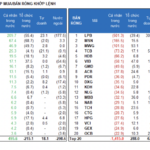

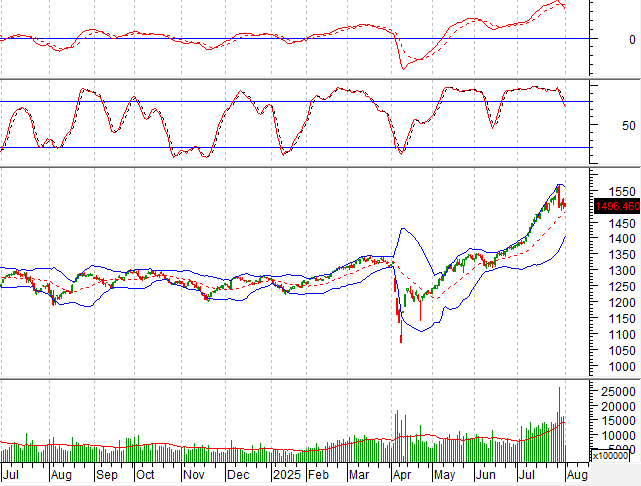

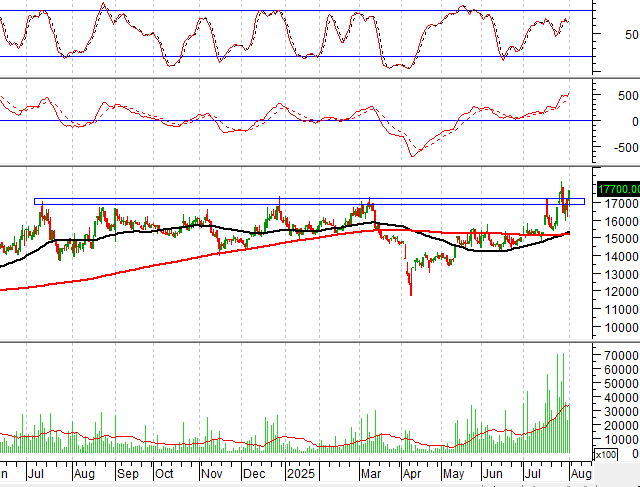

Technical Indicators for VN-Index

During the trading session on the morning of August 1, 2025, the VN-Index opened lower and formed a small-bodied candle pattern, along with a decline in trading volume. This indicates that investors are adopting a cautious stance.

Additionally, the Stochastic Oscillator has generated a sell signal and fallen out of the overbought territory. This suggests that the downside risk may persist in the upcoming sessions.

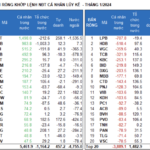

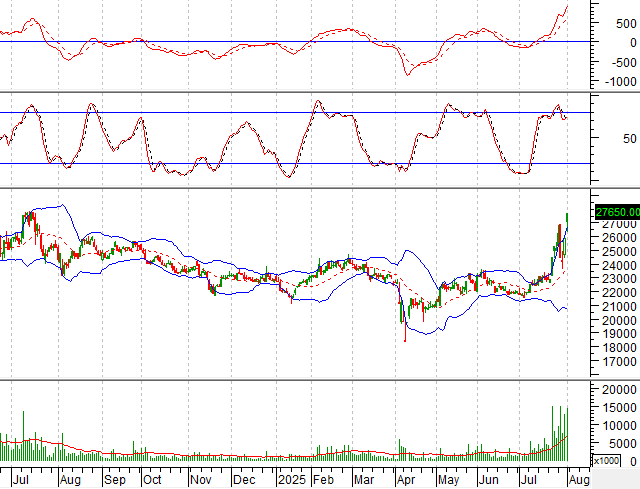

Technical Insights for HNX-Index

On the morning of August 1, 2025, the HNX-Index opened lower and formed a small-bodied candle, reflecting investors’ indecision. However, the index remains close to the upper band of the Bollinger Band, while the MACD continues to rise after providing a buy signal. These factors indicate the presence of positive momentum.

HAX – Green Car Service Joint Stock Company

On August 1, 2025, HAX shares opened with a significant gain, accompanied by increased trading volume above the 20-session average, reflecting investors’ optimism. Moreover, the MACD continues to rise after generating a buy signal, and the 50-day SMA has crossed above the 200-day SMA, forming a golden cross. If these positive technical signals are sustained, the upward momentum is likely to be reinforced.

PC1 – PC1 Group Joint Stock Company

During the trading session on August 1, 2025, PC1 shares witnessed a strong upward movement and formed a Rising Window candlestick pattern, accompanied by trading volume surpassing the 20-session average. This indicates active participation from investors.

Furthermore, the price has broken above the upper band of the Bollinger Bands, and the MACD continues to make higher highs and higher lows. These factors reinforce the current upward trend.

Technical Analysis Department, Vietstock Consulting

– 12:32 01/08/2025

The Great Capital Shift: Will Frontier and Emerging Markets Trump the US by 2025?

The global investment landscape may be shifting its gaze away from the traditional allure of the US stock market in 2025. There is a potential shift towards frontier and emerging markets, with Vietnam being a key player in this narrative.

Unlocking Profits: YEG Stuck at Floor Price

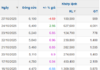

The morning rally stalled as the breadth turned negative. While stocks that had surged in recent times faced selling pressure, most remained in the green. YEG stood out as the lone stock stuck at the floor price after a meteoric rise of 125% in December alone.

The Cautious Sentiment Rises

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the Middle Bollinger Band. If the index manages to hold its ground above this level in the upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.