I. MARKET ANALYSIS OF STOCKS ON JULY 22, 2025

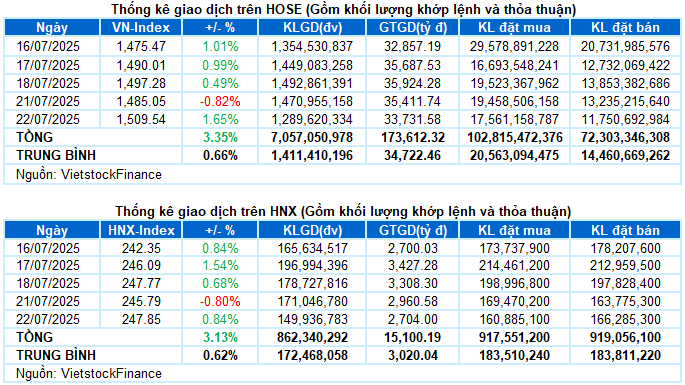

– The main indices returned to a strong upward trend during the trading session on July 22. Specifically, VN-Index increased by 1.65% from the previous session, reaching 1,509.54 points; HNX-Index also rose by 0.84%, closing at 247.85 points.

– The matched order volume on the HOSE floor decreased by 11.7%, reaching 1.2 billion units. The HNX floor also recorded over 146 million units, a 3.4% decrease compared to the previous session.

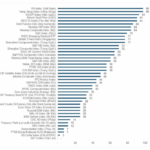

– Foreign investors returned to net selling with a value of nearly VND 1.8 trillion on the HOSE floor but still net bought over VND 21 billion on the HNX floor.

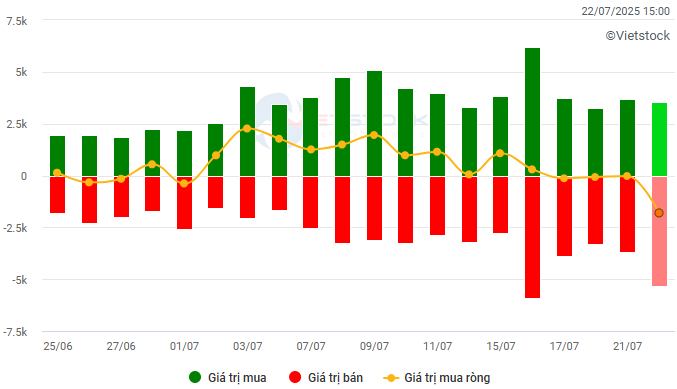

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

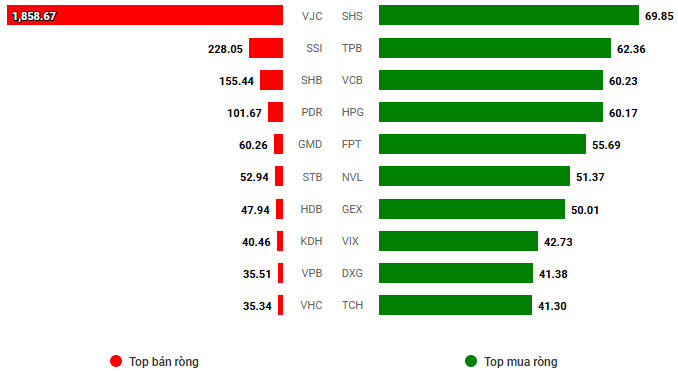

Net trading value by stock code. Unit: VND billion

– The market rebounded strongly after the previous deep correction session. Although there was slight volatility at the beginning of the session, the VN-Index quickly regained its positive momentum and maintained a positive status throughout the morning session, thanks to strong support from large-cap stocks, especially in real estate and finance. The uptrend was further strengthened in the afternoon session as buying demand spread across various sectors. The VN-Index broke through decisively towards the end of the session, closing at the 1,509.54 mark, a 24.49-point increase from the previous session.

– In terms of impact, VIC resumed its leading role, with this stock alone contributing more than 5 points to the VN-Index. Following were VHM, VCB, and BID, which together brought a total of 6.5 points of increase. Meanwhile, no codes had a significant impact on the opposite side, and the total impact of the 10 most negative stocks caused the general index to decrease by less than 1 point.

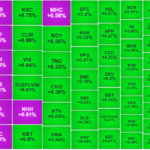

– VN30-Index closed with a strong increase of 1.71%, reaching 1,655.98 points. The breadth of the basket inclined towards the buying side with 26 rising stocks, 2 falling stocks, and 2 stagnant stocks. Leading the market was VJC with a prominent purple color, followed by VIC, HDB, VHM, and VRE, which all broke the 3% threshold. Meanwhile, GVR and TCB were the only two codes dominated by red, falling 0.5% and 0.3%, respectively.

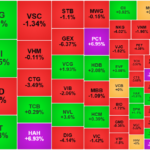

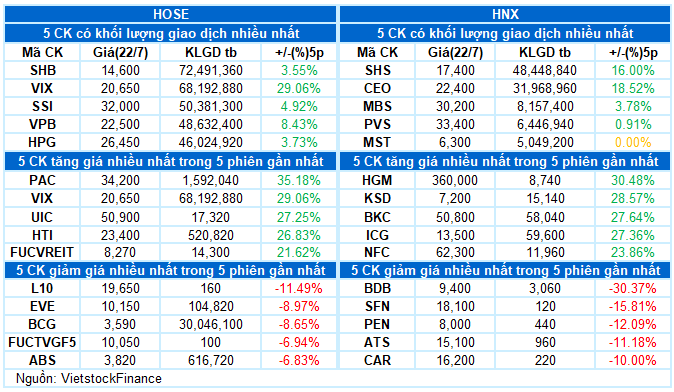

Considering the sectors, the green color covered most of the stock groups. The real estate group was the market leader with an outstanding increase of 3.23%. In addition to the VinGroup trio, cash flow also went to many notable codes such as BCM (+2.1%), NVL (+2.42%), DXG (+3.17%), VPI (+3.52%), TCH (+2.29%), CEO (+2.28%), and SJS hitting the ceiling price.

The industry and finance groups were no exception, with purple appearing in many stock codes such as VJC, GEX, VSC, VIX, EIB, and CTS. In addition, many other names also traded actively with outstanding increases, such as HAH (+4.89%), HHV (+1.17%), HVN (+4.75%), GEE (+4.36%); SSI (+2.07%), VND (+5.23%), HDB (+3.88%), VCI (+2.71%), and SHS (+6.1%).

On the opposite side, utilities and media services were the two rare groups that could not thrive in today’s session, facing adjustment pressure from codes such as DNH (-13.51%), HNA (-5.41%), AVC (-2.46%), DTK (-1.57%), DNP (-4%); FOX (-2.02%), FOC (-0.72%), YEG (-0.77%), and MFS (-0.85%).

VN-Index rebounded strongly and completely denied the previous declining candle, indicating that buying demand quickly returned after the short-term technical correction. Trading volume remained above the 20-session average despite a slight decrease. This development temporarily eliminates the previous reversal signal and opens up the possibility for the index to continue toward the historical peak of 1,530 points. At the same time, the MACD indicator continues to rise after a buy signal in mid-June 2025, reinforcing the positive outlook in the short term.

II. TREND AND PRICE MOVEMENT ANALYSIS

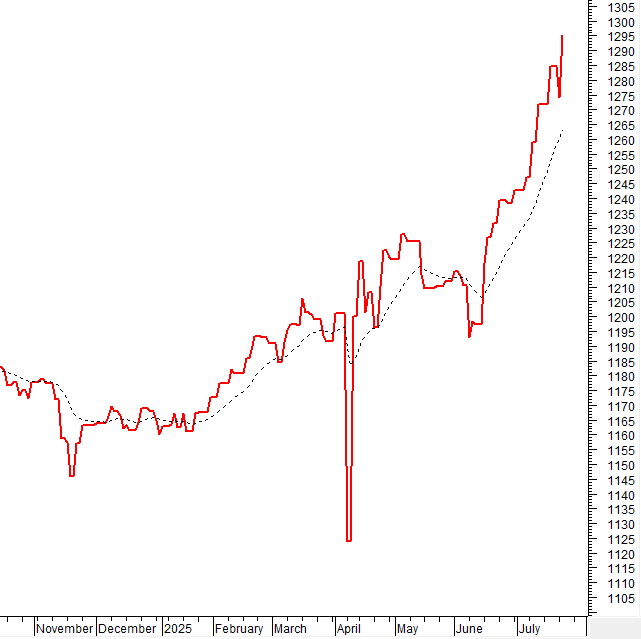

VN-Index – MACD continues to rise

VN-Index rebounded strongly and completely denied the previous declining candle, indicating that buying demand quickly returned after the short-term technical correction. Trading volume remained above the 20-session average, although slightly lower, reflecting investors’ more cautious sentiment but cash flow still present in the market.

This development temporarily eliminates the previous reversal signal and opens up the possibility for the index to continue toward the historical peak of 1,530 points. At the same time, the MACD indicator continues to rise after a buy signal in mid-June 2025, reinforcing the positive outlook in the short term.

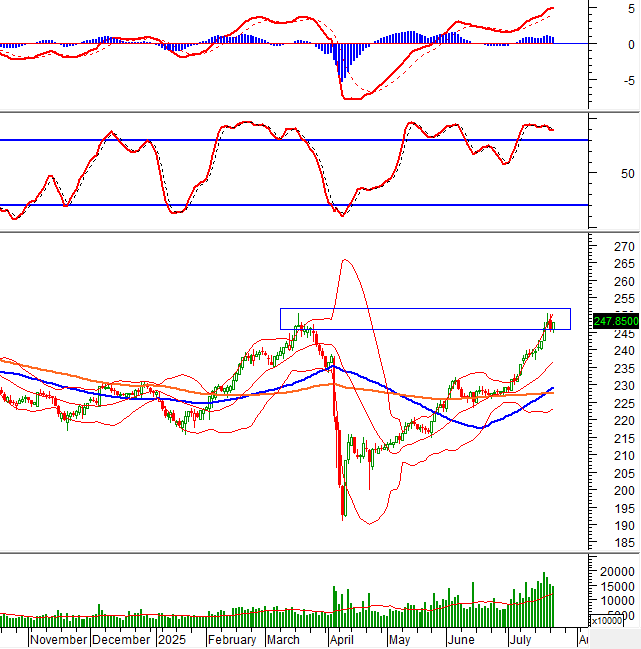

HNX-Index – Re-testing the old peak of March 2025

HNX-Index increased again with the trading volume maintained above the 20-session average, indicating a relatively positive investor sentiment.

Currently, the index is retesting the old peak of March 2025 (equivalent to 245-250 points). If it successfully surpasses this region in the next sessions, the short-term uptrend will be further reinforced.

Analysis of Cash Flow

Fluctuation of Smart Money Flow: The Negative Volume Index indicator of VN-Index is above the EMA 20 days. If this status continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Fluctuation of Foreign Cash Flow: Foreign investors returned to net selling in the trading session on July 22, 2025. If foreign investors maintain this action in the coming sessions, the situation will become less positive.

III. MARKET STATISTICS ON JULY 22, 2025

Department of Economic and Market Strategy Consulting, Vietstock Consulting

– 17:00 22/07/2025

Stock Market Week of July 21-25, 2025: Setting a New Historic High with a Six-Week Winning Streak

The VN-Index has been on a remarkable six-week streak of consecutive gains, accompanied by record-breaking liquidity. The persistent flow of funds and the unwavering confidence of investors have laid a solid foundation for the market’s upward trajectory. However, with the index reaching new historic highs, the recent selling spree by foreign investors and profit-taking at these elevated levels could trigger some technical fluctuations in the short term.

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

The Power of Differentiation: Small and Mid-Cap Stocks Make a Striking Comeback

While the blue-chip stocks dragged the broader index down, the mid and small-cap stocks surged. 21 stocks hit the roof, and nearly 100 others gained over 1%, an unusual phenomenon as the VN-Index dipped.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.