A Powerful Catalyst Sends the VN-Index to New Heights

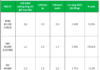

On HOSE, after peaking at a net sell-off on April 17th with a scale approaching the threshold of 40 trillion VND, foreign investors returned to net buying in May and maintained a balanced trading status in June, only to aggressively net buy in July, narrowing the net sell-off scale since the beginning of the year to nearly 29.4 trillion VND.

Specifically, in July, foreign investors net bought over 8.1 trillion VND, notably with an 11-session net buying streak from July 2nd to July 16th, peaking at over 2.2 trillion VND on July 3rd.

This net buying action has become a powerful catalyst, propelling the VN-Index beyond the 1,400-point threshold and even approaching the 1,500-point mark in just the first half of the month. Despite a slight reversal towards net selling in the latter part of July, the VN-Index continued its upward trajectory, setting a new historical high of 1,557.42 points.

Source: VietstockFinance

|

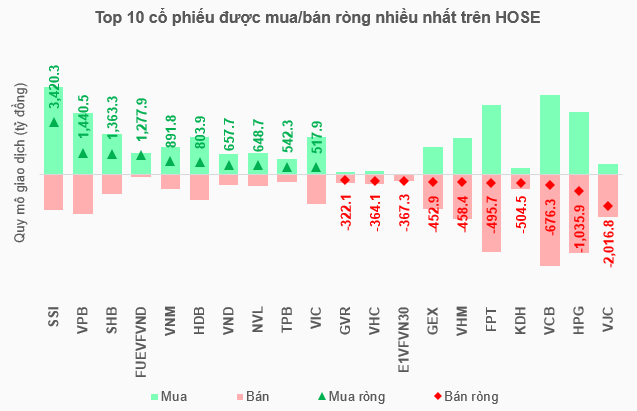

According to statistics on foreign investors’ transactions on HOSE in July, up to 4 securities were net bought in the range of thousands of billions of VND, including SSI with more than 3.4 trillion, VPB with over 1.4 trillion, SHB with nearly 1.4 trillion, and FUEVFVND of Dragon Capital with nearly 1.3 trillion VND.

On the net selling side, VJC experienced the strongest net selling with a scale of over 2 trillion VND, followed by HPG with over 1 trillion VND.

Source: VietstockFinance

|

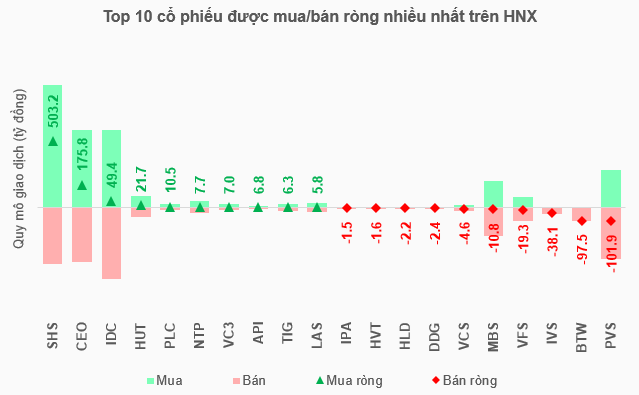

On the HNX, July recorded a net buying value of nearly 547 billion VND, narrowing the net sell-off scale since the beginning of the year to nearly 762 billion VND.

The focus of net buying in July belonged to SHS with a scale of over 503 billion VND, continuing its leading position in the first half of the year with more than 408 billion VND. Following SHS in the July rankings was CEO with nearly 176 billion VND.

A similar scenario unfolded on the net selling side, with PVS leading the way in July with a scale of nearly 102 billion VND, following its position as the most net-sold security on the exchange in the first half of the year with nearly 931 billion VND.

Source: VietstockFinance

|

Taking the Lead on the “Upgrade Wave” with the Appearance of P-Notes

Nguyen Hoang Anh – Director of Investment Advisory, LPBank Securities (LPBS) shared three main reasons for the return of foreign investors’ net buying. Firstly, foreign investors responded positively to the tariff agreement between Vietnam and the US, as Vietnam was one of the earliest countries to reach an agreement, and the tax rates are generally competitive, not affecting the prospects of a global production hub.

Secondly, global capital is gradually withdrawing from the US market and flowing into emerging markets as the US dollar weakens. Vietnam is also one of the destinations for this capital flow.

Finally, the expectation of an upgrade by FTSE Russell also encourages the return of foreign capital after a period of strong net selling, along with some funds specializing in speculating on the “upgrade wave.”

However, the Director of Investment Advisory of LPBS noted that while the market upgrade expectation and foreign capital inflows will propel the Vietnamese stock market forward, and valuation levels may change, the short-term outlook is tempered as the market has already priced in these expectations.

According to Truong Hien Phuong – Senior Director, KIS Vietnam Securities, foreign capital will continue to net buy but at a slower pace. Foreign investors usually buy to anticipate an upgrade event rather than waiting for it to happen before investing. The July performance indicates their active participation in the market. However, it is observed that a portion of the current capital inflows originates from P-Notes, while investment funds have not significantly increased their allocations. Therefore, during and after the market upgrade, foreign investors will continue to invest, but the scale may not be as large as in the previous period.

Pham Thi To Tam – Director of Investment Advisory, KAFI Securities concurred with this situation, recalling the period in 2018 when the expectation of a market upgrade led to a surge in P-Notes capital, which then quickly exited when the upgrade did not materialize as expected. Ms. Tam cautioned that P-Notes are speculative in nature, entering and exiting swiftly, creating a risk of high volatility for the market.

For now, we can expect foreign investors to net buy until the end of the third quarter, as the expectation of an upgrade remains. However, we should consider the risk in September – when FTSE Russell announces the results – if the market is not upgraded, there may be a slight correction.

In the longer term, the monetary policies of major countries, especially the US, along with the global geopolitical situation, will determine the trend of foreign capital allocation into emerging and frontier markets.

– 09:00 04/08/2025

The Hunt for the Whale’s Money Trail: Proprietary Trading Rebounds to Net Buying, Foreigners Dump Nearly VND 2,500 Billion

The VN-Index witnessed a significant shift as foreign investors offloaded nearly VND 2,500 billion, contrasting the self-enterprise sector’s rebound with net buying of over VND 292 billion. This push and pull of financial forces resulted in the index surrendering the 1,500-point mark during the August 1st session, extending the foreign sector’s net sell-off to a substantial VND 4,700 billion in the last two sessions.

The Green Industrial Revolution: Businesses Can’t Go It Alone.

The green transition in industrial production requires an accompanying ecosystem of aligned policies, green financing, suitable technology, and collaboration between stakeholders.

The Two $3 Billion Coastal Metropolis Projects: What Makes Them So Special?

Introducing our two visionary projects: the Tu Bong New Coastal City and the Dam Mon New Coastal City. With a sprawling 620-hectare and 82-hectare reclamation respectively, these transformative developments are set to redefine the urban landscape and unlock the vast potential of Vietnam’s stunning coastline.