|

Source: VietstockFinance

|

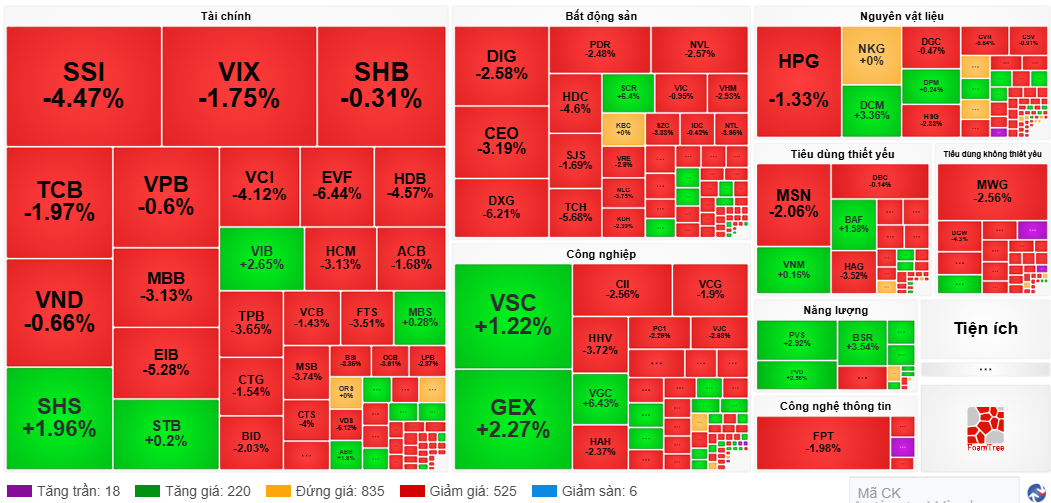

Today’s trading session witnessed a continuous surge in liquidity. At the close, the HOSE floor recorded a trading value of nearly VND 72,000 billion. The HNX floor reached nearly VND 6,600 billion, and UPCoM reached VND 1,700 billion. In total, there was over VND 80,200 billion, with this liquidity, the stock market set a new record, surpassing the previous record of nearly VND 56,000 billion on November 19, 2021.

The red dominated the end of the session, with 705 codes decreasing, including 86 floor codes. Selling pressure pushed a series of stocks to the floor.

All VN30 stocks ended today’s session with a decrease, with 4 codes falling to the floor. In the industry groups, large-cap stocks fell sharply.

For securities groups, VND, HCM, VCI, SSI, etc., fell to the floor simultaneously. Along with that, the banking group also suffered the same fate. HDB, EIB, OCB… fell to the floor, SHB fell near the floor. The SHB, TCB, STB, VIB, MBB, ACB… declined sharply.

Real estate stocks were also dominated by floor colors. DIG, CEO, PDR, NVL, DXG, TCH, HDC, etc., all fell to the floor. VIC, VHM fell by 2-3%, this decline was enough to put pressure on the index.

The oil and gas group could not maintain its early positivity. At the close, only BSR, PVC, and PVP remained in the green. The rest turned red.

Going against the market, 19 stocks hit the ceiling today. HUT, PET, ADS, DLG, VHG, etc., ended the session in purple.

Morning session: Liquidity surges, nearly 41,000 billion VND changed hands

The decline was partly narrowed from the beginning of the session, but the decline was still large. VN-Index closed the morning session at 1,533.61 points, down nearly 24 points. HNX-Index recorded a slight decrease of 1 point to 262 points.

Liquidity surged with a trading value of nearly 41,000 billion VND in the morning session, indicating a large profit-taking force when VN-Index set a new record high after a long series of increases. The positive point is that the bottom-fishing demand is abundant, helping the market not fall into a deep decline.

Source: VietstockFinance

|

In the context of a general decline, many stocks still maintained their green color. In the financial group, SHS, VIB, MBS, ABB, etc., maintained their uptrend. For industrial stocks, VSC, GEX, VGC, CTI, ACV, etc., gained points.

In the essential consumer goods group, VNM, BAF, NAF, MML, etc., rose slightly.

The bright spot of this morning session came from oil and gas stocks, PVS, PVD, BSR, PVT, PVC, etc., maintained their green color for most of the morning session. Fertilizer stocks also maintained a good uptrend. DCM, DPM, LAS, BFC are the representatives of this group that gained points.

Despite the market being flooded with red, some codes still went against the trend and hit the ceiling. Among the 18 purple codes, some notable ones include VTZ, PET, ADS, DLG, etc.

10:40 am: Massive profit-taking, VN-Index fell sharply at times

After the initial fluctuations, VN-Index began to face stronger profit-taking pressure. By 10:25, the index recorded a decrease of up to 30 points. This decrease was contributed by VHM, VIC, and many bank codes such as VCB, BID, TCB, CTG, HDB, MBB, etc.

The number of declining codes increased significantly compared to the beginning of the session, reaching nearly 490 declining codes. This number far exceeded the number of nearly 230 increasing codes.

In the context of a red market, many stocks still recorded good increases, such as VND, SHS, VIX, VSC, GEX, VIB, etc.

Liquidity surged with a trading value of more than 31,000 billion VND poured into the market as of 10:38.

Opening: Profit-taking pressure exists, money flows strongly into the market

VN-Index opened with an increase to 1,564, setting a new intraday high. However, selling pressure quickly spread, causing the index to fall sharply. By 9:25, the main index of the HOSE floor decreased by nearly 13 points, standing at 1,544.71 points.

The market breadth at this time temporarily leaned towards the sell-side with nearly 310 decreasing codes and 240 increasing codes.

However, the profit-taking pressure was only temporary. The market quickly recovered. Leading stocks in industries showed a good increase. In the securities group, VIX, SHS, VND, MBS, etc., increased by 4-5%, and the liquidity of these codes led the financial group.

In the industrial group, VSC, GEX, VGC rose strongly. In particular, VGC hit the ceiling.

The oil and gas group also showed positive green. BSR, PVS, PVD, PLX, PVC, PVT all increased.

The dynamic money flow is strongly flowing into the market. In just the first 30 minutes of the session, there was more than 11,000 billion VND in trading value. If this trend continues, liquidity is expected to surge today.

– 15:35 29/07/2025

Market Beat Aug 01: Caution Creeps In, VN-Index Wobbles at 1,500 Mark

The trading session concluded with the VN-Index shedding 7.31 points (-0.49%), settling at 1,495.21. Likewise, the HNX-Index witnessed a decline of 1.41 points (-0.53%), closing at 264.93. The market breadth tilted towards decliners, as 423 stocks closed in the red versus 366 advancers. The VN30 basket echoed a similar sentiment, with 15 stocks losing ground, 10 advancing, and 5 remaining unchanged.

The Vietstock Daily: Record-Breaking Volumes Signal a Market Turnaround

The VN-Index plummeted over 64 points, accompanied by the emergence of a Black Marubozu candlestick pattern. Trading volume surged to a record high, and the number of declining stocks far outweighed those advancing, clearly reflecting the widespread panic and selling pressure across the market. As of now, the Stochastic Oscillator has given a fresh sell signal within the overbought region. Concurrently, the MACD is narrowing its gap with the Signal line, and the outlook will turn even more pessimistic if a sell signal is confirmed in the upcoming sessions.

Bullish Momentum Returns

The VN-Index staged a remarkable recovery, decisively erasing the previous day’s losses and showcasing the swift return of bullish momentum after a brief technical correction. Trading volume remained above the 20-session average, despite a slight dip, indicating sustained investor interest. This dynamic development negates the earlier bearish signal and paves the way for a potential push towards the historic peak of 1,530 points. Moreover, the MACD indicator continues its upward trajectory since the buy signal in mid-June 2025, reinforcing the positive outlook in the near term.

Market Beat: VN-Index Hits New High, Financials and Industrials Soar.

The trading session concluded with significant gains, as the VN-Index climbed by 0.66% to reach 1,531.13, a gain of 10.11 points. Meanwhile, the HNX-Index also experienced a notable surge, increasing by 1.55% or 3.89 points, to finish at 254.56. The market breadth was overwhelmingly positive, with buyers dominating as 509 codes advanced while only 317 codes declined. However, the large-cap stocks in the VN30 basket painted a different picture, with 17 codes declining, 13 advancing, and 4 remaining unchanged, resulting in a slightly bearish sentiment.