Kinh Bac Urban Development Corporation JSC (KBC on HoSE) has released its Q2 2025 consolidated financial report, revealing a 35.1% year-on-year decline in net revenue to VND 578.7 billion. However, thanks to a negative cost of goods sold of over VND 9.9 billion, gross profit increased by 26.7% to nearly VND 588.6 billion.

Additionally, in this quarter, Kinh Bac recorded over VND 164.1 billion in financial activity revenue, a 50.1% increase from the previous year. Consequently, financial expenses also rose by 108% to nearly VND 112.1 billion.

On the other hand, selling expenses and administrative expenses were recorded at VND 22.6 billion and VND 92.8 billion, respectively, representing decreases of 53.9% and 20.5% compared to the same period last year.

Illustrative image

After deducting taxes and fees, Kinh Bac reported a net profit after tax of over VND 399 billion, a 46.4% increase compared to the same period last year.

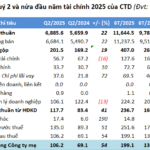

For the first six months of 2025, Kinh Bac’s net revenue exceeded VND 3,695.5 billion, marking a 253.9% increase from the first six months of 2024. This growth was driven by a 5.3-fold increase in land and infrastructure lease revenue, totaling more than VND 2,829.7 billion, and a rise in real estate transfer revenue from VND 225.2 billion to nearly VND 411.6 billion.

For the first half of 2025, Kinh Bac reported a profit after tax of over VND 1,248.1 billion, 6.4 times higher than the same period in 2024.

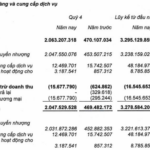

As of June 30, 2025, Kinh Bac’s total assets had increased by 57.2% from the beginning of the year to nearly VND 70,302.5 billion. This included cash and cash equivalents of nearly VND 18,239.1 billion, 2.8 times higher than the beginning of the year due to increased bank deposits, accounting for 25.9% of total assets, and short-term receivables of nearly VND 16,604.9 billion, representing 23.6% of total assets.

Furthermore, Kinh Bac recognized inventory valued at nearly VND 23,761.1 billion, a 71.6% increase from the beginning of the year and accounting for 33.8% of total assets. Specifically, the cost of producing and trading unfinished goods at the Trang Cat Urban Area and Service Project alone accounted for over VND 15,829 billion, an 87.5% increase from the beginning of the year.

On the liability side of the balance sheet, total liabilities stood at nearly VND 44,605.3 billion, an 85.2% increase from the beginning of the year. Of this, total financial borrowings were nearly VND 25,109.6 billion, 2.6 times higher than at the start of the year and accounting for 56.3% of total debt.

Notably, Kinh Bac has a long-term loan of nearly VND 12,366.8 billion from VPBank at an interest rate of 10.8% per annum. This loan is secured by asset rights from the Trang Cat Urban Area and Service Project and capital contributions to the subsidiary, with a maturity date in 2033.

“Insider Trading: Chairman-Linked Entity Seeks to Increase Stake in SAM as Prices Hit 2-Year High”

National Securities Incorporation (NSI) aims to strengthen its foothold in SAM Holdings Joint Stock Company (HOSE: SAM) by acquiring an additional 5 million shares from August 6 to September 4.

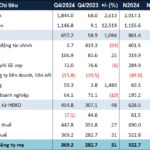

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

Delivering The Privia, KDH Achieves 2024 Profit Goals

Thanks to a surge in Q4 results, Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH) reported a 13% increase in consolidated net profit for 2024.