We had the opportunity to speak to Mr. Dam Nhan Duc, Chief Economist at Military Commercial Joint Stock Bank (MB, HOSE: MBB), PhD in Economics from University of Paris Dauphine, about this topic.

Mr. Dam Nhan Duc, Chief Economist at Military Commercial Joint Stock Bank (MB, HOSE: MBB), PhD in Economics from University of Paris Dauphine

|

Please share your views on the impact of IR activities on enterprise valuation and shareholder value.

Mr. Dam Nhan Duc: In my opinion, in addition to the fundamental factors related to the company’s operations, market factors such as the stock market and local investment habits, and the attractiveness of foreign capital, a well-thought-out investor relations strategy is crucial to increasing enterprise valuation and enhancing shareholder value.

For example, in the banking industry, Vietnamese banks are not far behind their regional peers in terms of non-interest income and profitability ratios (ROE and NIM). However, they are trading at lower price-to-book (P/B) and price-to-earnings (P/E) ratios. This suggests that while the product is good, the pricing may not reflect its true value due to market conditions and possibly, ineffective selling and marketing strategies. In this context, investor relations (IR) activities are akin to the sales function.

Looking at our regional peers, their effective IR strategies have contributed significantly to their stock performance. According to surveys, banks in Singapore, Thailand, Indonesia, and other countries in the region proactively engage in IR activities. In Vietnam, however, many companies still adopt a passive IR approach, primarily fulfilling regulatory requirements, as reported by financial communications organizations.

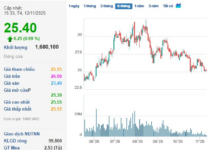

I believe that the core of business is to increase enterprise value and create value for customers and shareholders. Therefore, in addition to ensuring efficient operations, proactive IR activities will positively impact enterprise valuation. Thanks to the trust of our shareholders and investors, MB’s market capitalization has increased 7.8 times since January 1, 2017, the highest among listed banks and 3.3 times higher than the VN-Index growth rate.

How has MB implemented its investor relations activities?

For mandatory IR activities, MB’s Investor Relations Department has diligently complied with the timely and accurate disclosure requirements as stipulated in Circular No. 96/2020/BTC of the Ministry of Finance. Annually, we publish hundreds of mandatory documents without any violations regarding information disclosure regulations. All abnormal and periodic disclosure documents, such as quarterly financial reports, annual reports, charters, and documents related to the General Meeting of Shareholders, are provided simultaneously in Vietnamese and English to ensure that foreign shareholders have equal access to information.

Regarding proactive IR activities, we continuously improve our content, diversify our communication channels, and actively participate in investor events organized by leading domestic and foreign securities companies to provide accurate and timely information about the bank’s operations to investors and shareholders.

Can you share MB’s IR strategy for the coming period?

Moving forward, we will continue to enhance our mandatory and proactive IR activities. First, we will increase transparency and proactive disclosure of information. Second, we will further enhance data reliability. Third, we will diversify our communication channels and materials for investor engagement. In addition to regularly organizing and participating in events and strengthening our online presence, we will develop new materials to provide comprehensive information to investors. In 2024, we enhanced our annual report to offer detailed and holistic insights to our shareholders and the investment community. We also aim to develop a separate ESG report to meet the stringent requirements of many investors.

What is MB’s story for the next three years?

MB’s story is an ongoing journey with many chapters. While the 2021-2024 phase focused on digital transformation, brand transformation, rapid customer acquisition, and industry-leading growth, the next chapter for 2025-2028 will emphasize continued leadership in digital transformation, high growth, improved operational quality, and a customer-centric approach. Our goal is to become a leading financial institution, breaking away from the pack and joining the league of the top five largest commercial banks in Vietnam. With an expected growth rate of 30-35% per year, MB’s scale could double in the next three years.

Supporting this rapid growth trajectory is a solid foundation of governance, a stable shareholder structure, advanced risk management practices, competitive funding costs, and industry-leading digital capabilities.

Is there anything else you would like to share with our readers?

With the “soldier spirit” embedded in MB’s DNA and carried by every member of our team, I firmly believe that MB will remain true to its values and continue its journey of serving customers and society, contributing to the economic development of Vietnam. I am confident that MB will not only be a strong domestic bank but also a globally recognized financial brand, trusted and respected on the international stage. With our potential and pioneering spirit, I have full faith in MB’s sustainable and prosperous future.

|

Please vote for MB as the Listed Company with the Best IR Activities in 2025 from August 1, 2025, to August 14, 2025, on the IR Awards 2025 website (ir.viestock.vn). |

– 08:00 31/07/2025

The Green Age of IR: A “Greening” Strategy and Capital Attraction for Vietnamese Enterprises

At the IR View seminar on ‘greening’, held as part of the IR Awards 2024 ceremony on the morning of September 24, leaders from VietinBank, PAN Group, Vinamilk, and ACB revealed their secrets to attracting international capital. They shared insights on effective Investor Relations (IR) practices and their strategies for sustainable development in the new era of a green economy.

Unlocking the Billion-Dollar Investment: Nguyen Thanh Long of HDCapital on the Power of IR for Vietnam’s Economy

After years of navigating the stock market, Mr. Nguyen Thanh Long, CEO of HD Capital Fund Management JSC, has witnessed a remarkable transformation in investor relations (IR).