Vietnam’s Banking Credit System: Navigating Towards a New Governance Framework

Over the years, bank credit has been the primary channel of capital conduction in Vietnam’s economy, with the credit balance-to-GDP ratio surpassing 130%, one of the highest in the region. This figure not only reflects the central role of credit but also indicates a significant reliance on this capital channel.

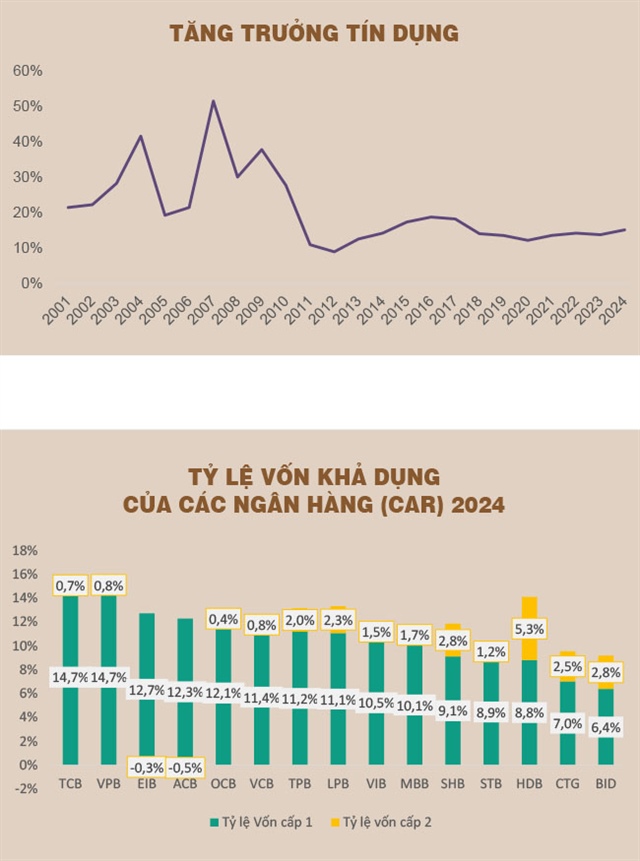

However, the resilience of Vietnam’s banking system lags behind that of its regional peers. The average CAR of Vietnamese banks is maintained at around 12.3%, higher than the minimum requirement of 8%, but lower than the ASEAN-5 group and the Asia-Pacific region’s average of approximately 13.1%.

|

With the issuance of Resolution 57/NQ-TW by the Political Bureau on innovating legal construction methods, orienting towards a market-based operation mechanism, the government has directed the State Bank of Vietnam (SBV) to move towards eliminating the credit “room” mechanism. Instead, they aim to govern credit based on the risk management capabilities and capital adequacy ratios of individual credit institutions.

In alignment with this orientation, the SBV has implemented a roadmap for enhancing capital adequacy standards through various legal documents:

– Circular 13/2010/TT-NHNN: Replaced Decision 457/2005/QD-NHNN, initially providing clearer definitions of capital components and governance requirements, approximating Basel I standards.

– Circular 36/2014/TT-NHNN: Introduced safety limits on credit, the ratio of short-term capital for medium and long-term loans, and the loan-to-deposit ratio (LDR), laying the foundation for approaching Basel II standards.

– Circular 41/2016/TT-NHNN and its amendments, such as Circulars 22/2019/TT-NHNN and 22/2023/TT-NHNN: Approximating Basel II standards with a minimum CAR of 8% and clear risk classification criteria.

|

This reform roadmap, aimed at enhancing capital adequacy standards, not only strengthens the resilience of the banking system but also paves the way for the implementation of a market-based credit mechanism. This mechanism removes rigid administrative credit limits, allowing credit to be based on the intrinsic capacity of individual banks. |

– Circular 14/2025/TT-NHNN (Circular 14): A significant step towards Basel III, with a minimum CAR of 10.5% from 2030 (including the conservation buffer – CCB), along with additional requirements for the countercyclical buffer (CcyB) and permission to implement the internal ratings-based (IRB) approach.

The reform roadmap strengthens the resilience of the banking system and facilitates the shift to a market-based credit mechanism. This mechanism eliminates rigid administrative credit limits and empowers banks to extend credit based on their intrinsic strengths. This is a necessary condition for the safe and efficient operation of Vietnam’s financial system in an increasingly integrated global economy.

Circular 14 – A Foundation for Proactive Credit Growth

Circular 14 marks a significant step in the roadmap to enhance the banking system, introducing several reforms that approximate Basel III standards. One notable change is the explicit requirement for three levels of capital adequacy ratios: a minimum common equity tier 1 (CET1) of 4.5%, tier 1 capital of 6%, and total capital (CAR) of 8%. Unlike previous regulations, these ratios apply to both individual and consolidated reports, providing a comprehensive view of systemic risk.

Circular 14 also introduces the CCB, with a gradual increase to 2.5% by 2030. Consequently, banks will be required to maintain a minimum CAR of 10.5%, tier 1 capital of 8.5%, and CET1 of 7%. Banks can opt for early adoption according to a four-year roadmap with SBV approval.

Additionally, Circular 14 empowers the SBV to establish the CcyB within a range of 0-2.5%, depending on market conditions. This mechanism deviates from the administrative nature of the previous credit “room” and provides flexibility for the SBV to control systemic risks through market tools.

Another progressive aspect is the permission for banks to apply the IRB approach instead of the standardized approach (SA). Simultaneously, the SBV has set a risk-weighted asset (RWA) floor to prevent overly optimistic risk assessments by banks.

Circular 14 ushers in a new credit operation mechanism, where banks can proactively grow their credit portfolios based on their capital strength and risk management capabilities, rather than being constrained by growth ceilings. This evolution aligns with the government’s and SBV’s emphasis on “eliminating credit room” and embracing market mechanisms.

Caution Against the Re-emergence of Credit Bubble Risks

While the reform direction is appropriate, loosening credit limits must be accompanied by more synchronized risk supervision tools. In the past, Vietnam experienced a period of rapid credit growth (2007-2009), reaching over 50% annually, which led to a real estate bubble, inflation, and a surge in non-performing loans. Consequently, the credit “room” mechanism was introduced in 2011 as a temporary measure to regulate capital flow in the absence of comprehensive capital adequacy standards.

During the transition phase, if the implementation of the IRB approach is not adequately prepared in terms of data, models, analytical capabilities, and supervision, it could lead to inaccuracies in risk assessment and asset valuation, impacting credit quality and capital adequacy.

To enhance control, the SBV should promote the regular conduct of stress tests and strengthen qualitative supervision of banks adopting the IRB approach. In the long term, it is equally important to develop a multi-layered financial structure where bank credit is not the near-exclusive channel for capital conduction. Balanced development of the corporate bond market, investment funds, and the stock market will help diversify risks and reduce the burden on the banking system.

Lão Trịnh

– 10:00 04/08/2025

Trump’s Second Term: Global Financial Fallout

Donald Trump’s second term brought about significant changes to the financial landscape, particularly in the approach to Basel III – the global standard for bank risk management. The delay and adjustments in the implementation of Basel III in the US had repercussions not only on the domestic financial system but also on international markets, including Vietnam.

KienlongBank: Leading the Way with the Dual Implementation of Basel III and ESG Projects

“With the synchronous implementation of both the Basel III and ESG projects, KienlongBank is demonstrating its strong commitment to enhancing its risk management capabilities and resilience against unforeseen fluctuations. This dual initiative underscores the bank’s proactive approach to not only meet but exceed regulatory standards, solidifying its foundation for sustainable growth.”

KienlongBank: Leading the Way with Concurrent Basel III & ESG Initiatives

“With the synchronized implementation of both the Basel III and ESG projects, KienlongBank is demonstrating its strong commitment to enhancing its risk management capabilities and resilience against unforeseen fluctuations. The bank is also actively promoting its development towards sustainability, adhering to international and Vietnamese standards in environmental, social, and governance practices.”