The One Commune One Product (OCOP) program has been a significant driving force behind the development of Vietnam’s rural economy. However, to turn OCOP into a global movement, linked to the preservation of heritage and local traditional cultures, contributing to the sustainable and integrative development of the rural economy, it is essential to integrate environmental, social, and governance (ESG) factors into the program.

The OCOP program, implemented since 2018, has marked a turning point in Vietnam’s rural economic development. There are now thousands of high-quality products, ranging from organic rice and mung bean cakes to brocade textiles, Ha Lung sausage, and fish sauces from Phu Quoc and Cat Hai.

To develop OCOP products, the government has introduced numerous investment support policies to build essential infrastructure for production, processing, preservation, and consumption. These supportive policies for OCOP product development are divided into two groups.

The first group includes direct policies such as Decision No. 490/QD-TTg dated May 7, 2018, by the Prime Minister approving the One Commune One Product Program for the 2018-2020 period; Decision No. 1048/QD-TTg dated August 21, 2019, by the Prime Minister issuing the Criteria for Evaluation and Classification of Products under the One Commune One Product Program; and Decision No. 781/QD-TTg dated June 8, 2020, on amending and supplementing Decision No. 1048/QD-TTg…

The second group consists of supportive policies: participants in the OCOP Program can access state policies on industry development, agriculture and rural development, credit interest rate support, science and technology, human resource training, etc. Additionally, policies focus on essential infrastructure such as electricity, technology, e-commerce infrastructure, concentrated raw material areas, and bio-safety production.

THE OCOP MODEL HAS THE POTENTIAL FOR INTERNATIONAL OUTREACH

Infrastructure for OCOP products includes not only physical aspects such as electricity, raw material areas, processing equipment, storage facilities, and commercial infrastructure but also shared technology systems, production-consumption linkages, and support for human resource development and technology to enhance value and expand markets.

With these efforts, Ms. Beth Bechdol, Deputy Director-General of FAO, believes that Vietnam’s OCOP model will become an effective rural development program with potential for international outreach.

Thus, it can be said that both OCOP products and infrastructure are closely related to ESG. This triad of standards is used to assess the level of sustainable development and a company’s impact on the community and is employed by investors to screen potential investments. Therefore, integrating ESG into the OCOP Program is not only an opportunity but also a crucial strategic requirement to meet international market demands and attract investments.

For instance, the new Hai Phong OCOP (including Hai Duong and Hai Phong) and Ninh Binh OCOP (including Ninh Binh, Nam Dinh, and Ha Nam) are transitioning to a model of commodity production based on value chains, creating market competitiveness by using organic fertilizers and applying new environmentally friendly technologies to reduce carbon emissions…

Additionally, OCOP projects related to the circular economy, such as reusing agricultural by-products to produce fertilizers, contribute to environmental protection and generate additional income.

OCOP is not just about products; it is also a journey to improve the livelihoods of farmers, especially women and ethnic minorities. Many OCOP projects have created jobs for thousands of local workers while preserving indigenous cultures, as seen in Ninh Binh. These stories not only enhance brand attraction but also meet the social criteria of ESG, appealing to investors concerned about community impact. OCOP cooperatives are adopting transparent governance standards, utilizing AI and blockchain technologies for product traceability.

INTEGRATING ESG INTO OCOP WILL ATTRACT MORE INVESTORS

The government’s supportive policies not only reduce financial burdens but also enhance the competitiveness of OCOP projects, facilitating the attraction of investments from domestic and international ESG funds. According to Precedence Research, the global ESG market is valued at $29.86 trillion in 2024 and is projected to reach $167.49 trillion by 2034, with a compound annual growth rate (CAGR) of approximately 18.82% from 2025 to 2034.

Regarding the demand for sustainable products, global consumers, particularly Gen Z and Millennials, prioritize organic and environmentally friendly products, similar to OCOP offerings such as organic rice and coffee.

Integrating ESG into OCOP is not only an inevitable trend but also the key to bringing Vietnamese rural products to the global market, meeting the increasing demands for sustainability. This is also a sustainable development solution for Vietnam’s rural economy in the coming years.

Major investment funds like BlackRock and Vanguard tend to require businesses to integrate ESG into their strategies. Moreover, the global carbon market and green bonds present opportunities for OCOP projects, especially agro-forestry combinations. Vietnam needs to catch up with this trend quickly. The commitment to Net Zero by 2050 and policies such as the 8th National Power Development Plan (PDP8) and the upcoming carbon market launch demonstrate Vietnam’s integration into the ESG trend.

Vietnam’s ESG-integrated OCOP products have the potential to leverage free trade agreements (EVFTA and CPTPP) for exports and attract capital from ESG funds like IFC, ADB, and Mekong Capital.

“Compared to other countries in the region, Vietnam combines strong economic growth with a strong commitment to sustainability, making it an ideal destination for ESG investments,” said Mr. Chad Ovel, CEO of Mekong Capital.

Investors recognize that integrating ESG into OCOP offers them attractive benefits due to the high profit potential. OCOP products that meet ESG standards can be sold at 15-30% higher prices in international markets.

Moreover, ESG compliance enables OCOP projects to meet the requirements of the Carbon Border Adjustment Mechanism (CBAM) and modern consumers’ demands. Investing in OCOP in this direction not only generates profits but also creates jobs, protects the environment, and promotes sustainable rural development.

Therefore, integrating ESG into OCOP is not only an inevitable trend but also the key to bringing Vietnamese rural products to the global market, meeting the increasing demands for sustainability. This is also a sustainable development solution for Vietnam’s rural economy in the coming years.

The full content of this article was published in the Vietnam Economic Magazine, Issue 30-2025, released on July 28, 2025. Please find the article here: https://premium.vneconomy.vn/dat-mua/an-pham/tap-chi-kinh-te-viet-nam-so-28.html

“Vinatex: Your Trusted Partner in the Global Textile Industry”

By 2030, Vinatex aims to double its consolidated profits and triple its individual profits. We strive to ensure our workers’ annual income surpasses the CPI by 2-3%, meeting 100% of environmental standards and reducing greenhouse gas emissions.

“Regulator and Large Financial Institutions’ Involvement Makes the Digital Asset Market More Efficient, Says SSI’s Director.”

“The crypto market in Vietnam is currently dominated by individual investors, with almost 100% of transactions originating from this demographic. Major institutions like Dragon Capital, VinaCapital, and SSI have yet to fully engage in asset management roles within this space. ‘When this changes, the market will mature and become more regulated,’ says Thomas Nguyen, SSI Securities’ Overseas Markets Director.”

“Front-Running the Upgrade ‘Wave’: Foreign Investors Buy Over 8 Trillion VND in July”

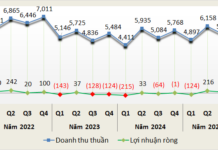

The VN-Index witnessed a remarkable journey in July, reaching an unprecedented closing high of 1,557.42 points. This achievement can be largely attributed to the significant net foreign buying of over VND 8.1 trillion, with 14 net buying sessions during the month. As a result, the net selling scale from the beginning of the year was narrowed to nearly VND 29.4 trillion.