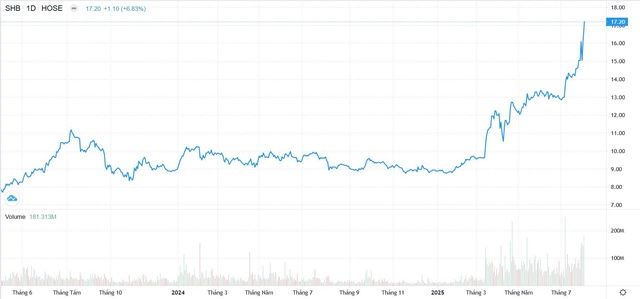

SHB stock closed at its third consecutive ceiling session on July 31, trading at 17,200 VND per share and officially surpassing its June 2021 peak. Since the beginning of the year, SHB stock has surged by over 90%.

SHB stock concluded July’s trading session with a liquidity of 181 million units and a buy surplus of more than 9 million shares. The stock has witnessed numerous sessions with over 100 million shares traded since the start of the month, leading the VN30 group and the banking sector. Notably, on July 7, SHB recorded a record trading volume of nearly 250 million shares. During this period, foreign investors were net buyers of SHB, purchasing over 100 million shares in the month.

The positive performance of SHB stock despite the volatile fluctuations in the Vietnamese stock market demonstrates investors’ confidence in this bank stock.

SHB stock performance over the past 2 years

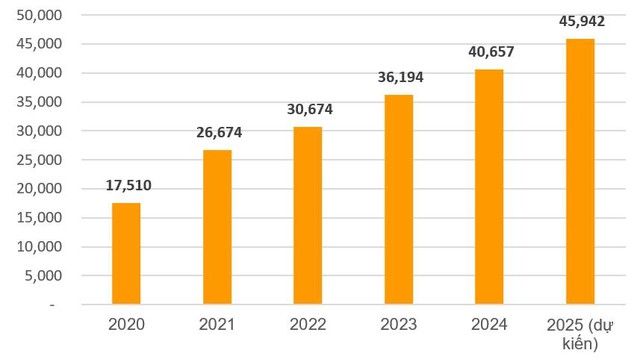

Prior to this, the State Bank approved SHB’s charter capital increase to 45,942 billion VND through a 13% stock dividend payment for 2024, expected to be implemented in Q3 2025. Previously, SHB had completed the first 2024 cash dividend payment at a rate of 5%. Thus, the total dividend ratio for 2024 was 18% and is expected to be maintained in 2025.

For many years, SHB has been a bank that consistently pays dividends to its shareholders, ranging from 10-18%. Following the Covid-19 pandemic, SHB resumed dividend payments in stocks and cash for 2023-2024, reflecting its strong financial position and long-term commitment to shareholders. SHB maintains its position in the TOP5 largest private banks in Vietnam.

SHB’s charter capital over the years (in billion VND)

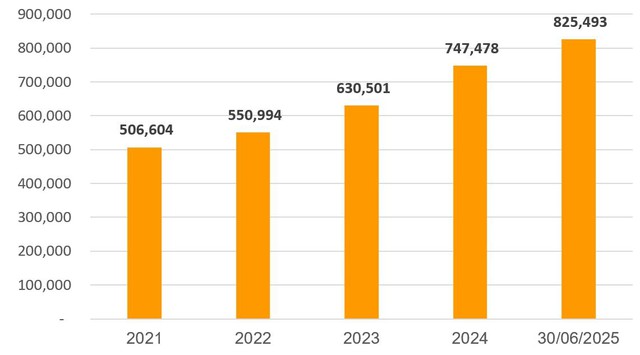

Efficient operations, improved asset quality

According to the second-quarter financial report, as of June 30, 2025, SHB’s total assets reached nearly VND 825 trillion, with customer loan balances exceeding VND 594.5 trillion, up 14.4% from the beginning of the year and a strong increase of 28.9% over the same period.

SHB not only focuses on its main business activities but also actively participates in government programs and policies. Resolution 68 presents significant opportunities for commercial banks, especially in supporting the development of the private sector through expanded credit and preferential loan packages for small and medium-sized enterprises, as well as engagement in the digital transformation and sustainable development agenda.

A report from Yuanta Securities assesses that SHB still has ample room for growth, despite its high cyclicality. Meanwhile, MBS Securities believes that the positive credit growth since the beginning of the year, coupled with a low-interest-rate environment, particularly targeting corporate clients, will continue to drive credit growth for banks.

SHB’s total asset growth over the years (in trillion VND)

In the first six months, SHB recorded a pre-tax profit of VND 8,913 billion, up 30% over the same period in 2024, completing 61% of the 2025 plan. In Q2 alone, pre-tax profit exceeded VND 4,500 billion, a 59% increase year-over-year.

Operational efficiency continued to improve, with the ROE ratio surpassing 18%. The cost-to-income ratio (CIR) stood at an impressive 16.4%, among the lowest in the industry. Safety indicators were also well-maintained, with the loan-to-deposit ratio (LDR) and the ratio of short-term capital used for medium and long-term loans within the limits set by the State Bank of Vietnam. The consolidated capital adequacy ratio (CAR) remained above 11%, well above the minimum requirement of 8%, ensuring capital adequacy.

Asset quality showed marked improvement, with the bad debt ratio (NPL) as per Circular 31 being kept at a low level. Substandard debt decreased significantly to just 0.3%, expanding the scope for further asset quality enhancement.

In tandem with its business expansion, SHB has refined its credit risk measurement model and capital calculation method in accordance with Basel II, employing the advanced IRB approach. The bank continues to refine its modern risk management framework, aiming to fully meet the requirements of Basel II – IRB by 2027, while enhancing the risk management capabilities of the credit institution system as directed by the State Bank.

Additionally, SHB has effectively implemented liquidity risk management practices in line with Basel III (LCR, NSFR) and state-of-the-art asset and liability management tools (FTP, ALM). These tools enable the bank to control cash flow, ensure liquidity, and proactively prepare for market fluctuations. SHB anticipates further leveraging these tools to enhance operational efficiency and build a solid capital buffer to support long-term growth.

For 2025, SHB aims for a pre-tax profit target of VND 14,500 billion, a 25% increase from 2024. Total assets are projected to surpass VND 832 trillion and reach the milestone of VND 1 quadrillion in 2026, signifying a robust advancement in scale and stature in the domestic and regional financial markets.

Robust Transformation Strategy

During the 2024-2028 period, SHB is implementing a robust transformation strategy, aiming to become a modern and sustainable bank while expanding into the international financial market. SHB is among the few banks selected by the World Bank, JICA, ADB, KFW, and other international financial institutions as a relending bank for key national projects and ADB’s global trade finance program.

Currently, SHB continues its strategic collaboration with major domestic and foreign economic groups, developing ecosystems and supply chains for satellite companies, small and medium-sized enterprises, and the science and technology sector. Recently, SHB signed comprehensive cooperation agreements with Vietnam Steel Corporation, Binh Son Refinery and Petrochemical JSC, and the Tasco Group…

SHB’s comprehensive cooperation with prominent corporations and businesses

SHB aims to become the TOP 1 bank in terms of efficiency, the most favored digital bank, and the best retail bank, while providing financial services to strategic private and state-owned enterprises with sustainable supply chains and ecosystems. By 2035, SHB envisions becoming a modern retail bank, a green bank, and a leading digital bank in the region.

To achieve this goal and compete in the global financial markets, SHB will implement the “Bank of the Future” model, integrating advanced technologies such as artificial intelligence (AI), big data, and machine learning into its operations, products, and services. This model will not only enhance SHB’s competitiveness but also expand its technology infrastructure and develop innovative financial products, offering personalized experiences to its customers.

Anchored by four pillars: reform of mechanisms, policies, regulations, and processes; people-centricity; customer and market centrality; and IT modernization and digital transformation, SHB remains steadfast in its six core cultural values of “Heart – Trust – Faith – Wisdom – Intelligence – Vision.” The bank contributes to the socio-economic development of the country, joining its journey towards a new era of prosperity and strength.

The Stock Market Breakthrough: Unraveling the Power of Holistic Transformation and Sustainable Business Strategies

Over the past two months, SHB stock has surged with market-leading liquidity, attracting foreign investment. For years, SHB has consistently paid dividends at a rate of 10-18%. Recently, SHB announced breakthrough business results, showcasing significant changes in its strategic transformation implementation.

A Bank Stock Surpasses All-Time High on December 23

Currently, several banking codes have reached or are approaching historical highs, including BID, ACB, HDB, VCB, and LPB.