If the transaction is successful, NSI‘s ownership rate at SAM will increase from 1.56% to 2.88%, equivalent to over 10.9 million shares.

Previously, from July 10-14, NSI purchased 5.9 million SAM shares through a negotiated deal to acquire a 1.56% stake, as it currently stands.

Major shareholder owning over 10% of NSI‘s charter capital, Tran Viet Anh, is the Chairman of the Board at SAM. In addition, NSI Board member, Bui Quang Bach, also serves as an Independent Member on SAM‘s Board of Directors.

| Stock price movement over the past 2 years |

NSI’s move to buy more shares comes as SAM recently announced its Q2/2025 consolidated financial statements, revealing a decline in net profit for both the second quarter and the first half of the year. Despite the disappointing financial results, SAM‘s stock price remains near its 2-year high, trading at VND 8,160 per share on August 4, 2025.

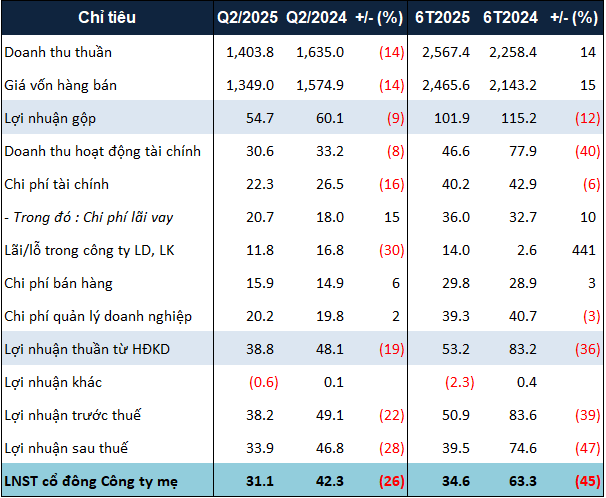

In the first six months of the year, SAM‘s revenue increased by 14%, but this growth was outpaced by the cost of goods sold, resulting in a 12% decrease in gross profit to nearly VND 102 billion. Financial revenue also declined by 40%, amounting to nearly VND 47 billion.

On a positive note, profit from joint ventures and associates increased significantly, surging by 5.4 times compared to the same period last year. Additionally, SAM successfully reduced its financial and management expenses by 6% and 3%, respectively, bringing them down to over VND 40 billion and VND 39 billion.

However, these improvements were not enough to offset the losses in gross profit and financial revenue. Consequently, SAM reported a net profit of nearly VND 35 billion, reflecting a 45% decrease compared to the previous year’s figure.

|

SAM’s Q2 and 6-month business results in 2025 in VND billion

Source: VietstockFinance

|

Compared to the target of nearly VND 126 billion in pre-tax profit for 2025, the company has achieved over 40% of this goal in the first half of the year.

As of June 30, 2025, SAM‘s total assets increased by 10% from the beginning of the year, reaching nearly VND 7 trillion. Accounts receivable and inventory increased by 39% and 22%, respectively, totaling nearly VND 1.7 trillion and VND 616 billion. Notably, the prepayment to the seller, Cong Ty TNHH Thuong mai va Dau tu Tap doan Tam Sen, increased significantly from nearly VND 12 billion at the beginning of the year to nearly VND 138 billion.

The company’s liabilities also increased by 35% to nearly VND 2.3 trillion. The most significant change was in loan balances, which rose by 34% to over VND 1.6 trillion, mainly due to an increase in short-term bank loans.

– 14:43 04/08/2025

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

“Struggling to Stay Afloat: Can Phaat Dat Stay on Course to Meet their 2024 Business Goals?”

The fourth quarter saw positive growth; however, CTCP Phat Dat Real Estate Development JSC (HOSE: PDR) witnessed a 24% year-over-year decline in net profit for the full year 2024.