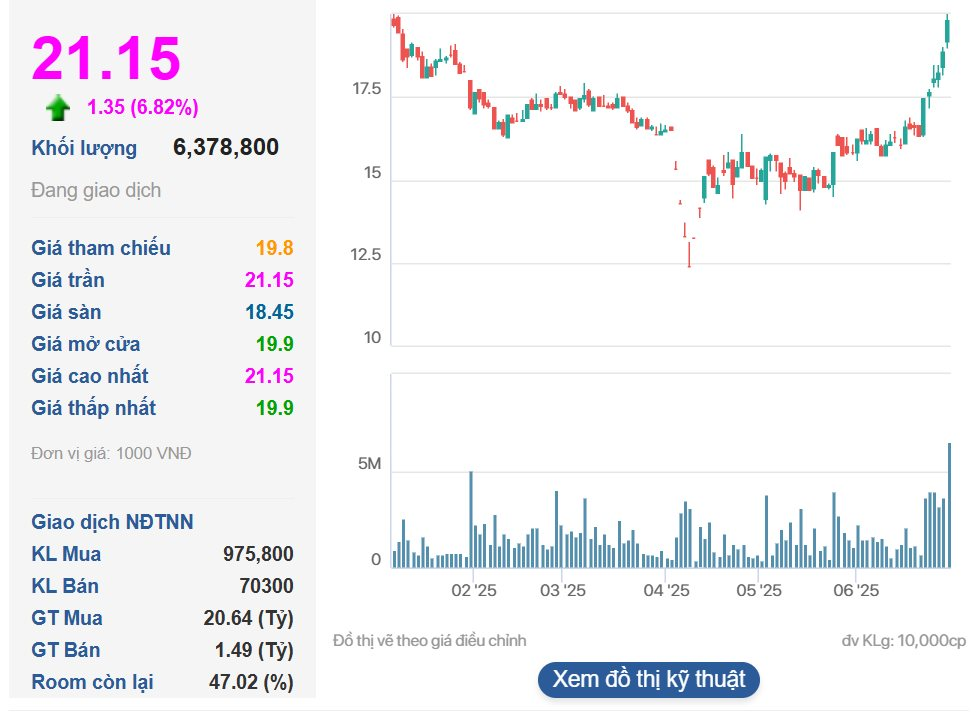

ANV’s share price surged during morning trade on June 30, marking its seventh consecutive session in the green.

On June 30, shares of ANV, issued by Nam Viet Joint Stock Company, soared to the ceiling price of 21,150 VND per share with buy orders far outstripping sell offers. This marked the seventh consecutive session of gains for ANV.

The upward momentum for ANV began after news broke on June 18, 2025, that the U.S. Department of Commerce (DOC) had announced the final results of the 20th administrative review (POR20) regarding anti-dumping duties on frozen tra fish fillets from Vietnam imported into the U.S. for the period from August 1, 2022, to July 31, 2023.

Specifically, seven Vietnamese enterprises were assigned a zero percent tax rate, including Nam Viet.

Doan Toi, Vice Chairman and CEO of ANV, saw his stake in the company increase to 54.98% after purchasing an additional 3 million shares.

Earlier in April, following the announcement of a potential 46% retaliatory tariff on Vietnamese exports to the U.S., ANV shares plummeted to the floor price for four consecutive sessions.

In response to this development, Doan Toi, Vice Chairman and CEO of ANV, sent a letter to shareholders, reassuring them that the U.S. market holds potential for the company, both presently and in the future, particularly for its key products: tra fish and tilapia. He emphasized the company’s strategy to aggressively expand into existing export markets beyond the U.S.

Toi also highlighted that the U.S. is not a primary market for Nam Viet, with key markets including China, the Middle East, Brazil, Asia, and Mexico.

Additionally, Toi disclosed his decision to intervene and support the company’s share price by purchasing 3 million ANV shares. From April 11 to April 18, Toi successfully acquired the intended number of shares, increasing his ownership from over 143.6 million shares (53.85%) to 146.6 million shares (54.98%), solidifying his position as the largest shareholder of ANV.

Since the release of the aforementioned letter on April 9, ANV’s share price has surged by over 70%.

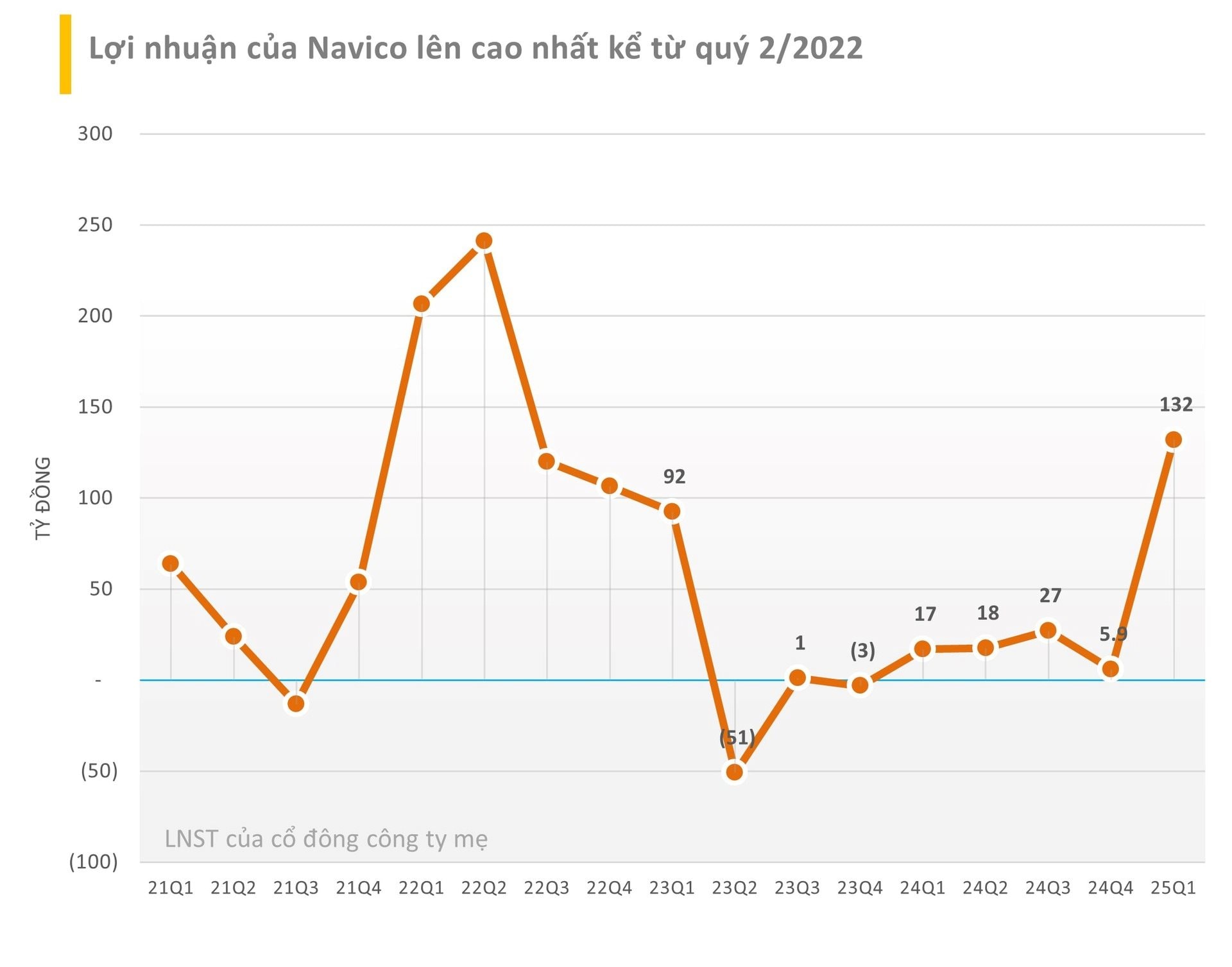

Nam Viet’s financial performance has also shown signs of improvement. In Q1 2025, the company reported impressive results, with a slight increase in revenue from 1,016 billion VND to 1,106 billion VND, accompanied by a significant surge in net profit from 17 billion VND to 132 billion VND—the highest since Q2 2022.

ANV’s impressive financial results for Q1 2025 showed a significant surge in net profit to 132 billion VND.

On June 28, ANV held its 2025 Annual General Meeting of Shareholders, approving the company’s business plan for 2025. The company set ambitious targets, aiming for revenue in the range of 6,200–7,000 billion VND and a pre-tax profit of 500 billion VND. Compared to the pre-tax profit achieved in 2024, this year’s target represents a sixfold increase.

According to a report by VCBS on ANV, the securities firm believes that there is significant growth potential for tra fish exports to the American and European markets. The consumption of tra fish in the U.S. may not be significantly impacted by retaliatory tariffs, given its large import volume and competitive pricing compared to other types of fish.

Competing fish species, such as cod, face restricted fishing quotas, while another alternative, hake, is subject to a ban in the U.S. and high tariffs in the EU. Additionally, there is growing potential for tra fish exports to Brazil, facilitated by recent positive developments in negotiations between the two countries.

Furthermore, the domestic consumption of tra fish in Vietnam is on a positive growth trajectory. The country’s tra fish consumption is projected to reach approximately 121,000 tons in 2025, representing a 0.56% increase compared to the previous year. This presents a valuable opportunity for seafood companies to enhance their domestic revenue.

Vietnamese tilapia has a significant opportunity to expand its market share in the U.S. due to the high retaliatory tariff imposed on its Chinese competitor. Chinese tilapia faces a potential 30% retaliatory tariff, resulting in export prices to the U.S. that are predicted to be 35% higher than those of Vietnamese tilapia.

ANV’s profit margin is expected to improve due to stable or slightly decreasing prices for fishmeal and corn by-products in 2025.

The Surprising Story of Vietnam’s Seafood Exports

The Vietnamese seafood industry experienced a slight slowdown in May, recording exports of over $850 million, following a strong growth trajectory in the initial months of the year.

The Profitable Stockbroking Company: Leading the Industry with a 43% Dividend Payout

“VietinBank Securities has announced a dividend plan that will see shareholders receive a substantial return on their investment. In a move that underscores the company’s commitment to rewarding its shareholders, it has been revealed that for every 100 shares owned, shareholders will be entitled to an additional 43 shares. This generous dividend policy highlights VietinBank Securities’ strong financial performance and its dedication to creating value for its investors.”