Vibrant Forex and International Payments Business

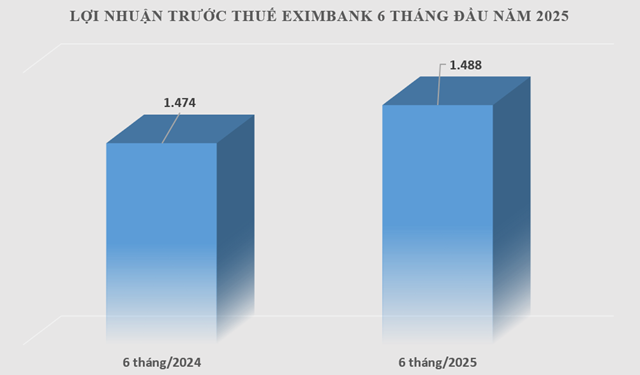

Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB) has just announced its business results for the first six months of 2025, reporting a pre-tax profit of VND 1,489 billion, a 0.97% increase compared to the same period last year. Notably, in the second quarter of 2025, Eximbank achieved a profit of VND 657 billion.

Net interest income for the first half of the year reached VND 2,824 billion. Service income for the same period amounted to VND 1,204 billion, a substantial 63% increase year-on-year, contributing to a rise in pure service income to VND 338 billion, up by 44% compared to 2024.

Remarkably, foreign exchange trading emerged as a standout performer for Eximbank in the first half of 2025, with pure income from this segment reaching VND 364 billion, marking a notable 76% increase compared to the same period in 2024. Building on its traditional strengths in international payments and trade finance, Eximbank witnessed a vibrant landscape in international payments, with a turnover of 3.9 billion USD, signifying a 28% increase year-on-year. Additional income streams contributed VND 250 billion to the bank’s coffers. During this period, the bank achieved a Return on Assets (ROA) of 0.47% and a Return on Equity (ROE) of 4.55%.

Operating expenses for the first six months were VND 1,959 billion, reflecting a 25% increase compared to the previous year. This rise in expenses was primarily driven by increases in staff costs, rent, and depreciation.

Provisions witnessed a decrease of 35% year-on-year, amounting to VND 328 billion. This positive development was attributed to improved asset quality and the absence of certain provisioning requirements. Despite the challenging environment for the banking industry, marked by a significant increase in non-performing loans, Eximbank successfully maintained its non-performing loan ratio at 2.66% as of June 30, 2025, through comprehensive, flexible, and proactive approaches to controlling and handling bad debts.

Credit Growth of 9.8%

As of June 30, 2025, Eximbank’s total assets continued to grow, reaching VND 256,442 billion, representing a 7% increase, or VND 16,673 billion, compared to the beginning of the year. Total mobilized capital stood at VND 225,517 billion, indicating a 7% increase from the start of the year. Notably, the CASA (non-term deposit) ratio reached VND 24,141 billion, reflecting a 3.6% increase compared to the beginning of the year.

Eximbank’s credit growth was impressive, recording a 9.8% increase to VND 184,663 billion. This growth was aligned with the government and SBV’s directives, focusing on export-import businesses and consumer credit. The 9.8% credit growth also reflects the demands of businesses and individuals, as well as Vietnam’s positive economic growth momentum.

Throughout the first half of 2025, Eximbank maintained a safe operating ratio as per SBV regulations. The bank’s capital adequacy ratio (CAR) fluctuated around 12%, consistently above the SBV’s minimum requirement of 8%. Additionally, the ratio of short-term capital used for medium and long-term loans remained below the SBV’s maximum limit of 30%, and the loan-to-deposit ratio (LDR) was maintained below 85%, as stipulated by the SBV.

In the first six months, Eximbank achieved 29% of its annual profit plan for 2025, which was approved at the Annual General Meeting of Shareholders in 2025 (with a pre-tax profit target of VND 5,188 billion).

During this period, Eximbank accelerated its digital transformation journey with the launch of a new core card system in May 2025. The bank was recognized as the “Leading Licensee in Merchant Sale Volume 2024,” underscoring its success in card payment transactions. In April 2025, Eximbank was awarded the Sao Khue 2025 for its ESale and BPM solutions, acknowledging their practical applicability and contribution to enhancing customer experience—key aspects in the digital banking era.

Not only has Eximbank grown in scale, but it has also actively engaged in community initiatives. The bank organized the Ho Chi Minh City Night Run Eximbank 2025, attracting over 5,000 participants, and hosted blood donation drives under the theme “Give Blood Today, Give Hope for Tomorrow—Building the Future with Eximbank.” Additionally, Eximbank showed its commitment to giving back through programs in Quang Tri and Thua Thien Hue…

Lower Interest Rates to Support People and Businesses

Eximbank maintained a competitive average lending rate of 7.1%/year in June 2025, with an even lower rate of 6.61%/year for corporate clients. These rates are considered low compared to other commercial banks, demonstrating Eximbank’s commitment to supporting individuals and businesses during these challenging economic times.

Eximbank representatives affirmed that the bank has actively lowered lending rates and introduced supportive programs for SMEs, aligning with the government and State Bank’s directives. These efforts aim to enhance access to capital for businesses and individuals, ultimately boosting Vietnam’s economic growth and ushering in a new era of prosperity.

Eximbank’s Customer Base Continues to Expand

|

Eximbank has witnessed a growth in its customer base since the beginning of the year, particularly in the individual customer segment. Currently, the bank serves approximately 2.6 million customers.

Fortifying Foundations for Future Growth

Eximbank is in a pivotal year, laying the groundwork for a significant breakthrough in the 2026-2030 period. The bank is focused on fortifying its foundations and driving comprehensive transformation to enable sustainable growth. To achieve this, Eximbank is collaborating with international consulting partners and experts to undertake a comprehensive restructuring of the bank and develop a medium and long-term strategy that places customers at its core. Additionally, the bank is strengthening its internal audit and risk management systems.

Eximbank is also preparing for its strategic move to relocate its head office to Hanoi, following approval from the State Bank of Vietnam. This marks a pivotal moment in the bank’s restructuring and rebranding journey, reflecting a shift in leadership thinking and positioning Eximbank for enhanced governance, increased competitiveness, and greater transparency and efficiency.

Unlocking the Domestic Market’s Potential: A Strategy for Sustainable Growth in the Seafood Industry

The domestic market, with its vast purchasing power of over 100 million consumers, presents a strategic opportunity for Vietnam’s seafood industry to sustain stable and robust growth. By effectively tapping into this market, the industry can unlock a powerful solution to maintain its momentum and prosper.

“Unleashing the Potential: Clearing Bottlenecks for a Robust Semiconductor Industry”

“Recognizing the pivotal role of the semiconductor industry in developing Vietnamese-based artificial intelligence, Prime Minister Pham Minh Chinh underscored the imperative of conducting a thorough analysis to assess accomplishments, shortcomings, underlying factors, and lessons learned to catalyze the advancement of the semiconductor industry.”

Establishing an International Financial Center in Vietnam: Local Communities and Investors Alike Are Ready.

The decision to establish an International Financial Center (IFC) in Vietnam is a testament to the country’s ambitious vision for the new era. This strategic move by the Government and the Communist Party of Vietnam aims to propel the nation forward, creating a powerful new impetus for development. The IFC is designed to be a magnet for domestic and international businesses, attracting attention and investment from across the globe.