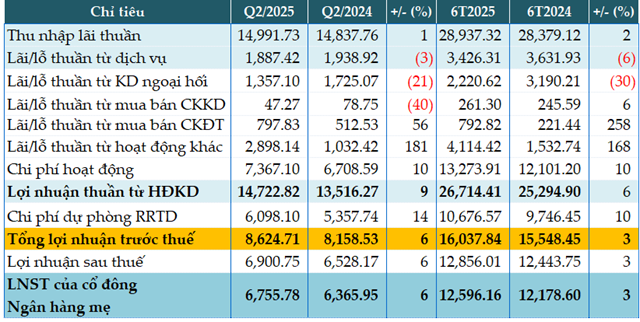

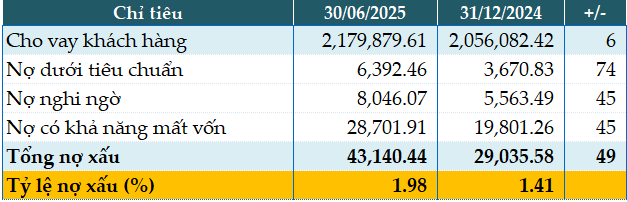

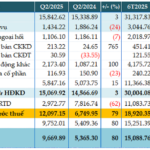

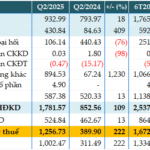

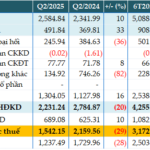

BIDV’s net interest income for Q2 2025 saw a modest 1% year-on-year increase, totaling nearly VND 14,992 billion.

Non-interest income sources witnessed a decline, including service fees (-3%), foreign exchange trading (-21%), and securities trading (-40%).

Conversely, investment securities income rose by 56% to VND 780 billion. Other income surged by 181% year-on-year, reaching VND 2,898 billion.

Operating expenses climbed by 10% to VND 7,367 billion, resulting in a 9% increase in profit from business operations, totaling VND 14,722 billion.

BIDV set aside VND 6,098 billion in risk provisions for the quarter, a 14% increase. Consequently, pre-tax profit rose by 6%, amounting to VND 8,624 billion.

For the first half of the year, the bank’s pre-tax profit reached VND 16,037 billion, a slight 3% increase year-on-year.

|

BID’s Q2 and 6-month business results in 2025. Unit: VND billion

Source: VietstockFinance

|

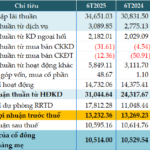

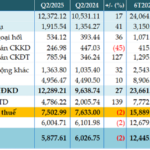

As of Q2 2025, BIDV’s total assets exceeded VND 2.99 quadrillion, an 8% increase from the beginning of the year. Customer lending and deposits both grew by 6%, reaching nearly VND 2.18 quadrillion and VND 2.07 quadrillion, respectively.

As of June 30, 2025, BIDV’s total bad debt stood at VND 43,140 billion, a 49% increase from the beginning of the year. The bad debt ratio increased from 1.41% to 1.98% during this period.

|

BID’s loan quality as of June 30, 2025. Unit: VND billion

Source: VietstockFinance

|

Hàn Đông

– 20:51 30/07/2025

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”

Profits Soar and Bad Debt Declines: ABBank’s Impressive First Half of the Year

The recently released Q2 2025 consolidated financial statements reveal that An Binh Joint Stock Commercial Bank (ABBank) posted a remarkable performance with a pre-tax profit of VND 1,257 billion, tripling its figure from the previous year. This outstanding result brings the bank’s half-year pre-tax profit to VND 1,672 billion, achieving 92% of its annual target.

Agribank’s Pre-Tax Profit for H1 2025 Exceeds VND 13,232 Billion, with Improved Non-Performing Loan Ratio

The consolidated financial statements for the first half of 2025 reveal that the Vietnam Bank for Agriculture and Rural Development (Agribank) recorded a pre-tax profit of over VND 13,232 billion for the period, a figure almost identical to the same period last year. Non-performing loans at the end of the second quarter showed improvement compared to the beginning of the year.

“A Surge in Semiannual Profits: CASA Rises by 37.9%, MB by 18%”

The consolidated financial statements reveal that Military Commercial Joint Stock Bank (MB, HOSE: MBB) recorded a remarkable performance in the first six months of 2025. The bank’s profit before tax stood at VND 15,889 billion, reflecting an impressive 18% year-over-year growth. This outstanding result can be attributed to the robust growth across various revenue streams.