The Vietnam Pepper and Spice Association (VPSA) reports that the pepper industry produces approximately 200,000 tons annually, of which 95% is exported. Domestic consumption accounts for only 5%, with deeper processing and sales in the domestic market making up just 2.5%.

According to the VPSA, for every 1 VND collected through a 5% VAT on the industry, the government would have to refund up to 39 VND. This means that the actual VAT revenue from the industry is less than 55 billion VND per year, while the amount refunded to exporting enterprises exceeds 2,100 billion VND.

Additionally, the current tax refund mechanism has loopholes that can be exploited for fraud, causing losses to both the state budget and legitimate businesses. Exporting enterprises with profit margins of only 1-3% are burdened by the requirement to pay taxes upfront and then wait for refunds, hindering their capital flow and reducing their competitiveness in the international market.

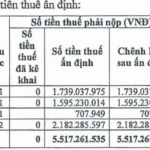

In light of this situation, the VPSA proposes that the government, National Assembly, and relevant ministries consider the application of value-added tax on the pepper and spice industry. They suggest exempting export-serving goods from input VAT and instead imposing a 0.5% presumptive tax on export turnover. For domestic consumption products, the association proposes retaining the 5% VAT rate.

VASEP proposes that certain seafood products be exempt from VAT as they were previously. Image: VASEP.

The Vietnam Association of Seafood Exporters and Producers (VASEP) has also petitioned the government regarding tax issues, despite the industry achieving over $10 billion in export turnover in 2024. They highlight a significant inconsistency in the VAT Law of 2024, where the same type of seafood product can be subject to two different tax calculations depending on the applicable clause. While one clause specifies that the product is not subject to tax, another clause states that a 5% tax must be paid. This discrepancy causes confusion for businesses when declaring taxes, especially for products that are only minimally processed for export.

VASEP also draws attention to the current tax refund mechanism’s dependence on the tax payment of the selling party. If the seller has not declared or owes taxes, the buyer’s input invoice will not be accepted for a tax refund, even if the buyer has made full and proper payments. This situation is particularly common when dealing with small sellers or when the timing of the transaction does not coincide with the tax declaration period or the input tax credit period.

VASEP proposes that the government exempt unprocessed or minimally processed seafood products from VAT, as was previously the case. They also suggest developing a digital tax liability verification system to enable enterprises to independently verify and expedite tax refunds, reducing risks during declaration.

Previously, the Vietnam Food Association, the Vietnam Coffee Cocoa Association, and other industry associations have also submitted proposals to the government and relevant ministries, recommending that rice and coffee cocoa be added to the list of VAT-exempt commodities.

What Do We Learn from the Record State Budget Collection?

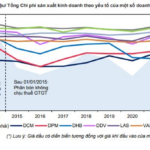

This year, for the first time, the budget revenue reached an impressive figure of over 1.7 quadrillion VND, surpassing the 2023 figure by 13.7%. Despite this remarkable achievement, there are still underlying issues with the budget revenue, including an outdated personal income tax policy that poses the risk of tax losses.

The VAT Amendment Law’s Impact on State Budget Collection and Business Operations

The newly amended Value-Added Tax Law, approved by the National Assembly, will come into force on July 1, 2025, with significant changes. This revised law is a step towards practicality and is expected to have a notable impact on both state budget revenue and business operations.