|

Source: VietstockFinance

|

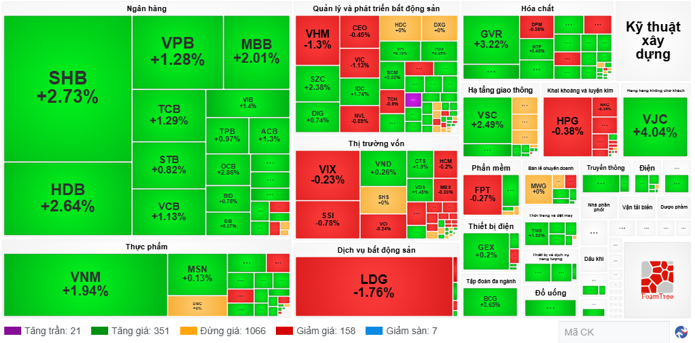

The VN-Index gained 8.71 points to close at 1,521.02, the HNX-Index rose 1.34 points to 250.67, and the UPCoM-Index climbed 0.36 points to 105.16. The market’s liquidity reached over 40.3 trillion VND.

The session’s volatility was largely influenced by the rollercoaster rides of real estate and securities groups, as both sectors turned from red to green.

In the real estate sector, the rebound of VIC, which ended the day up 0.87%, and the slight loss of VHM, down 0.22%, significantly changed the VN-Index’s landscape. Additionally, green hues were visible across other stocks, including NLG, DIG, DXG, CEO, and HDC. In the industrial park group, SZC, IDC, and BCM posted positive results, with SIP even hitting the ceiling price.

Regarding the securities group, despite mixed performances, some notable gainers included VIX, up 3.93%; VND, up 1.28%; and CTS, up 3.67%…

Across the market, several sectors displayed dominant green hues, notably banking, transportation infrastructure, oil and gas, and electrical equipment. Many large-cap stocks witnessed positive momentum, including HDB, SHB, MBB, VSC, BSR, VNM, and VJC…

The market’s transformation was also evident in the performance of different capitalization groups. While the Large Cap group trailed in the morning session, it rebounded in the afternoon to lead with a 0.61% gain. Meanwhile, the Mid Cap, Small Cap, and Micro Cap groups rose 0.39%, 0.59%, and 0.2%, respectively.

As the market extended its winning streak, foreign investors net sold over 432 trillion VND. Five stocks witnessed net selling in the hundreds of trillions of VND: HPG, MSN, VHM, FPT, and NLG.

On the buying side, HDB topped with a robust net buy value of nearly 475 trillion VND, followed by SSI, VNM, and SHB.

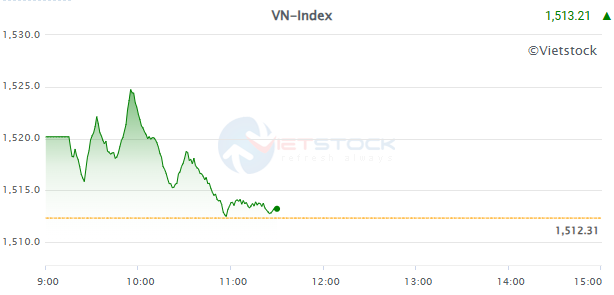

Morning session: VIC and VHM duo exert pressure, pushing VN-Index towards reference level

Following the initial excitement, the market faced mounting pressure, particularly from the VIC and VHM duo, which wiped off a significant number of points from the VN-Index, bringing it back towards the reference level.

Source: VietstockFinance

|

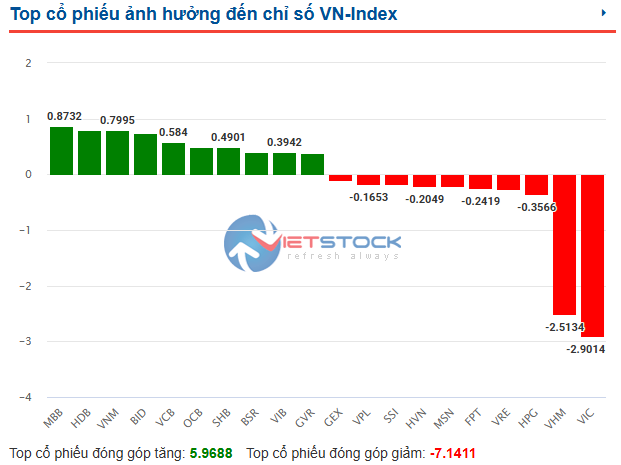

At the end of the morning session, the VN-Index managed a slight gain of 0.9 points to reach 1,513.09. Meanwhile, the HNX-Index and UPCoM-Index climbed 0.72 points and 0.28 points, respectively.

Among the sectors significantly influencing the overall market, the banking sector maintained its dominant green hue, while others exhibited clear differentiation, notably real estate, with the securities sector dominated by red hues.

Within the real estate sector, despite numerous gainers like NLG, DIG, and HDC, the pressure exerted by the VIC and VHM duo, which declined 2.87% and 2.93%, respectively, pushed the sector down 1.62%, making it the worst-performing sector in the morning session.

These two stocks also accounted for the highest point deductions from the VN-Index, with VIC and VHM responsible for over 2.9 points and 2.5 points, respectively.

Source: VietstockFinance

|

Following real estate, the securities sector declined 0.62%, with notable losers including SSI, VCI, VND, SHS, and FTS…

Additionally, several other large-cap stocks posted lackluster performances, such as MSN, MWG, HPG, and FPT…

The market’s liquidity reached over 19,597 trillion VND, with the HOSE contributing nearly 18 trillion VND, slightly higher than the average of the last five sessions.

Foreign investors were also active, with net selling of over 400 trillion VND. The most net-sold stocks in the morning session were VHM, MSN, and FPT. On the buying side, HDB led the market with nearly 494 trillion VND, far surpassing other stocks.

10:40 am: Frequent fluctuations, futures unexpectedly turn red

The market experienced several fluctuations in the first half of the morning session, sometimes surging over 12 points to approach 1,525, and sometimes retracing to a gain of less than 3 points. While the VN30 remained slightly positive, the VN30F1M unexpectedly turned red.

As of 10:30 am, the VN-Index had climbed 5.28 points to 1,517.59, with a trading value of nearly 13.1 trillion VND.

The banking group continued its positive momentum, with HDB surging 6.23% and SHB rising 3.7%. The real estate sector also improved compared to the beginning of the session, with green hues appearing in many stocks, notably DIG, NLG, CEO, HDC, and DXG…

Meanwhile, the securities sector failed to witness a positive shift. Red hues remained dominant, with SSI losing 1.24%.

In the futures market, the VN30 1-month futures contract (VN30F1M) dropped 2.6 points to 1,650.4, equivalent to a negative basis of 4.02 points compared to the VN30. In contrast, the VN30 remained slightly positive.

Opening: Market continues upward trajectory

Vietnam’s stock market commenced the trading session on July 24th with a positive note, witnessing broad-based participation and price gains across all capitalization groups.

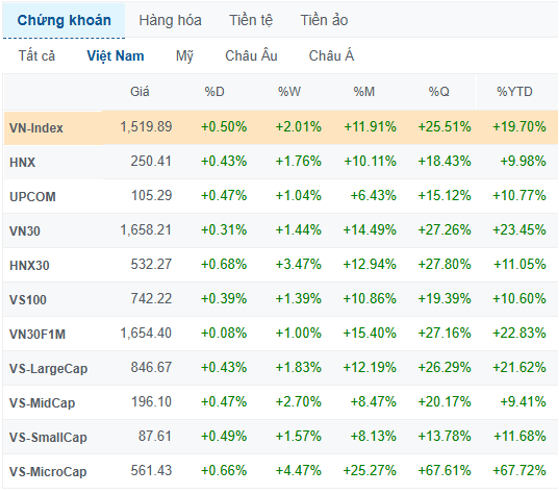

As of 9:30 am, the VN-Index had advanced 7.6 points to 1,519.91, the HNX-Index rose 1.08 points to 250.41, and the UPCoM-Index climbed 0.49 points to 105.29.

A glance at the market landscape revealed the dominance of the banking sector, with prominent green areas, led by SHB, HDB, VPB, TCB, VCB, MBB, and VIB…

Numerous large-cap stocks contributed positively to the indices, including VNM, GVR, and VJC…

Conversely, other notable sectors, such as real estate, securities, and steel, exhibited less favorable dynamics.

Source: VietstockFinance

|

The market’s liquidity reached over 3.9 trillion VND. The Mid Cap, Small Cap, and Micro Cap groups actively attracted capital inflows, rising 0.47%, 0.49%, and 0.66%, respectively. Meanwhile, the Large Cap group advanced 0.43%.

Source: VietstockFinance

|

The local market’s bullish sentiment echoed across Asian peers, with Hang Seng, Shanghai Composite, Singapore Straits Times, and Nikkei 225 climbing 0.47%, 0.25%, 0.47%, and 1.99%, respectively.

US stocks also ended higher overnight as the latest trade developments fueled optimism on Wall Street that the US would secure more deals before the upcoming tariff deadline.

At the close on July 23rd, the Dow Jones rose 507.85 points to 45,010.29, just shy of its record closing high by about 4 points. The S&P 500 advanced to 6,358.91 points, marking its 12th record close this year. The index also hit an all-time intraday high during the session. The Nasdaq Composite climbed to 21,020.02, closing above the 21,000 level for the first time.

– 4:15 pm, July 24, 2025

“Market Mayhem: The Wild Ride”

The VN-Index witnessed a volatile session, forming a Doji candlestick pattern, which indicates a tug-of-war between buyers and sellers at higher levels. Trading volume continued to set new records, reflecting the vibrant participation of cash flow. Currently, the Stochastic Oscillator has provided a fresh buy signal, while the MACD is narrowing its gap with the Signal line. If the buy signal is validated in the upcoming sessions, the positive outlook in the short term is likely to prevail.

Market Beat July 29: Profit-taking Pressure Mounts, VN-Index Down 64 Points

The selling pressure intensified during the afternoon session, driving the market deeper into negative territory. The downward trend gained momentum towards the closing bell, with the VN-Index plunging 64 points to close at 1,493.41. The HNX-Index also witnessed a sharp decline, falling over 8 points to end the day at 255.36.

Market Beat Aug 01: Caution Creeps In, VN-Index Wobbles at 1,500 Mark

The trading session concluded with the VN-Index shedding 7.31 points (-0.49%), settling at 1,495.21. Likewise, the HNX-Index witnessed a decline of 1.41 points (-0.53%), closing at 264.93. The market breadth tilted towards decliners, as 423 stocks closed in the red versus 366 advancers. The VN30 basket echoed a similar sentiment, with 15 stocks losing ground, 10 advancing, and 5 remaining unchanged.

The Vietstock Daily: Record-Breaking Volumes Signal a Market Turnaround

The VN-Index plummeted over 64 points, accompanied by the emergence of a Black Marubozu candlestick pattern. Trading volume surged to a record high, and the number of declining stocks far outweighed those advancing, clearly reflecting the widespread panic and selling pressure across the market. As of now, the Stochastic Oscillator has given a fresh sell signal within the overbought region. Concurrently, the MACD is narrowing its gap with the Signal line, and the outlook will turn even more pessimistic if a sell signal is confirmed in the upcoming sessions.

Market Beat July 22: VN-Index Surges Past 1,500

The market rallied in the latter half of the morning session and sustained its upward momentum until the end of the trading day. The VN-Index soared past the 1,500-point mark, closing at 1,509.54—a gain of over 24 points. The HNX-Index also saw a boost, rising by 2 points to close at 247.85.