|

Source: VietstockFinance

|

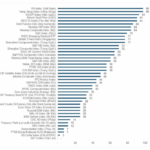

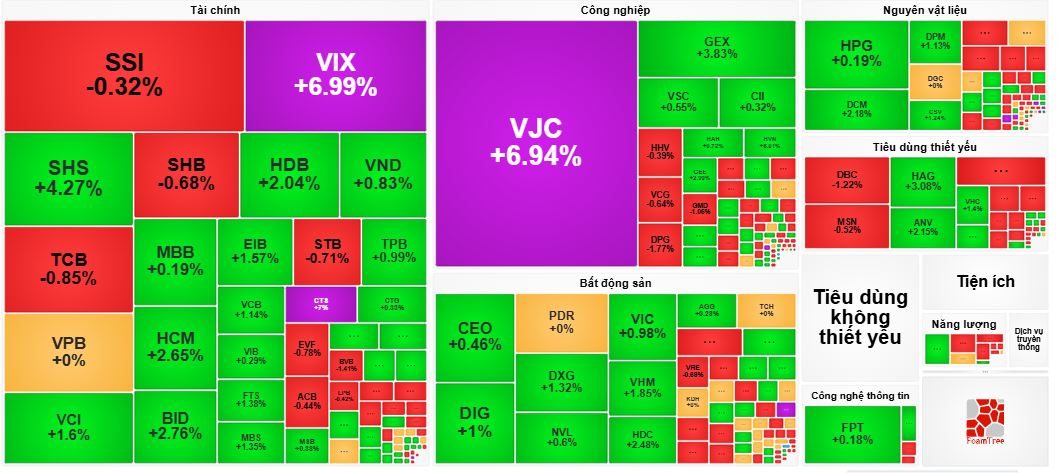

Large-cap stocks made significant contributions to the index’s gain. The top 10 stocks that pushed the index up added 16.2 points to the VN-Index. Among them, VIC, VHM, VCB, and BID were the most prominent.

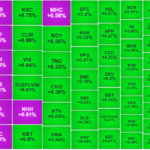

Buying pressure dominated the market at the end of the session, with over 500 stocks rising compared to 300 declining ones. A few stocks, including VIX, EIB, CTS, VJC, VSC, GEX, and PAN, stood out with strong gains. These were just a few examples of nearly 40 stocks that hit their daily limit-up during today’s session.

Most sectors were in the green today, with real estate and securities being the two most notable performers. Within the real estate sector, stocks such as VIC, VHM, CEO, DXG, DIG, and NVL led the gains.

Securities stocks regained their momentum after a weak opening. Towards the end of the session, several securities stocks witnessed strong rallies, with VIX and CTS hitting their daily limit-up. VND rose by 5%, while SHS climbed by 6%. Many other securities stocks, including SSI, VCI, HCM, and BSI, posted gains ranging from 2% to 3%.

Strong trading activities continued, with today’s trading value reaching VND 37.5 trillion, and over 1.5 billion shares changing hands. Block deals accounted for nearly VND 3.7 trillion of the total trading value.

| Improved liquidity on the HOSE compared to the previous period |

Morning Session: Vingroup and Aviation Stocks Lift VN-Index

The market maintained its upward momentum until the end of the morning session, with the VN-Index climbing by 6 points to close at 1,491.1 points. The HNX-Index also edged higher by 0.23 points to reach 246 points. Compared to the opening, the market breadth became more balanced, with 348 gainers and 350 losers.

| Top 10 stocks with the most significant impact on the VN-Index during the morning session of July 22, 2025 (in terms of points) |

The index was mainly driven by stocks in the financial and aviation sectors, including VIC, HVN, VHM, VJC, VCB, BID, and VIX. Notably, SJS joined the group of stocks with a strong positive impact on the VN-Index, as it surged to its daily limit-up during the morning session.

On the other hand, banking stocks continued to weigh on the market. TCB, VPB, SSB, STB, MBB, and ACB were among the top decliners. However, the overall impact of these stocks on the index was relatively limited, as the top 10 losers caused the index to lose only 2.3 points.

Liquidity remained robust, with the morning session recording a trading value of over VND 20 trillion, indicating strong optimism among investors.

10:50 AM: Green Dominates the Market Again

The initial dip caused some concerns, but it did not significantly affect investor sentiment. Buying pressure quickly returned, pushing the VN-Index up by nearly 9 points to 1,493.6 points.

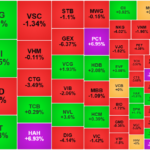

Most sectors turned positive, led by financials and securities. In contrast to the earlier dominance of red, the financial sector witnessed a strong rebound, with many stocks posting substantial gains. SHS rose nearly 5%, while VIX and CTS hit their daily limit-up. Among banking stocks, several names, including EIB, HDB, BID, MBB, CTG, and VCB, advanced by 1-2%.

Real estate stocks also rebounded, with CEO, DIG, VIC, DXG, VHM, NVL, and HDC leading the sector with gains of over 1%.

In the aviation sector, VJC unexpectedly surged to its daily limit-up, while HVN climbed by 6%.

Consumer staples stocks were mixed, with HAG, ANV, VHC, and PAN in the green, while DBC, MSN, VNM, KSC, and BAF declined.

Market heatmap at 11:00 AM. Source: VietstockFinance

|

VIC regained its position as the main pillar of the VN-Index, followed by HVN, VHM, VJC, and several financial stocks, including VCB, VIX, and BID. Stocks from the Gelex Group, namely GEX and GEE, also made positive contributions to the index’s gain.

Notably, foreign investors net sold nearly VND 2.2 trillion in the first half of the morning session, with VJC being the main target of their selling pressure.

Market Open: Strong Selling Pressure at the Opening

The market opened on July 22 with a tug-of-war between buyers and sellers. The VN-Index fluctuated around the reference level in the early minutes. By 9:25 AM, the index had gained nearly 2 points to reach 1,486 points. However, just a few minutes later, at 9:35 AM, the index dropped by more than 8 points to fall below 1,477 points.

Red dominated the market, with a total of 360 declining stocks compared to only about 180 gainers. Financial and banking stocks were the main drag on the market, creating significant pressure on the overall sentiment.

TCB, VCB, MBB, and STB were among the banking stocks that weighed the most on the index.

Real estate stocks also witnessed a similar trend, although VIC managed to stay in positive territory and acted as a crucial support for the VN-Index.

In the materials sector, DCM, DPM, CSV, DGC, and BFC showed resilience, while several stocks, including BKC, HCC, and KVC, hit their daily limit-up.

– 3:45 PM, July 22, 2025

Stock Market Week of July 21-25, 2025: Setting a New Historic High with a Six-Week Winning Streak

The VN-Index has been on a remarkable six-week streak of consecutive gains, accompanied by record-breaking liquidity. The persistent flow of funds and the unwavering confidence of investors have laid a solid foundation for the market’s upward trajectory. However, with the index reaching new historic highs, the recent selling spree by foreign investors and profit-taking at these elevated levels could trigger some technical fluctuations in the short term.

The Stock Market Sell-Off: VN-Index Plunges Below 1500, Foreign Investors Dump 1.2 Billion

Market liquidity remained high this morning, with a slight increase in matched transactions on the HoSE, up nearly 3%. However, today’s performance contrasts with yesterday’s morning session. A broad-based decline in stock prices indicates a resurgence of selling pressure, particularly from foreign investors, who offloaded a net amount of VND 1,372 billion, with over VND 1,200 billion on the HoSE alone.

The Power of Differentiation: Small and Mid-Cap Stocks Make a Striking Comeback

While the blue-chip stocks dragged the broader index down, the mid and small-cap stocks surged. 21 stocks hit the roof, and nearly 100 others gained over 1%, an unusual phenomenon as the VN-Index dipped.

“Extreme Foreign Sell-Off, VN-Index Plunges Below 1500 Points”

The VN-Index hovered around the 1500 mark last week, thanks to bottom-fishing efforts by cash flow. The index rebounded from a low of 1479.98 to close at 1495.21 on Friday. The market remains deeply divided, with many mid and small-cap stocks hitting the ceiling. Large-cap stocks, on the other hand, witnessed a net sell-off of over VND 1.8 trillion, out of a total net sell-off of VND 2.296 trillion.