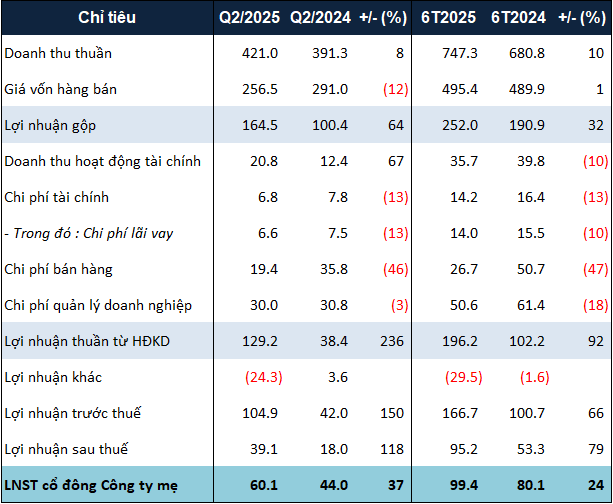

According to the consolidated financial statements, CEO’s net revenue for Q2 2025 reached VND 421 billion, an 8% increase from the previous year, mainly driven by service revenue. In contrast, real estate business revenue decreased by 6%, amounting to VND 233 billion.

Despite the rise in revenue, the company managed to reduce its cost of goods sold by 12%, resulting in a gross profit of nearly VND 165 billion, a significant 64% increase. This improvement led to a notable rise in the gross profit margin from 26% to 39%.

CEO also successfully lowered other expenses, including a 13% reduction in financial costs, a 46% decrease in sales expenses, and a 3% drop in management expenses.

As a result, the company recorded a net profit of over VND 60 billion in Q2 2025, reflecting a 37% year-over-year increase. For the first six months of the year, CEO’s net profit exceeded VND 99 billion, a 24% increase.

|

CEO’s Q2 and six-month business results for 2025 in VND billion

Source: VietstockFinance

|

Compared to the targeted after-tax profit of VND 182 billion set for 2025, the six-month performance accounts for nearly 55% of the annual goal.

As of June 30, 2025, CEO’s total assets decreased by 3% from the beginning of the year to over VND 8,700 billion. This change was mainly due to a 13% reduction in short-term cash holdings, amounting to VND 1,700 billion. Conversely, the construction-in-progress balance for the Sonasea Van Don Harbour City resort complex project increased by 6%, surpassing VND 982 billion.

Liabilities also witnessed a 12% decrease, totaling over VND 2,300 billion. This reduction was primarily attributed to a 30% decline in prepayments from buyers, amounting to VND 570 billion. Additionally, loan balances decreased by 9%, reaching VND 481 billion.

Ha Le

– 07:42 01/08/2025

“Missing Revenue Targets, Kinh Bac Reports 46% Surge in Q2 2025 Net Profit”

In Q2 of 2025, Kinh Bac’s net revenue decreased by 35.1% compared to the same period last year, falling to VND 578.7 billion. However, due to effective cost management, the company reported a remarkable 46.4% increase in net profit, amounting to over VND 399 billion.

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

“TTC AgriS Reaps Results: On Track to Achieve Annual Profit Goals”

TTC AgriS (HoSE: SBT) has unveiled its impressive Q2 financial results for the 2024-2025 fiscal year, showcasing significant growth in both revenue and profit.