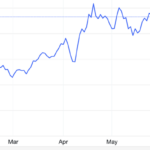

Gold prices witnessed a sharp decline this week, falling below the $3,300/ounce mark despite favorable traditional factors for precious metals.

As of this morning, June 29, Vietnam time, the world gold price stood at $3,273.40/ounce, a decrease of $44.57/ounce from the previous day.

According to Kitco’s gold price forecast survey, 53% of experts predict a further decline next week, while only 35% expect an increase.

In contrast, small investors remain slightly more optimistic, with 51% of 233 respondents believing that prices will rise.

On the bearish outlook for gold, Jesse Colombo, an independent precious metals analyst and author of the Bubble Bubble report, advised investors to prepare for a short-term downturn as the summer trading season kicks off next week with the long July 4 holiday weekend.

Colombo anticipates gold prices to fluctuate within a broad range of $3,200 to $3,500/ounce.

Additionally, factors such as trade agreements and the ceasefire between Israel and Iran have eased regional tensions, improving market sentiment. These developments may also exert pressure on gold prices as safe-haven demands for gold diminish, with investors finding allure in other profitable assets like stocks. Colombo foresees gold prices heading towards a second consecutive weekly decline.

“If it closes the week below $3,300/ounce, prices could retreat to $3,250/ounce and even the psychological mark of $3,200/ounce. Conversely, if it climbs back above $3,300/ounce, gold could rebound to the $3,330-$3,360/ounce range,” Colombo analyzed.

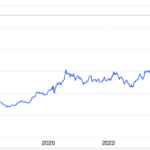

World gold prices fell below the $3,300/ounce level this week.

Meanwhile, Robert Minter, Director of ETF Strategy, predicted that gold prices would continue to accumulate as the US Federal Reserve maintains a neutral monetary policy.

Nitesh Shah of WisdomTree opined that gold prices had previously surged significantly and are now adjusting to more reasonable levels after that rapid increase.

However, not everyone believes that the downward trend will persist. Several experts argue that gold can still find a solid bottom. Grady stated, ” Even if prices drop to $3,200, $3,150, or even $3,100, I believe there will be buying support at those levels. ”

Some analysts also view gold as an appealing monetary asset amid soaring public debt and a safeguard against the weakening purchasing power of the US dollar.

Domestically, gold prices continued their downward trend today, June 29, with gold bars and SJC gold rings falling by VND 200,000- VND 500,000/tael. Gold bar prices are now at VND 117.2- VND 119.2 million/tael (buying-selling).

Investors who bought SJC gold bars on June 22 and sold them on June 29 would incur an immediate loss of VND 2.5 million per tael.

SJC gold ring prices also experienced a turbulent week, heavily influenced by the downward trend in world gold prices, especially on June 27, when the spot gold price broke below the crucial $3,300/ounce support level.

This morning, SJC gold ring prices dropped by VND 20,000/tael on both sides compared to yesterday, currently trading at VND 11.32- VND 11.57 million/tael (buying-selling). The price difference between gold bars and gold rings at SJC remains at VND 2 million/tael.

Meanwhile, Bao Tin Minh Chau Company lowered its buying price for gold rings by VND 400,000 to VND 114.1 million and maintained its selling price at VND 117.1 million. The price difference for gold rings is also held at VND 3 million/tael.

Experts caution that gold investors need to be vigilant and thoroughly research the market to ensure risk-free gold transactions.

Gold Ring and SJC Gold Prices Take a Sharp Downturn

The gold ring and SJC gold prices have taken a downturn, falling by almost one million VND per tael after a recent surge.