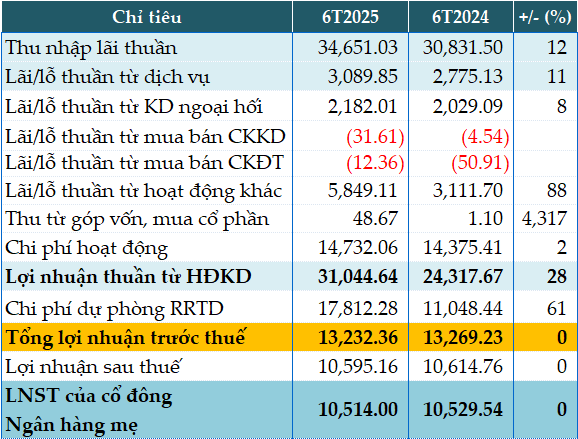

In the first half of 2025, Agribank’s net interest income increased by 12% year-on-year to VND 34,651 billion.

Non-interest income also grew, with service income up 11% (VND 3,089 billion), foreign exchange trading income up 8% to VND 2,182 billion, and other operating income at VND 5,849 billion, an impressive 88% increase due to VND 5,972 billion in recovered written-off principal.

On the other hand, trading and investment securities activities continued to incur losses, despite showing improvement compared to the previous year.

Operating expenses rose marginally by 2% to VND 14,732 billion, resulting in a 28% increase in profit from business operations to VND 31,044 billion.

However, the bank’s credit risk provisions increased by 61% during this period, leading to a similar profit before tax of VND 13,232 billion as in the previous year.

|

Agribank’s Semi-Annual Business Results for 2025 in VND billions

Source: VietstockFinance

|

As of the second quarter, Agribank’s total assets reached nearly VND 2.39 quadrillion, a 7% increase since the beginning of the year. Customer loans and deposits also grew by 8% and 7%, respectively, totaling over VND 1.85 quadrillion and nearly VND 1.04 quadrillion.

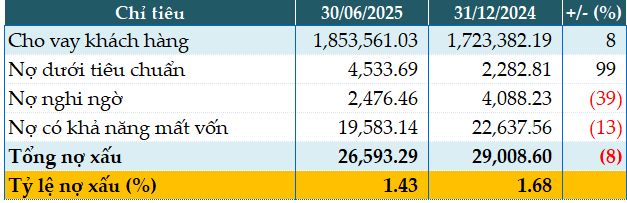

Agribank also witnessed an improvement in loan quality, with total non-performing loans as of June 30, 2025, decreasing by 8% from the beginning of the year to VND 26,593 billion. The non-performing loan ratio also dropped significantly from 1.68% to 1.43% during this period.

|

Loan Quality of Agribank as of June 30, 2025, in VND billions

Source: VietstockFinance

|

– 2:08 PM, August 3, 2025

“A Surge in Semiannual Profits: CASA Rises by 37.9%, MB by 18%”

The consolidated financial statements reveal that Military Commercial Joint Stock Bank (MB, HOSE: MBB) recorded a remarkable performance in the first six months of 2025. The bank’s profit before tax stood at VND 15,889 billion, reflecting an impressive 18% year-over-year growth. This outstanding result can be attributed to the robust growth across various revenue streams.

VietCredit Returns to Profitability Through Financial Product Digitization

The Q4 2024 financial report from VietCredit Joint Stock Finance Company (VietCredit – stock code: TIN) reveals a positive turnaround for the business, with a post-tax profit of VND 69.6 billion and other encouraging signs.

The Powerhouse Performer: VietinBank’s Stellar Growth with a Near 2.4 Million Billion Dong Total Asset Portfolio, Witnessing a 61% Surge in Pre-Tax Profit for Q4/2024

For the fourth quarter of 2024, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank) reported a remarkable performance with a pre-tax profit of over VND 12,245 billion, surging by 61% year-on-year. This impressive growth is attributed to a significant reduction in credit risk provisions.