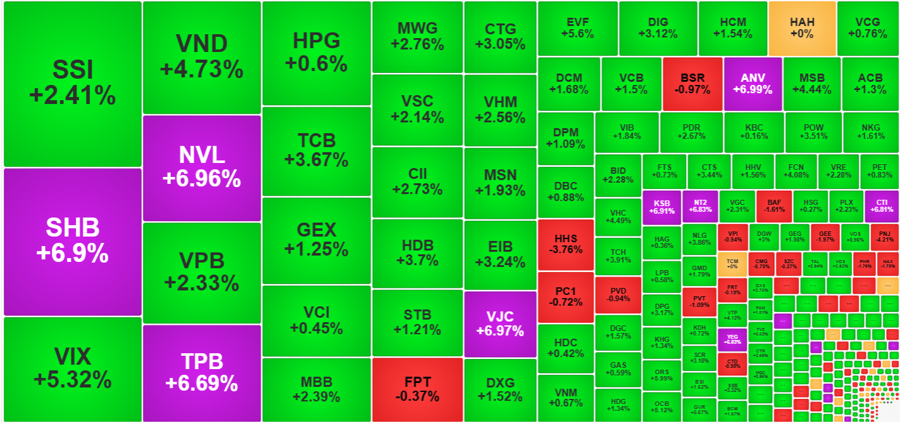

Today’s market witnessed a remarkable surge in enthusiasm, despite a significant decline in liquidity. The VN-Index not only reclaimed the 1500-point mark lost last weekend but also surpassed 1528.19 points, reigniting hopes of retesting the historical peak. This impressive recovery was largely driven by strong gains in the largest blue-chip stocks.

Among the top five most influential stocks, VIC soared to the ceiling price, surging by 6.92%, while VHM, TCB, VCB, and CTG posted notable gains of 2.56%, 3.67%, 1.5%, and 3.05%, respectively. Together, these stocks contributed almost half (14.2 points) of the VN-Index’s 32.98-point gain, equivalent to a 2.21% increase.

Today’s performance was not merely a result of large-cap stocks propping up the market. The VN30 index, representing the 30 largest stocks, rose by an impressive 2.42%, with 29 stocks recording gains. FPT was the sole decliner, falling by 0.37%. Furthermore, 23 out of 30 stocks in the VN30 index witnessed increases of over 1%, including 16 stocks that climbed by more than 2%. Among these, VJC, SHB, VIC, and TPB reached the ceiling price.

The banking sector played a pivotal role in boosting the VN30 index, with several stocks witnessing significant gains in the afternoon session. BID rose by 1.6% from its closing price in the morning session, while CTG, HDB, LPB, MBB, SSB, STB, TCB, VIB, and VPB all recorded gains ranging from 2.53% to 3.53%. This momentum extended across the banking sector, with 23 stocks witnessing increases of over 1%.

The robust recovery of the VN-Index naturally spurred a highly enthusiastic market atmosphere. By the end of the session, the HoSE witnessed 242 gainers and 89 losers, a significant improvement from the morning session’s 165 gainers and 141 losers. This positive shift in market breadth became evident after 2 p.m., driven by the strong performance of blue-chip stocks.

While the midcap and small-cap indices closed with gains of 1.67% and 1.03%, respectively, numerous stocks in these categories witnessed sharp increases. On the HoSE alone, 21 stocks reached the ceiling price, including SHB, TPB, VIC, and VJC from the VN30 index. Additionally, approximately 80 other stocks rose by over 2% but did not reach the ceiling price, 16 of which belonged to the VN30 index.

Among mid- and small-cap stocks, NVL, ANV, and KSB stood out with their extraordinary liquidity, recording transaction values of VND 1,030.7 billion, VND 263.4 billion, and VND 115 billion, respectively. Other stocks, such as QCG, YEG, NT2, and CTI, also witnessed robust liquidity. Dozens of stocks in this category witnessed liquidity exceeding VND 100 billion, accompanied by price increases of over 2%.

The decliners did not witness significant transactions, as the bullish sentiment discouraged investors from selling at low prices. Among the 89 declining stocks on the VN-Index, notable transactions included HHS, which fell by 3.76% with a liquidity of VND 242.2 billion; PDR, which dropped by 4.95% with a liquidity of VND 216.7 billion; BAF, which declined by 1.61% with a liquidity of VND 99.4 billion; PVT, which fell by 1.09% with a liquidity of VND 86.5 billion; GEE, which decreased by 1.97% with a liquidity of VND 68.7 billion; and PNJ, which slid by 4.21% with a liquidity of VND 66.9 billion.

Foreign investors executed a massive negotiated sale in VIC after the market closed, resulting in a total net sell value of over VND 9,944 billion. Excluding this transaction, net selling by foreign investors amounted to approximately VND 313 billion, a relatively low figure compared to the previous two sessions, where net selling on the HoSE reached VND 1,923 billion and VND 2,233 billion, respectively.

The VN-Index’s strong rebound, led by blue-chip stocks, after several sessions of fluctuation around the 1500-point mark, is a positive sign, offering a chance to retest the historical peak. However, it is worth noting that today’s matched transaction value on the HoSE decreased by 15% compared to the previous session, reaching VND 30,907 billion, the lowest in the last 13 sessions. While this value remains high, it indicates a slight cooling compared to the historic week, which averaged VND 46,132 billion per session.

The Flow of Capital: The Rhythm of Adjustment Endures

The market has experienced its most significant correction since the April lows, following a remarkable 42% surge in the VN-Index. The abrupt 4.1% decline on July 29, accompanied by record-breaking trading volumes, signaled the conclusion of a short-term cycle. It’s essential for the market to cool off and consolidate before embarking on the next upward trajectory.

The Great Unloading: Corporate Leaders Race to Sell Shares, HIG Bids Farewell to the Stock Exchange

“In a recent development, four top executives at Petrosetco have signaled their intent to offload nearly 1 million PET shares between August 6 and September 4, through matching and negotiated transactions. This move comes as Hà Đức Hiếu, a member of the Board of Management at Dat Xanh Group, also registers to sell 6.355 million DXG shares to reduce his equity holdings.”