Bottom-fishing efforts are keeping the VN-Index hovering around the 1500 mark. The index rebounded from a low of 1479.98 to close the week at 1495.21. The market is deeply divided, with many mid- and small-cap stocks reaching the ceiling. Large-cap stocks in the VN30 group saw net selling of over VND 1.8 trillion out of a total net sell-off of VND 2.296 trillion.

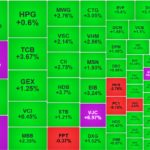

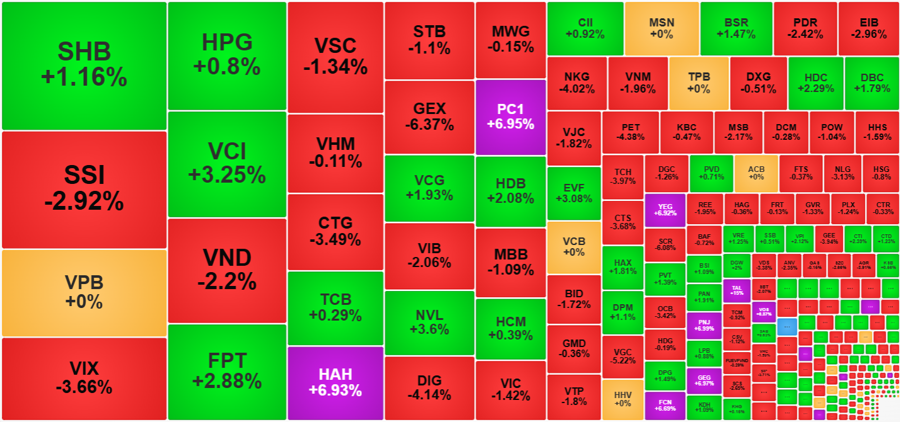

The top 10 stocks had only three gainers: TCB up 0.29%, HPG up 0.8%, and FPT up 2.88%. Conversely, losses in VIC (-1.42%), BID (-1.72%), CTG (-3.49%), and MBB (-1.09%) wiped off nearly 4.9 points from the index’s 7.31-point decline.

The VN30 blue-chip index also weakened, falling 0.07% with 10 gainers and 15 losers. Fortunately, FPT had a significant impact, adding back 3.45 points, offsetting the loss in VIC (-2.48 points). FPT, a rare large-cap standout in this session after an 8-session correction from its peak, saw its price surge in the last 20 minutes of continuous matching, rising 4.89% in just 10 minutes despite foreign investors’ heavy selling.

Four other VN30 stocks posted significant gains: HDB (+2.08%), BVH (+1.52%), SHB (+1.16%), and VRE (+1.25%). Unfortunately, their combined market cap couldn’t make up for the loss in VIC. Conversely, 12 stocks in the VN30 basket fell by more than 1%, a stark contrast to the VN30-Index’s 0.07% decline. CTG’s 3.49% drop had a limited impact on the index, and SSI, BCM, and VIB also fell by over 2% without significantly affecting the index.

Despite the point-offsetting efforts among large-cap stocks, the VN-Index failed to hold above the 1500 level, closing at 1495.21, down 0.49% from the reference level. However, bottom-fishing attempts showed some success: The index rebounded from its intraday low of 1479.98, mirroring the previous two sessions’ patterns. Today’s reversal lasted from around 2 pm until the market close. The market breadth improved from 100 gainers and 215 losers to 141 gainers and 180 losers at the close.

The rest of the market demonstrated the price-supporting flow’s effectiveness: Many stocks recovered towards the end of the day, with a significant number even posting strong gains. Among the 141 gainers, 80 rose more than 1%, including 15 that hit the ceiling. HAH, with a matching value of VND 702.7 billion, PC1 (VND 532 billion), YEG (VND 141.3 billion), and FCN (VND 120.3 billion), stood out. Additionally, TAL, PNJ, GEG, PAC, SJS, and VOS also hit the ceiling with relatively high liquidity.

Today’s price-pushing and supporting flow was not as strong as yesterday’s, with only about 20 stocks trading over VND 100 billion and rising more than 1%. SHB led this group with a turnover of VND 2,083.3 billion, up 1.16%. VCI followed with a turnover of VND 1,243.8 billion, up 3.25%. FPT recorded a turnover of VND 1,126.3 billion, up 2.88%. The group with matching orders exceeding VND 200 billion included HAH, VCG, NVL, PC1, HDB, BSR, HDC, DBC, and EVF. However, their combined turnover accounted for 30.2% of the total matching value on the HoSE, indicating a high level of concentration.

Foreign investors were an unexpected factor today, with net selling of VND 2,296 billion on the HoSE. VN30 stocks alone saw net selling of VND 1,801 billion. SSI experienced intense net selling of VND 466.1 billion, followed by CTG (-VND 385.5 billion), FPT (-VND 287.2 billion), HPG (-VND 282.4 billion), VHM (-VND 154.6 billion), STB (-VND 133.9 billion), and GMD (-VND 122.3 billion). On the buying side, SHB (+VND 152.6 billion), NVL (+VND 85.4 billion), MSB (+VND 81.7 billion), HDB (+VND 77.8 billion), HAH (+VND 71.6 billion), and VIX (+VND 63.4 billion) stood out.

The July Record of VN-Index: Retail Investors Cash Out with 11,000 Billion Profit

Individual investors recorded a net sell-off of VND 7,324.1 billion, including a substantial VND 11,260.5 billion sold through matched orders in the past July.

“Blue-Chip Stocks Surge: VN-Index Recaptures the 1,500-Point Milestone”

Despite a significant decline in liquidity, today’s session witnessed an exuberant market performance. The largest blue-chip stocks witnessed a robust surge, propelling the VN-Index not only to reclaim the 1500-point mark lost last week but also to surpass 1528.19 points, reigniting hopes of testing the historical peak once again.

The Flow of Capital: The Rhythm of Adjustment Endures

The market has experienced its most significant correction since the April lows, following a remarkable 42% surge in the VN-Index. The abrupt 4.1% decline on July 29, accompanied by record-breaking trading volumes, signaled the conclusion of a short-term cycle. It’s essential for the market to cool off and consolidate before embarking on the next upward trajectory.