On August 1, 2025, S&P Global released the report on Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) for July 2025, highlighting three key points:

NEW ORDERS ON THE RISE

S&P Global’s report indicates a rebound in Vietnam’s manufacturing sector in July, with a rise in new orders leading to faster output growth. This occurred despite ongoing export weakness due to tariffs. Purchasing activity also increased, while employment remained almost stable.

There were some reports of challenges in sourcing raw materials, resulting in supplier delivery delays, lower input inventories, and higher purchasing costs.

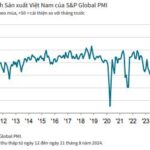

Vietnam’s Manufacturing PMI stood at 52.4 in July, up from 48.9 in June and above the 50-point threshold for the first time in four months. This indicates an improvement in the overall health of the manufacturing sector, with the strongest business conditions seen in almost a year.

The improvement in operating conditions coincided with a rebound in new orders in July. New orders increased for the first time in four months, and at the fastest rate since last November, as customer demand improved.

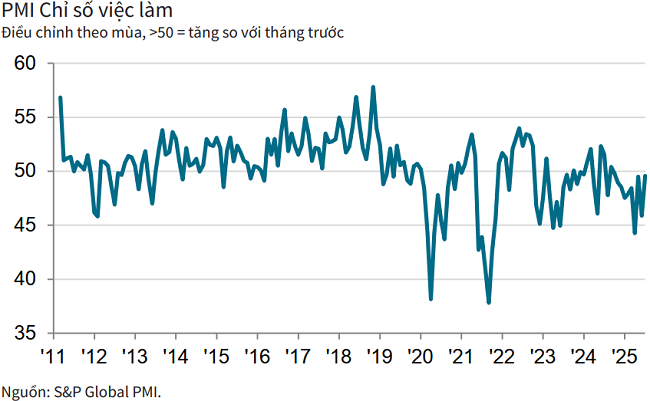

However, some survey respondents highlighted the negative impact of US tariffs on their ability to secure new orders. In fact, new export orders continued to fall due to tariffs, extending the current sequence of decline to nine months.

“The rise in new orders supported a further increase in production during July. Output has now risen in each of the past three months, with the latest expansion the most pronounced in almost one year,” S&P Global stated.

Higher demand for outputs led to a resurgence in purchasing activity. The rate of growth in this regard was the fastest since August 2024. Meanwhile, employment remained almost stable. Although staffing levels continued to fall amid rising spare capacity following the recent new orders downturn, the rate of reduction eased to a nine-month low as higher output requirements limited the scope for job cutting.

Backlogs of work continued to decline, although the rate of reduction was the weakest in the seven-month sequence of falling work-in-hand.

TARIFFS REMAIN A CONCERN

According to S&P Global, although input purchasing increased, stocks of purchases continued to fall as panel members reported challenges in sourcing raw materials. However, the rate of depletion eased to the weakest since December 2023. Stocks of finished goods also declined in July.

Raw material shortages led to a further lengthening of suppliers’ delivery times. The deterioration in vendor performance was marked and only slightly softer than June’s recent low.

“Difficulties in sourcing materials, especially from abroad, led to higher input costs at the start of the second half of the year. Input prices have now risen in each of the past two months, with the latest increase the strongest since the start of 2025,” S&P Global noted.

Output charge inflation also quickened in July as companies passed on higher input costs to clients. This was the strongest rise in selling prices in seven months. However, the increase in output prices was only marginal.

While manufacturers remained optimistic about higher output in the coming year, business confidence eased to a three-month low in July and was well below the historical average for the series. Panel members attributed their optimism to hopes of improved economic conditions, new product launches, and expectations of higher new orders. On the other hand, concerns about the impact of US tariffs weighed on output prospects.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, said: “The July data pointed to a recovery in the health of Vietnam’s manufacturing sector following disruptions caused by news of US tariffs in recent months. Although tariffs continued to weigh on new export orders, companies were able to secure sufficient new work from other sources to ensure that total new orders rose.”

“A key feature of the latest survey was the impact of difficulties in sourcing raw materials. Companies reported that this was linked to widespread supplier delivery delays, falling input inventories, and rising cost pressures. If raw material supply continues to cause issues in the coming months, we may see the pace of expansion in the manufacturing sector limited,” noted Andrew Harker.

“Vietnam’s Manufacturing Sector Loses Momentum in Late 2024”

The Vietnamese manufacturing sector faced headwinds in the final month of 2024, as the Purchasing Managers’ Index (PMI) dipped from 50.8 in November to 49.8 in December, slipping below the 50-point threshold for the first time in three months. This indicates a mild deterioration in business conditions, presenting a challenging landscape for the industry as the year drew to a close.

“PMI Surges to 50.8 in November, Marking the Second Consecutive Month of Improvement Post-Yagi”

The S&P Global Manufacturing Purchasing Managers’ Index (PMI) for Vietnam remained above the 50.0 no-change mark in November, signaling a second consecutive monthly improvement in business conditions following the disruption caused by Storm Yagi in September. However, with the index falling from 51.2 in October to 50.8, the health of the sector strengthened only modestly.