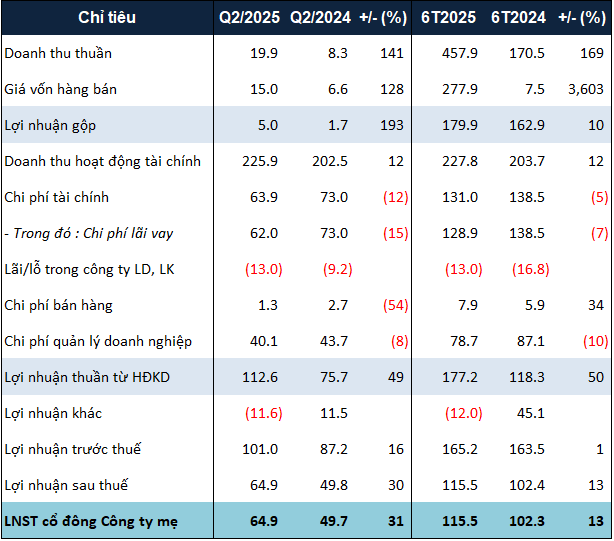

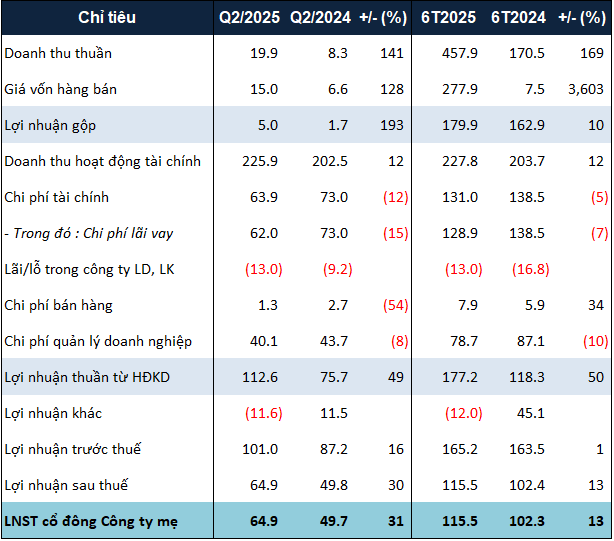

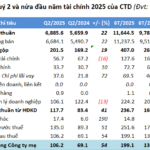

According to the consolidated financial statements, PDR’s net revenue for Q2 2025 was nearly VND 20 billion, 2.4 times higher than the same period last year, thanks to the recognition of nearly VND 12 billion in real estate transfer revenue. The company attributed this growth to the improving economic conditions, which positively impacted the real estate business.

However, the most notable aspect of PDR’s Q2 performance was its financial revenue of nearly VND 226 billion, a 12% increase. While the transfer of shares only brought in VND 140 billion, a decrease of VND 61 billion compared to the previous year, PDR benefited from a VND 85 billion reversal of exchange rate differences arising from the conversion of ACA loans into capital contributions.

Additionally, the company successfully reduced its expenses, with a 15% reduction in interest expenses, a 54% decrease in selling expenses, and an 8% cut in management expenses.

As a result of these factors, PDR recorded a net profit of nearly VND 65 billion in Q2, representing a 31% increase compared to the same period last year. Combined with the results of Q1, the company’s total net profit for the first half of 2025 reached nearly VND 116 billion, a 13% increase.

|

PDR’s business results for Q2 and the first half of 2025 in VND billion

Source: VietstockFinance

|

On the other hand, compared to the target after-tax profit of VND 728 billion set for 2025, PDR’s profit for the first half reached only about 16% of this goal.

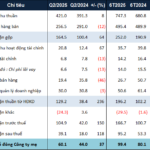

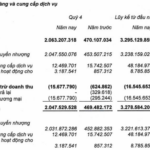

As of June 30, 2025, PDR’s total assets were nearly VND 24,300 billion, remaining relatively unchanged from the beginning of the year. Short-term cash decreased by 73%, falling to just over VND 125 billion. In contrast, long-term receivables surged to nearly VND 426 billion, an elevenfold increase, due to the emergence of long-term loan receivables of over VND 337 billion from Ngo May Real Estate Investment Joint Stock Company, the investor of the Q1 Tower project in Quy Nhon, Binh Dinh province.

It is worth noting that Ngo May was once a subsidiary of PDR, with PDR owning 94% of its capital. On June 25, 2025, PDR transferred its entire stake in Ngo May to Quy Nhon 68 Investment Company for VND 435 billion, thereby reducing its ownership to 0%.

PDR plans to divest from the investor of the Q1 Tower project

PDR’s total liabilities decreased by 4%, amounting to nearly VND 12,400 billion. This reduction was mainly due to decreases in two items: short-term prepayments from buyers and other long-term payables.

Specifically, prepayments for the Bac Ha Thanh project decreased by over 80%, from VND 130 billion to more than VND 25 billion. Additionally, PDR no longer recorded other long-term payables of over VND 404 billion to Realty Holdings Real Estate Business and Services Joint Stock Company compared to the beginning of the year.

Profile of the partner who received the transfer of the Q1 Tower project from PDR

According to our research, Quy Nhon 68 is headquartered at the Golden King office building, 15 Nguyen Luong Bang, District 7, Ho Chi Minh City. Notably, this address is also the headquarters of Hoang Quan Commercial Consulting Real Estate Services Joint Stock Company (HOSE: HQC).

Quy Nhon 68’s main business line is real estate, and its charter capital is VND 500 billion, contributed by General Director and legal representative Phan Sy Nguyen (70%) and Mr. Nguyen Thanh Hien (30%).

Ha Le

– 14:58 31/07/2025

How Much Has the CEO Invested in the Sonasea Van Don Harbour City Project?

With a significant boost in gross margins, CTCP Group C.E.O Joint Stock Company (HNX: CEO) witnessed a remarkable surge in its Q2 and H1 2025 net profits, rising by 37% and 24% year-over-year, respectively.

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

“TTC AgriS Reaps Results: On Track to Achieve Annual Profit Goals”

TTC AgriS (HoSE: SBT) has unveiled its impressive Q2 financial results for the 2024-2025 fiscal year, showcasing significant growth in both revenue and profit.