Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 1.37 billion shares, equivalent to a value of more than 36.4 trillion VND; HNX-Index reached over 187 million shares, equivalent to a value of more than 3.8 trillion VND.

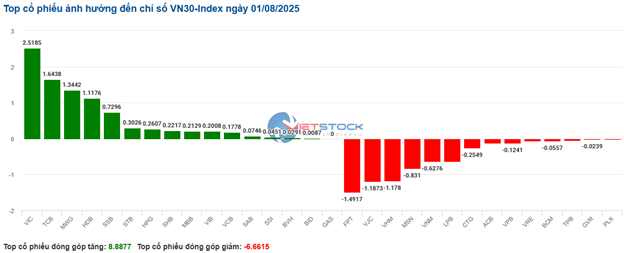

VN-Index opened the afternoon session with sellers maintaining a more dominant position, causing the index to plunge despite buying pressure appearing at the end of the session, which helped the index recover. However, the VN-Index still closed in the red, with a rather negative sentiment. In terms of impact, CTG, VIC, BID, and GEX were the codes with the most negative influence on the VN-Index, with a decrease of more than 5 points. On the other hand, FPT, PNJ, HDB, and TAL remained in the green and contributed more than 2.4 points to the overall index.

| Top 10 stocks with the most significant impact on the VN-Index on 08/01/2025 |

Similarly, the HNX-Index also witnessed a rather pessimistic performance, with the index negatively impacted by codes such as SHS (-6.52%), MBS (-3.3%), DTK (-5.19%), and CEO (-3.32%)…

|

Source: VietstockFinance

|

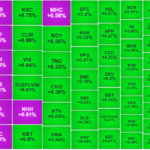

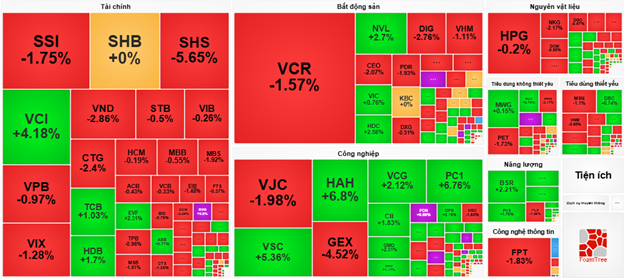

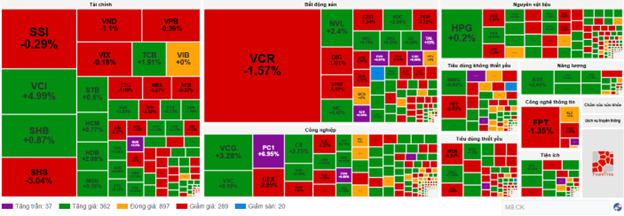

The financial sector was the group with the most significant decline in the market, falling by 0.66%, mainly due to codes such as BID (-1.72%), CTG (-3.49%), MBB (-1.09%), and STB (-1.1%). This was followed by the real estate and consumer staples sectors, which decreased by 0.39% and 0.25%, respectively. On the contrary, the information technology sector was the only group to remain in the green, increasing by 2.54%, mainly driven by the performance of FPT (+2.88%), ITD (+4.9%), POT (+6.32%), and HPT (+14.78%).

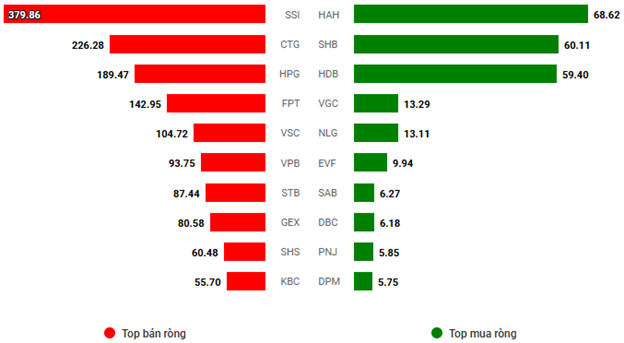

In terms of foreign trading activities, foreign investors continued to be net sellers on the HOSE exchange, focusing on codes such as SSI (466.97 billion VND), CTG (385.15 billion VND), FPT (287.63 billion VND), and HPG (281.98 billion VND). On the HNX exchange, foreign investors net sold more than 162 billion VND, mainly offloading CEO (47.66 billion VND), SHS (45.46 billion VND), IDC (28.39 billion VND), and MBS (16.17 billion VND).

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Red Dominates

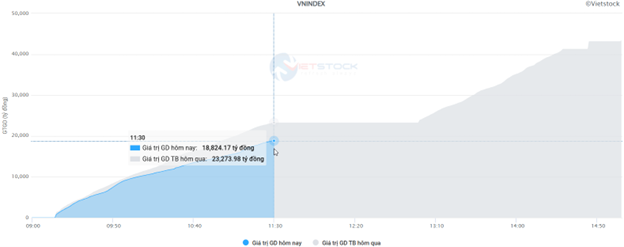

The main indices were all in the red at the end of the morning session. By midday, the VN-Index decreased by 0.4%, reaching 1,496.46 points, while the HNX-Index stood at 265.55 points, down 0.3%. The market breadth inclined towards the sell-side, with 367 declining stocks and 317 advancing stocks.

This morning, S&P Global released the report on Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) for July 2025. Accordingly, the index reached 52.4 points in July, up from 48.9 points in June and above the 50-point threshold for the first time in four months. This indicates an improvement in the overall health of the manufacturing sector.

Against this backdrop, the stock market continues to witness a tug-of-war between buyers and sellers. Investor sentiment turned more cautious. The trading volume on the HOSE reached nearly 694 million units, equivalent to a value of nearly 19 trillion VND, a decrease of 19% compared to the previous session’s high. The HNX recorded a volume of over 97 million units, equivalent to 1.9 trillion VND.

Source: VietstockFinance

|

Within the top 10 stocks influencing the VN-Index, CTG and VHM were the two codes with the most negative impact, taking away a total of 2.3 points from the index. Conversely, VIC made the most positive contribution, adding 0.7 points to the overall index.

The mixed performance continued across sectors, with fluctuations within a narrow range. The energy group temporarily led the market with a gain of 0.91%, mainly driven by stocks such as BSR (+2.21%), PVS (+1.75%), OIL (+1.64%), PVT (+2.49%), VTO (+3.61%), MVB (+5.52%), and VIP (+3.37%).

Following closely was the industrial sector, with notable gainers attracting strong buying interest, including FCN, VOS, and PAC, which hit the daily limit-up, along with VSC (+5.36%), HAH (+6.8%), PC1 (+6.76%), GMD (+2.31%), VCG (+2.12%), and DPG (+2.76%).

On the opposite end, the information technology sector lagged the market with a correction of 1.75%, as selling pressure concentrated on stocks like FPT (-1.83%), CMG (-1.48%), and DLG, which hit the daily limit-down.

Source: VietstockFinance

|

Foreign investors continued to net sell, with a value of 2.2 trillion VND across all three exchanges. The selling pressure was focused on SSI, with a net sell value of 379.86 billion VND. Meanwhile, HAH led the net buy list with a value of 68.62 billion VND.

|

Top 10 stocks with the strongest foreign net buying/selling

Unit: Billion VND

Source: VietstockFinance

|

10:30 AM: Mixed Trading Persists, Financials Continue to Support the Index

As of 10:30 AM, the market witnessed a slight improvement with more gainers, but the mixed performance continued. The VN-Index fluctuated around the reference level and gained more than 1 point, trading at around 1,503 points. The HNX-Index also experienced a tug-of-war between buyers and sellers, increasing by nearly 1 point to 267 points. The financial and industrial sectors continued to be the main supporters of the indices.

The breadth among the VN30-Index constituents was relatively balanced, with 15 advancing stocks, 13 declining stocks, and 2 stocks remaining unchanged. Notably, on the positive side, VIC, TCB, MWG, and HDB contributed 2.5 points, 1.6 points, 1.3 points, and 1.1 points to the VN30 index, respectively. On the other hand, FPT, VJC, VHM, and MSN faced selling pressure, deducting more than 4.5 points from the overall index.

Source: VietstockFinance

|

The financial sector continued to be the pillar supporting the indices, with most stocks trading in the green. Notable gainers within the sector included VCI (+5.11%), SHB (+0.58%), TCB (+1.62%), HCM (+0.97%), HDB (+2.27%), STB (+0.5%), and others. However, a few stocks within the sector faced selling pressure, including ACB, which declined by 0.22%, SHS down by 2.17%, VND losing 0.88%, and VPB falling by 0.19%.

The industrial sector also witnessed a positive performance, with most stocks trading in the green. Notably, PC1 and FCN hit the daily limit-up, followed by VCG, VSC, and CII, which increased by 3.47%, 0.19%, and 2.75%, respectively.

In contrast, the consumer staples and information technology sectors were the only groups trading in the red, with a mixed performance and slightly stronger selling pressure. Specifically, selling pressure was observed in VNM, which decreased by 0.82%, MSN down by 0.97%, SBT losing 4.75%, FPT falling by 1.25%, CMG declining by 1.23%, and ELC down by 0.21%…

Compared to the opening, buying pressure continued to build up. There were 362 advancing stocks and 289 declining stocks.

Source: VietstockFinance

|

Opening: Mixed Performance at the Start of the Session

At the beginning of the session on August 1, as of 9:30 AM, the VN-Index and HNX-Index exhibited contrasting performances. Notably, the red dominated the VN30-Index basket, with 18 declining stocks, 7 advancing stocks, and 5 stocks trading unchanged.

Several large-cap information technology stocks witnessed negative performance at the beginning of the session, including FPT, which decreased by 1.06%, CMG down by 1.11%, and ELC falling by 0.42%.

Additionally, the consumer staples sector experienced a mixed performance with stronger selling pressure. Specifically, selling pressure was observed in large-cap stocks such as VNM, which declined by 0.49%, MSN down by 0.83%, and MCH losing 0.48%.

In contrast, the oil and gas sector continued its stable growth trajectory, with most stocks trading in the green. Notably, BSR increased by 4.41%, PVS gained 1.17%, and PVD advanced by 1.89%…

On the other hand, large-cap stocks like CTG, VPB, and SSI weighed on the market, deducting more than 1 point from the index. Conversely, VIC, TCB, and BSR led the gainers, contributing more than 5.3 points to the overall index.

– 15:55 01/08/2025

Stock Market Week of July 21-25, 2025: Setting a New Historic High with a Six-Week Winning Streak

The VN-Index has been on a remarkable six-week streak of consecutive gains, accompanied by record-breaking liquidity. The persistent flow of funds and the unwavering confidence of investors have laid a solid foundation for the market’s upward trajectory. However, with the index reaching new historic highs, the recent selling spree by foreign investors and profit-taking at these elevated levels could trigger some technical fluctuations in the short term.

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

Is the VN-Index Facing Major Adjustment Pressures?

From a technical standpoint, the near 490-point rally is likely over after an enormous volume surge failed to push prices higher, accompanied by volatile price action. This is a tell-tale sign of distribution in the market.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.