The VN-Index fell below the 1,500-point mark last week, ending at 1,495.21 points, a loss of 35.92 points from the previous week. This marked the strongest weekly decline and the fifth downward week in the 17 weeks since the April lows.

The domestic market’s pace of adjustment was in sync with the performance of global stock markets last week, despite positive news that supported the markets. For US stocks, the Dow Jones index failed to breach the record high of 45,000 points last month, while the S&P 500 saw its first correction from the record high of 6,400 points.

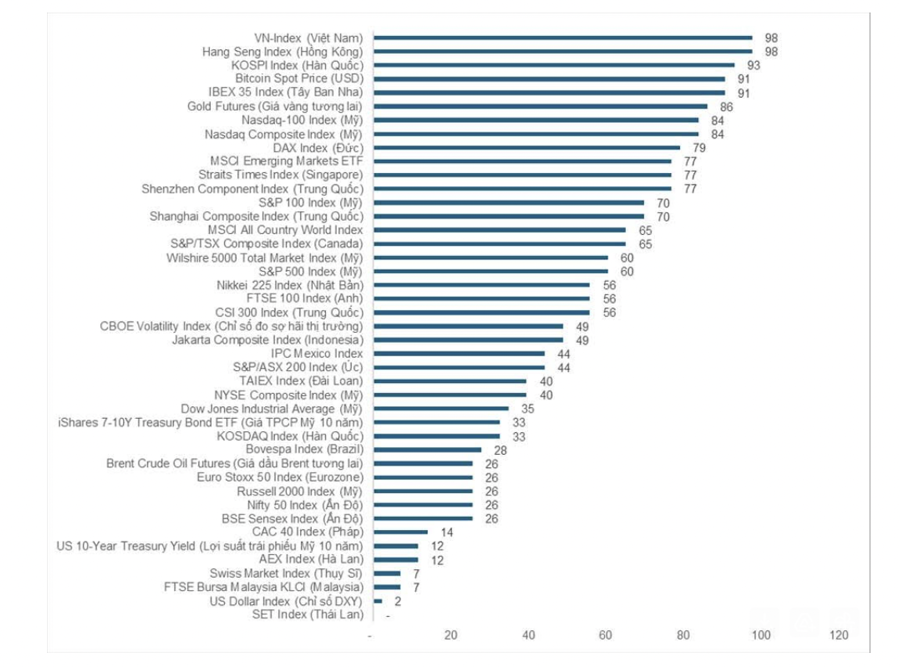

Commenting on this week’s market trend, Mr. Nguyen The Minh, Director of Individual Customer Analysis at Yuanta Securities, stated that while the VN-Index and Hang Seng indices have shown outstanding growth, the Relative Strength Index (RSI) reaching 98 points indicates limited room for further growth. Typically, this is a sign that the market is in an overbought state, and the pressure to correct may increase.

Notably, the VIX index (fear gauge) recovered, and the RSI improved to 49 points. However, as this level is still considered low, the market has not completely shifted to a pessimistic state.

An interesting statistic is that the performance of the S&P 500 in August of the second year of US presidential terms often sees a decline, with an average and median return of -3.4%.

The scale of global technology ETFs has reached a new record high, implying that investors are allocating a significant portion of their portfolios to tech stocks. Consequently, global capital flows are shifting towards countries with strong tech ETFs, such as the US, China, Taiwan, and South Korea. Unfortunately, the scale of Vietnam’s tech sector remains small, and the country’s stock market does not yet have a dedicated tech ETF.

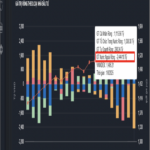

MBS Securities believes that for the VN-Index, the record-breaking liquidity of 9 billion shares on the HOSE and 11 billion shares on all three exchanges, coupled with the index closing the week with a long red candle and a new peak of 1,564.92 points, is a notable signal. This marks a decline of 69.71 points from the peak.

From a technical perspective, the nearly 490-point rally is likely over after extremely high liquidity failed to push prices higher, accompanied by strong price movements. This also indicates market distribution.

However, in the base case scenario, investors are advised to wait for confirmation from price action after the technical turning point to avoid false signals. A positive sign is the gradual decrease in market liquidity as it tests supply. Specifically, volume may remain high in the first few sessions due to selling pressure from profit-taking or distribution, but it should decrease as prices stabilize or correct towards support levels.

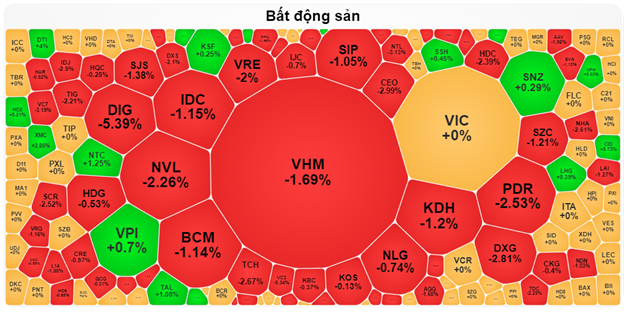

MBS expects the support zone for this week’s supply test to be in the range of 1,475 – 1,482 points. If liquidity remains low in this zone, the market will have a chance to recover. In addition to the overall signals, investors should also monitor heavily discounted stock groups, which will quickly approach support zones and have the potential to recover or form a balance or sideways trend. According to the closing prices, several stock groups are currently trading at deeper discounts than the VN-Index (-4%), including Vingroup, Viettel, Food, Real Estate, Steel, and Seafood.

Regarding trading strategies, investors should patiently wait for market signals as analyzed in the base case scenario above. Meanwhile, they can seek opportunities in heavily discounted stock groups at support levels. With high liquidity, the market is likely to attract bottom-fishing capital, depending on the stock’s performance during the current correction or distribution phase. Penny stocks that have formed accumulation bases may be a viable option while the market seeks equilibrium.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.

Stock Market Blog: Bide Your Time

The market witnessed bottom-fishing funds below the 1500-point mark of VNI, marking the third session hovering around this level, albeit with waning momentum. The ability to sustain this level remains uncertain, and liquidity signals are weakening.

“Blue-Chip Stocks Surge: VN-Index Recaptures the 1,500-Point Milestone”

Despite a significant decline in liquidity, today’s session witnessed an exuberant market performance. The largest blue-chip stocks witnessed a robust surge, propelling the VN-Index not only to reclaim the 1500-point mark lost last week but also to surpass 1528.19 points, reigniting hopes of testing the historical peak once again.