In a recent transaction, Pyn Elite’s ownership stake in HDG increased from 5.71% to 6.25%, equivalent to over 23 million shares. Based on the closing price of 28,050 VND/share on July 24, the foreign fund is estimated to have invested 56.1 billion VND in this deal.

Pyn Elite’s move came shortly before HDG announced its consolidated financial statements, revealing a net loss of nearly 25 billion VND in Q2 2025, compared to a profit of almost 64 billion VND in the same period last year. HDG‘s share price currently stands at 26,450 VND/share as of the beginning of the trading session on August 4, a decrease of nearly 6% since the foreign fund’s transaction.

| HDG’s share price performance from the beginning of 2025 until now |

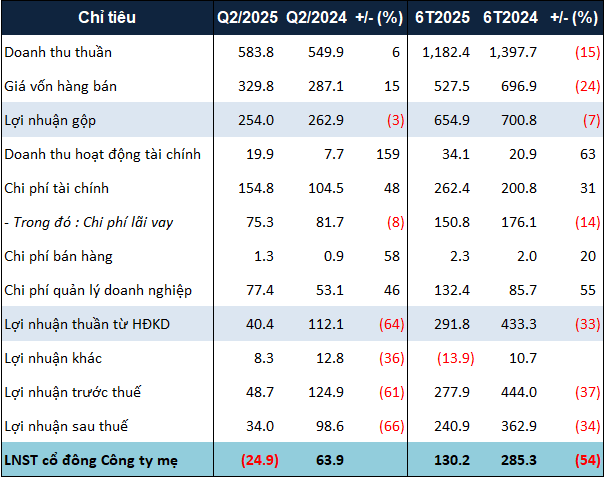

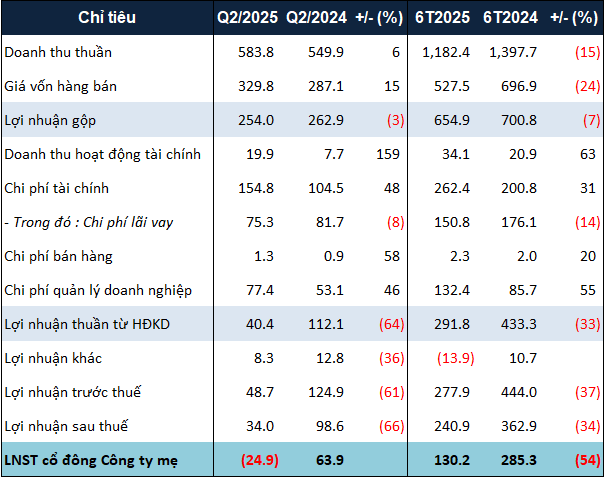

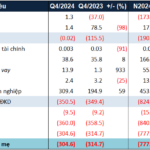

According to the financial statements, HDG‘s revenue for Q2 2025 was recorded at nearly 584 billion VND, a 6% increase compared to the same period last year. However, the cost of goods sold increased by 15%, resulting in a 3% decrease in gross profit, amounting to 254 billion VND.

Additionally, management expenses and financial expenses also witnessed significant increases of 46% and 48%, respectively, totaling more than 77 billion VND and nearly 155 billion VND. HDG attributed these increases to the revaluation of project loans, which led to foreign exchange losses, as well as provisions for differences in electricity selling prices at the Hong Phong 4 solar power project.

Consequently, HDG reported a post-tax profit of 34 billion VND, a 66% decrease compared to the previous year. However, after deducting the profit attributable to non-controlling interests, the company incurred a net loss of nearly 25 billion VND.

The loss in the second quarter significantly impacted HDG‘s performance for the first half of 2025, with a net profit of just over 130 billion VND, a 54% decrease compared to the same period last year.

|

Financial results for Q2 and the first half of 2025 for HDG. Unit: Billion VND

Source: VietstockFinance

|

On the other hand, compared to the target of 1,057 billion VND in post-tax profit set for 2025, the company’s performance in the first half of the year translates to an achievement of nearly 23% of the annual goal.

As per the balance sheet, HDG‘s total assets as of the end of June 2025 amounted to nearly 14.4 trillion VND, a 4% increase compared to the beginning of the year. The most notable change was the doubling of the construction in progress account to over 1.6 trillion VND, due to an additional 790 billion VND incurred from the Truong Thinh Hydropower Project.

Liabilities increased by 2%, reaching nearly 6.6 trillion VND. Within this, loan balances increased by 3%, surpassing 5 trillion VND due to an increase in long-term bank loans.

– 09:58 04/08/2025

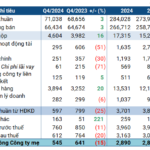

The Highest Post-Tax Profit in 4 Years, Yet HQC Only Achieved 1/3 of its 2024 Plan

In 2024, Hoang Quan Trade Service Real Estate Consulting Joint Stock Company (HOSE: HQC) recorded a net profit of VND 33 billion, the highest since 2020. However, due to ambitious targets, the company only achieved 33% of its full-year after-tax profit goal.

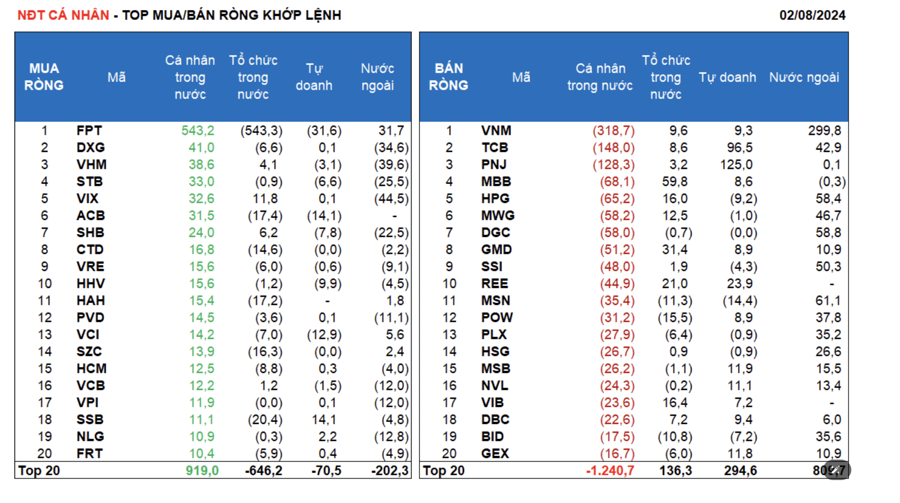

The Forex Fluctuation Conundrum: How it Led to a 15% Profit Plunge for Petrolimex in Q4

Petrolimex (Vietnam National Petroleum Group, HOSE: PLX) experienced a significant decline in profits in Q4 due to volatile exchange rates. Despite this challenge, the Group achieved growth in its cumulative results, surpassing the plans approved by the 2024 General Meeting of Shareholders.