Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 1.43 billion shares, equivalent to a value of more than 36.1 trillion VND; HNX-Index reached over 153 million shares, equivalent to a value of more than 2.9 trillion VND.

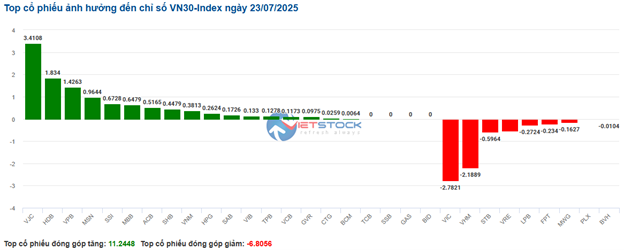

VN-Index opened the afternoon session on a less favorable note as buyers tried to pull the index up, but selling pressure persisted, resulting in a prolonged tug-of-war until the end of the session. Eventually, buying pressure slightly prevailed, allowing the index to close in the green. In terms of impact, VPB, VJC, HDB, and VNM were the most positive influences on the VN-Index, contributing 4.2 points. On the other hand, VHM, VIC, TCB, and LPB faced selling pressure, deducting over 6.2 points from the overall index.

| Top 10 stocks with the most significant impact on the VN-Index on July 23, 2025 |

Similarly, the HNX-Index also witnessed a positive performance, supported by gains in PVI (+3.53%), HUT (+2.88%), SHS (+2.3%), NTP (+2.07%), and others.

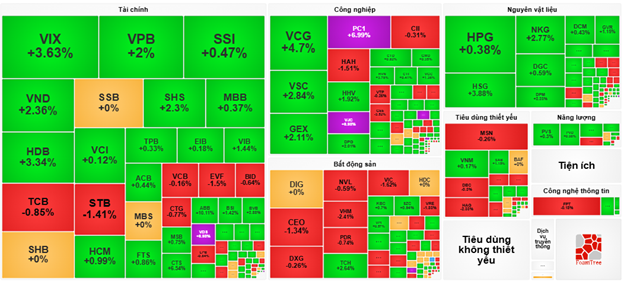

At the closing bell, green dominated most industry groups. The industrial sector led the market with a 1.87% gain, driven primarily by VJC (+6.98%), ACV (+2.66%), HVN (+2.72%), and MVN (+4.27%). Following the recovery were the media & telecommunications services and consumer staples sectors, rising 1.51% and 0.98%, respectively. Conversely, the real estate sector witnessed the sharpest decline, falling -1.59%, mainly due to losses in VIC (-2.13%), VHM (-3.46%), VRE (-2.5%), and SSH (-1.41%).

In terms of foreign trading activities, foreign investors net bought over 172 billion VND on the HOSE exchange, focusing on FRT (332.34 billion VND), VPB (218.96 billion VND), HDB (112.39 billion VND), and VNM (105.77 billion VND). On the HNX exchange, they net sold over 138 billion VND, mainly offloading CEO (82.28 billion VND), SHS (49.94 billion VND), MBS (23.43 billion VND), and IVS (7.07 billion VND).

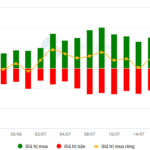

| Foreign Trading Activities – Net Buying/Selling |

Morning Session: Profit-taking pressure returns, pushing the VN-Index back to the starting point

As the VN-Index approached the 1,520-point threshold, intense profit-taking pressure resurfaced. At the midday break, the VN-Index hovered just above the reference level, reaching 1,510.25 points (+0.05%), while the HNX-Index climbed 0.39% to 248.82 points. The market breadth was positive, with 453 gainers and 251 losers.

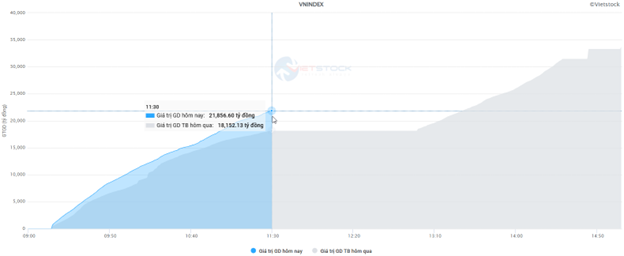

Liquidity remained elevated in the morning session. The trading volume on the HOSE reached 890 million shares, corresponding to a value of over 21 trillion VND, a 20% increase compared to the same period in the previous session. The HNX also recorded a volume of over 92 million shares, equivalent to 1.8 trillion VND.

Source: VietstockFinance

|

Among the top 10 stocks influencing the VN-Index, VHM and VIC had the most negative impact, deducting 2.2 points and 1.7 points, respectively. Conversely, VJC, VPB, HDB, and HVN made the most positive contributions, collectively adding over 3 points to the index.

Sector-wise, the industrial sector stood out, thanks to strong gains in stocks like VJC, PC1, BCG, and TCD, which hit the daily limit-up, propelling the sector to the top position with a 1.26% increase. The materials sector also performed well, with buying interest concentrated in stocks such as HSG (+3.88%), NKG (+2.77%), DPM (+2.23%), GVR (+1.15%), VGS (+1.92%), and NTP (+1.78%).

Notable outperformers that attracted strong buying interest in the morning session were stocks in the securities sector. However, the upward momentum started to wane compared to the highest levels achieved earlier.

Source: VietstockFinance

|

On the flip side, the real estate sector witnessed the most negative performance in the morning session, with widespread losses influenced by declines in stocks such as VIC (-1.62%), VHM (-2.41%), VRE (-1.83%), SSH (-6.83%), KSF (-2.26%), and CEO (-1.34%).

Foreign investors added further selling pressure, continuing to net sell with a value of over 786 billion VND across all three exchanges. The selling was concentrated in VIX, with a value of 232.3 billion VND, far exceeding the net sold value of other stocks. Meanwhile, VPB and HSG led the net bought list with values of 110.16 billion VND and 88.98 billion VND, respectively.

| Top 10 stocks with the most significant foreign net buying/selling in the morning session of July 23, 2025 |

10:30 AM: Buying interest spreads across the market, pushing the VN-Index up by nearly 8 points

The market continued to be dominated by green ticks. As of 10:30 AM, the VN-Index climbed 7.96 points, trading at 1,517.23. The HNX-Index rose 3.22 points to 251.07, with positive contributions from the financial and industrial sectors.

The highlight was the significant increase in the number of stocks in the VN30-Index basket, with an overwhelming majority posting gains. Notably, four stocks in the banking sector, including HDB, VPB, MBB, and ACB, contributed the most to the VN30 index, adding 1.83 points, 1.42 points, 0.64 points, and 0.51 points, respectively. Conversely, only a few stocks, namely VIC, VHM, STB, and VRE, faced selling pressure, deducting over 6.1 points from the overall index.

Source: VietstockFinance

|

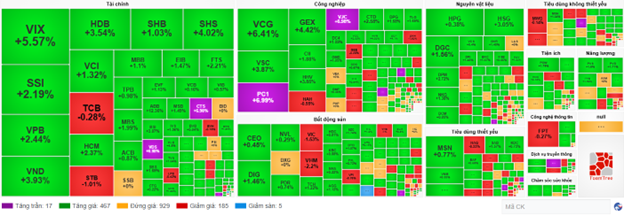

The financial sector continued to attract attention as most stocks in this group witnessed robust growth, including VIX (+5.33%), SSI (+2.19%), VPB (+2.67%), VND (+4.19%), HDB (+3.73%), VCI (+1.68%), HCM (+2.77%), and others.

The industrial sector also recorded positive performance, with leading stocks in the sector posting strong gains. Specifically, VCG, PC1, and VJC hit the daily limit-up, followed by VSC, GEX, and HHV, which rose 3.87%, 3.05%, and 4.23%, respectively.

Additionally, stocks in the materials sector also contributed significantly to the index’s upward movement, including HPG (+0.38%), HSG (+2.77%), DGC (+1.66%), DPM (+3.34%), and others.

In contrast, the real estate and information technology sectors were the only two groups that recorded losses, with intense selling pressure and a slight advantage for sellers. Specifically, selling pressure was concentrated in VIC, which fell by 1.45%, VHM decreased by 1.88%, VPI dropped by 0.76%, and VRE declined by 1.17%… Regarding the information technology sector, selling pressure persisted in FPT, which fell slightly by 0.27%.

Compared to the opening, buyers continued to dominate the market. There were 467 gainers and 185 losers.

Source: VietstockFinance

|

Opening: Strong market participation at the beginning of the session

Following the previous day’s gains, the VN-Index opened the morning session up 4.12 points, trading around the 1,513 level, with most stocks in the market trading in positive territory. The securities, industrial, and real estate sectors were the main contributors to the index’s performance.

Notably, the securities sector witnessed robust gains, with most stocks in this group trading in the green. Specifically, SSI (+0.78%), VIX (+3.15%), VND (+1.83%), SHS (+2.3%), VCI (+0.48%), CTS (+6.54%), and others posted gains.

The industrial sector recorded positive performance, with leading stocks in the sector registering strong gains. VJC hit the daily limit-up, followed by VSC and GEX, which rose 4.9% and 2.32%, respectively.

Additionally, stocks in the real estate sector also contributed to the index’s upward movement, including KBC (+1.76%), DIG (+0.24%), NDN (+0.92%), HDC (+0.32%), and others.

– 15:20, July 23, 2025

The Market Breakthrough

The VN-Index soared to new heights, surpassing its previous record peak set in early 2022. Impressive liquidity has been sustained, with average volumes over the past 20 weeks reflecting a strong influx of capital into the market. The MACD indicator continues to widen the gap with the Signal line since the buy signal emerged in mid-May 2025, reinforcing the upward momentum in the medium term. However, the Stochastic Oscillator has begun to level off in the overbought region, suggesting a potential for technical corrections at elevated price levels in the coming weeks.

Vietstock Weekly 21-25 July 2025: Marching Towards Historic Highs

The VN-Index rallied for the fifth consecutive week, eyeing the historic peak reached in early 2022 (1,500-1,530 points). Last week’s trading volume hit a record high, indicating vigorous market participation. The MACD indicator continues to widen the gap with the signal line after giving a bullish signal in mid-May 2025, reinforcing the intermediate uptrend. Nonetheless, investors should be cautious of potential short-term fluctuations as the Stochastic Oscillator ventures deeper into overbought territory.

Market Beat July 31st: Holding the 1,500-Point Mark Triumphantly

The VN-Index faced significant challenges during the morning session, with constant struggles and adjustments, suggesting a deep decline at the closing bell. However, a remarkable turnaround took place in the afternoon session, as the market staged a strong recovery, recouping much of the lost ground. The index ultimately closed at 1,502.52, limiting the damage to a modest 5.11-point loss.

The Vietstock Daily: Celebrating 25 Years with New Peaks

The VN-Index soared during the trading session commemorating the 25th anniversary of Vietnam’s stock market. The high trading volume, maintained above the 20-session average, indicates robust momentum in the flow of funds, despite the impressive rally witnessed recently. With the MACD indicator continuing to widen the gap above the signal line after providing a buy signal in mid-June 2025, the VN-Index is poised to extend its upward trajectory, finding strong support around the 1,500-point level.

Stock Market Insights: Has the Tide Turned?

The VN-Index retreated, forming a Bearish Engulfing candlestick pattern as it encountered resistance at the psychological level of 1,500 points. This retreat indicates significant profit-taking pressure. Additionally, the Stochastic Oscillator has provided a sell signal within the overbought territory. Investors should exercise caution in the near term as a fall below this level could trigger increased short-term corrective pressure.