rate increased sharply. This could be due to the high demand for USD for import and export activities of enterprises,” Ms. Ly explained.

“Before the tariffs took effect, companies were rushing to export their goods, resulting in a nearly 14% increase in exports and a 17.5% surge in imports over the past five months—a sudden rise that exceeded previous predictions,” she added.

Commercial bank USD rates have increased by about 2.9% since the beginning of the year.

Mr. Nguyen Thanh Lam, Director of Retail Analysis at Maybank Securities, attributed the five consecutive weeks of VND depreciation to market caution amid US-Vietnam trade negotiations and the outlook for Federal Reserve interest rates. The widening interest rate differential between USD and VND is fueling arbitrage activities.

“The exchange rate is expected to stabilize soon due to positive trade balance and FDI inflows. The Fed’s anticipated rate cut in July should also ease mid-term pressure,” Mr. Lam predicted.

Meanwhile, Mr. Dao Hong Duong, Director of Industry and Stock Analysis at VPBank Securities, believes that the pressure on the exchange rate is mainly short-term, and the State Bank of Vietnam can effectively manage it through regulatory measures.

Mr. Duong cited the declining loan-to-export ratio compared to the same period in 2024 and the US Dollar Index’s recent lows (97-98 points) as supporting factors.

“Given the current situation, I don’t think it’s necessary to adjust interest rates to curb the exchange rate. The 8% GDP growth target remains achievable, with interest rates and money supply playing a pivotal role,” Mr. Duong stated.

“Vietnamese Dong Devalues Against Major Currencies: Down 14% Against Euro Since January, 7-11% Against Pound, Yen, and Aussie Dollar”

The Vietnamese Dong has witnessed a significant depreciation against major currencies, given its relatively pegged status to the US Dollar. Since the beginning of the year, the US Dollar has weakened yet remained strong against the Vietnamese currency, presenting a challenging scenario for the country’s economy and those transacting in the local currency.

The Perils of Inflation and Exchange Rate Hikes: Challenges for Sustaining Low-Interest Rates.

The currency market is under pressure as domestic USD rates move contrary to global trends, despite the USD-Index falling over 10% since the start of the year.

The Rising Dollar: Impact and Implications

“Last week, from June 16 to 20, 2025, the US dollar surged in the international market after the Federal Reserve’s decision to hold interest rates steady at their June policy meeting.”