On August 1st, in Ho Chi Minh City, Vietnam Report JSC in collaboration with VietNamNet newspaper successfully organized the Vietnam CEO Summit 2025 with the theme “Digital Brands and the Future of Vietnam’s National Brands.” Within the framework of the conference, the organizers also honored the Top 50 Public Companies in Reputation and Efficiency (VIX50) and the Top 10 Reputable Companies in the Banking – Finance – Insurance – Technology sector in 2025.

Moving up in the Top 10 Reputable Joint Stock Commercial Banks

In the category of Top 10 Reputable Joint Stock Commercial Banks in 2025, LPBank was honored to be ranked 7th, up 2 ranks compared to 2024. This is one of the most important categories in the evaluation system conducted by Vietnam Report, reflecting the overall reputation and reliability of the bank in the eyes of the public, professionals, and the market. This result solidifies LPBank’s role as one of the important “levers” in leading the development of the banking industry and contributing to the country’s economic growth in the era of advancement.

Mr. Bui Thai Ha, Vice Chairman of LPBank’s Board of Directors, received the Top 10 Reputable Joint Stock Commercial Banks cup and certificate from the organizers.

Top 50 Public Companies in Reputation and Efficiency in 2025: LPBank Consolidates Leading Group Position

In the VIX50 category, LPBank ranked 11th, up one place from the previous year. This is a market-wide ranking that comprehensively evaluates financial performance, production and business activities, governance capacity, and enterprise information transparency.

Over the years, VIX50 has witnessed the continuous presence of many enterprises, including LPBank. The Bank’s continuous improvement in ranking year after year demonstrates its relentless efforts in building a solid financial foundation, effective governance, and affirmation of its pivotal role in the economy.

Mr. Bui Thai Ha received the VIX50 cup and certificate from the organizers.

Gaining Momentum – Solidifying Sustainable Development

Vietnam Report assessed that LPBank is one of the few enterprises in the field of finance and banking that has excellently met the stringent evaluation criteria to be named in both aforementioned award categories. According to LPBank’s representative, these achievements demonstrate the correctness of the development strategy of “Streamlining for: Leading Efficiency – Excellent Operation” that the bank has formulated.

Recently, S&P Global ranked LPBank as the most efficient bank in Vietnam and among the top 3 most efficient banks in Southeast Asia based on 2024 business results.

The recognition from independent assessment and ranking organizations in the market is a direct result of LPBank’s positive business picture – where financial indicators continue to grow steadily, asset quality is effectively controlled, and the digital transformation strategy gradually makes a clear impact.

According to the 2025 semi-annual financial report, the bank earned VND 6,164 billion in pre-tax profit, with total operating income reaching VND 9,601 billion. Non-credit income accounted for 27%, an increase of 17.3% over the same period last year. The ROE and ROA indices reached 23.67% and 1.95% respectively – higher than the industry average – indicating the bank’s ability to optimize resources and effectively control risks.

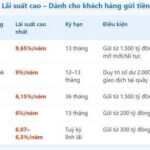

“Top Bank Offers Competitive Savings Rates: Aiming to Attract Deposits Worth Over VND 1.5 Trillion”

The deposit market in early July 2025 witnessed several banks offering high savings interest rates, reaching nearly 10% per annum. However, to avail of this rate, customers need to deposit trillions of Vietnamese Dong.

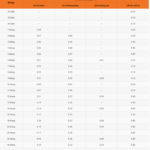

“Vietnam’s Manufacturing Sector Sees Modest Growth: November PMI at 50.8”

The Vietnam Manufacturing Purchasing Managers’ Index (PMI) remained above the 50-point threshold in November, indicating improved business conditions for the second straight month after disruptions caused by Storm Yagi in September. However, with a reading of 50.8, down from 51.2 in October, the sector’s health strengthened only modestly.