After a consecutive four-month upward trend with six weeks of strong gains and unprecedented liquidity, the Vietnamese stock market experienced a decline during the trading week of July 28 – August 1.

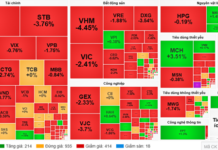

The VN-Index broke its streak of strong gains as it approached historical peak levels. The main index closed the week around the 1,495.21 mark, a 2.35% decrease from the previous week. Foreign investors aggressively sold off their holdings, with net selling exceeding VND 4,700 billion across the market.

Slowdown in decline, but risks of foreign net selling persist

According to Mr. Nguyen Thai Hoc, Pinetree Securities’ Analyst , the Vietnamese stock market ended its five-week winning streak with a significant drop, accompanied by record-breaking liquidity. This development is noteworthy given the positive macroeconomic conditions and impressive second-quarter financial results. However, the pressure to take profits after a nearly 20% surge in the VN-Index over the past two months has been immense.

Mr. Hoc also noted that last week witnessed intense market fluctuations. On Tuesday, the VN-Index breached historical highs, triggering FOMO, but a massive sell-off during the same session caused the index to lose over 4%, with numerous stocks hitting the floor price. Towards the week’s end, the downward trend eased as bottom-fishing demand emerged. Notably, foreign investors resumed substantial net selling, with several sessions exceeding VND 1,000 billion. In contrast, domestic self-operated and institutional investors stepped in as market supporters, and money flowed from large-cap stocks that had surged in the previous phase to mid-cap and some overlooked blue-chip stocks.

Regarding the outlook for the coming week, the Pinetree expert maintains a neutral stance, anticipating a sideways market. While the decline has slowed and buying support is present, the risk of continued foreign net selling remains. The VN-Index is likely to consolidate, neither exhibiting a strong upward trend nor plunging significantly.

The market will witness a clear divergence, with mid-cap and leading stocks that haven’t risen significantly potentially attracting cash flow. In contrast, large-cap and previously hot stocks will continue to face profit-taking pressure. Investors are advised to exercise caution and refrain from chasing rallies. A sensible strategy is to reduce exposure in overheated stocks while seeking opportunities in mid-cap or fundamentally solid blue-chip stocks supported by institutional and foreign money flows.

Short-term volatility persists; focus on cash-pulling sectors

The ASEAN Securities Analytics Team expects the market to remain volatile in the short term. The index’s near-term support level is 1,480 – 1,485, while the resistance level is 1,500 – 1,510.

For short-term traders, ASEANSC Research recommends that investors with high stock proportions focus on stocks with strong liquidity, maintaining a short-term upward trend and outperforming the overall market. Investors with substantial cash reserves can gradually deploy capital during volatile periods, prioritizing sectors with leading roles and supportive macroeconomic policies (such as Banking, Securities, and Real Estate).

For medium to long-term investors, it is advisable to allocate additional capital to leading stocks with promising profit growth prospects for 2025, currently trading at attractive valuations, and those that have returned to strong technical support levels.

Sharing a similar perspective, Vietcombank Securities believes the market has gone through a turbulent week and is now in a phase of equilibrium, regaining momentum. A positive sign is that cash flow still indicates investment activity, although there has been a divergence between sectors and individual stocks with unique stories or impressive second-quarter results. However, large-cap stocks lack consensus, and the risk of further volatility and adjustments remains.

According to VCBS, short-term volatility and fluctuations are likely to persist. The VN-Index is striving to find a balance around the 1,500 mark. Given the current situation, analysts advise investors to maintain a safe margin level, continue holding stocks showing recovery signs from support levels, and consider increasing positions in these stocks during market fluctuations. Additionally, investors with high cash proportions can follow speculative money flow and gradually invest in stocks attracting buying interest, offering significant upside potential compared to their nearest resistance levels.

What to Expect After the Wild Stock Market Swings?

The stock market is experiencing a lull as the VN-Index once again falters at the 1,500-point mark. Profit-taking pressures are mounting, while supportive news is drying up. Analysts suggest that the market may be entering a phase of accumulation and differentiation, with investors reassessing prospects for the second half of the year.

“Technical Analysis for August 4th: Proceeding With Caution”

The VN-Index and HNX-Index both climbed, while trading volume dipped compared to yesterday’s morning session, indicating investors remain cautious.

Vietstock Weekly 04-08/08/2025: Profits Taking Pressure Intensifies

The VN-Index stalled in its upward trajectory last week as trading volumes hit an all-time high, indicating significant profit-taking pressure. The index is currently retesting the old peak from April 2022 (1,480-1,530 points) while the Stochastic Oscillator has signaled a sell-off within the overbought territory. Investors should be cautious of the potential for further corrections if the indicator exits this zone in the coming period.

“Front-Running the Upgrade ‘Wave’: Foreign Investors Buy Over 8 Trillion VND in July”

The VN-Index witnessed a remarkable journey in July, reaching an unprecedented closing high of 1,557.42 points. This achievement can be largely attributed to the significant net foreign buying of over VND 8.1 trillion, with 14 net buying sessions during the month. As a result, the net selling scale from the beginning of the year was narrowed to nearly VND 29.4 trillion.