Hanoi-based HoSE-listed Ha Do Group Joint Stock Company (HDG) has reported a change in ownership of a major shareholder, an investor holding over 5% of the company’s shares.

Specifically, during the trading session on July 24, 2025, the Finnish fund Pyn Elite Fund (Non-Ucits) successfully purchased 2 million shares on the exchange.

Following this transaction, Pyn Elite Fund’s ownership of HDG shares increased from over 21.1 million to over 23.1 million, equivalent to a holding ratio increase from 5.71% to 6.25% in Ha Do.

Assuming the closing trading price of VND 28,050 per share on July 24, 2025, the Finnish fund is estimated to have spent approximately VND 56.1 billion to acquire the aforementioned number of shares.

Illustration

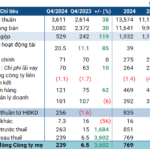

In terms of business performance, according to the consolidated financial statements for the second quarter of 2025, Ha Do recorded net revenue of nearly VND 583.8 billion, up 6.2% over the same period last year. After deducting cost of goods sold, gross profit reached over VND 254 billion, a decrease of 3.4%.

During this period, the enterprise also earned more than VND 19.9 billion in financial revenue, up 158.4% over the same period last year. Similarly, financial expenses increased from VND 104.5 billion to VND 154.8 billion; selling expenses increased by 40%, amounting to over VND 1.3 billion; and management expenses amounted to nearly VND 77.4 billion, up 45.8%.

As a result, after deducting taxes and fees, the company reported a net profit of nearly VND 34 billion, down 65.5% over the same period last year.

For the first six months of 2025, Ha Do’s net revenue was nearly VND 1,182.4 billion and after-tax profit was over VND 240.9 billion, down 15.4% and 33.6%, respectively, compared to the first six months of 2024.

For the year 2025, Ha Do Group sets a target of consolidated revenue of VND 2,936 billion and after-tax profit of VND 1,057 billion.

Thus, by the end of the second quarter of 2025, the company had achieved 40.3% of its revenue plan and 22.8% of its after-tax profit plan.

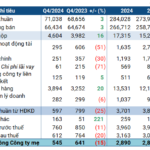

As of June 30, 2025, Ha Do’s total assets increased by 3.6% from the beginning of the year to nearly VND 14,350.3 billion. Of this, fixed assets accounted for VND 8,301.1 billion, or 57.8% of total assets; inventory was nearly VND 882.5 billion; and long-term work in progress was over VND 1,742.8 billion.

On the liability side of the balance sheet, total liabilities stood at over VND 6,593.5 billion, an increase of VND 120 billion from the beginning of the year. Of this, loans and finance leases amounted to nearly VND 5,013.3 billion, or 76% of total assets.

The Poultry Baron: Dabaco’s Profitable Venture

Like the announced estimated profit results, the livestock giant Dabaco (HOSE: DBC) had its third-highest profitable year in its listed history, surging tens of times higher than the abysmal low of the previous year.

Investment Fund Transactions: The Overwhelming Buying Power

In the first week of December (02-06/12) and the second week (09-13/12), the investment fund displayed a clear appetite for equity purchases, with buying activity outpacing selling.